- Cmind AI by Weihong Zhang

- Posts

- Cmind’s Edge: Q4 2025 Earnings at 22.5x P/E - The Make-or-Break Quarter for Bulls

Cmind’s Edge: Q4 2025 Earnings at 22.5x P/E - The Make-or-Break Quarter for Bulls

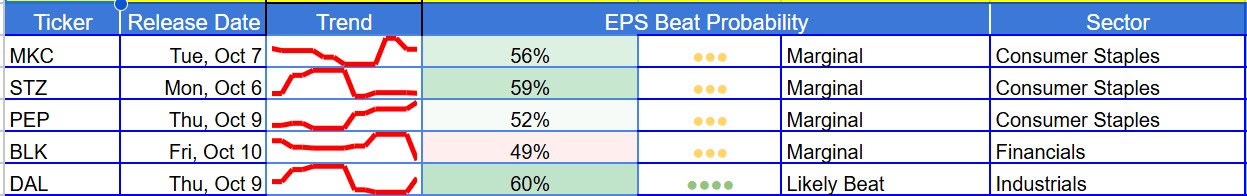

EPS Predictions for the Week of October 6, 2025

The first full week of October marks the official launch of Q3 2025 earnings season, featuring pivotal reports from consumer bellwethers Levi’s (LEVI), PepsiCo (PEP) and Delta Air Lines (DAL), alongside industry-specific insights from Constellation Brands (STZ) and McCormick (MKC). As markets trade near record highs with the S&P 500 closing above 6,700 for the first time, this earnings cycle arrives amid a complex backdrop of elevated market valuations, tariff-induced economic uncertainty, and Federal Reserve policy recalibration.

[Read the full outlook and predictions for all companies releasing this week]

Outside of PepiCo (marginal 52%) and Delta (likely beat 60%), several other companies are worth attention. Levi’s (LEVI) kicks off the week on Monday with a positive signal (79% beat probability), while AZZ (AZZ) and Resources Connection (RGP) stand out as one of the strongest small-cap beats (82%). On the marginal side, Blackrock (BLK), McCormick (MCK) and Constellation Brands (STZ) all post with caution on Helene of Troy (HELE) carries only a 19% beat probability.

Corporate earnings continue their remarkable streak with 81% of S&P 500 companies beating Q2 estimates. However, tariff headwinds are intensifying, with effective U.S. tariff rates now at 22.5% - the highest since 1909.

Stock Analysis

Levi Strauss & Co. (LEVI) is releasing its third-quarter earnings on Thursday, October 9, 2025, after the market closes, with a conference call scheduled at 5:00 PM Eastern Time. The consensus EPS is $0.31. Our latest prediction is that its beat category is a very likely beat with a probability of 80%. See our daily updates over the past 90 days.

The Levi Strauss (LEVI) Q3 2025 earnings release is important for several reasons: it is viewed as a critical test of the company’s turnaround story, provides an early read on global consumer demand for apparel, and acts as a key sentiment setter for the broader retail and apparel sector.

Sector Breakdown

Industrials show the highest concentration of positive signals, with AZZ, RGP, APOG, DAL are leaning toward beats. Consumer Staples is split with the week’s very likely miss (HELE).

Market Cap Breakdown

Large caps are mostly marginal with McCormick, Constellation, and PepsiCo reporting and Delta a likely beat. Mid-caps are mixed with LEVI strong, and HELE is flashing red. 19 small caps are reporting and show the widest dispersion: AZZ, RGP are the strongest, BSVN, NRIX, APOG, ODC as likely beats but SLDG, EDUC, APLD are flagged as likely misses.

🔝Top 5 Predicted Beats This Week

AZZ (Oct 8) – 82% – Industrials – Small Cap

RGP (Oct 8) – 82% – Industrials – Small Cap

LEVI (Oct 9) – 79% – Consumer Staples – Mid Cap

APOG (Oct 9) – 75% – Industrials – Small Cap

ODC (Oct 9) – 72% – Materials – Small Cap

🔻Top 5 Predicted Misses This Week

HELE (Oct 9) – 19% – Consumer Staples – Mid Cap

GLDG (Oct 10) – 37% – Materials – Small Cap

EDUC (Oct 9) – 39% – Communication Services – Small Cap

APLD (Oct 9) – 39% – Financials – Small Cap

TORO (Oct 6) – 40% – Industrials – Small Cap

(As of October 5, 2025)

Green clusters dominate Industrials and Consumer Discretionary and Consumer Staples shows a notable red patch. AZZ, RGP, APOG are central in the Industrials group, with weaker names like HELE in Consumer Staples amplifying the downside.

Individual Stock Predictions

Large Caps

Delta Airlines (60%) stands out with a beat, while Constellation Brands (59%), McCormick (55%), Pepsico (52%) and Blackrock (49%) are in a tight range of marginal beats.

Mid Caps

With a lighter reporting period, Levi (79%) is the strongest of beats, a critical test of the company’s turnaround story, and provides an early read on global consumer demand for apparel. Helene of Troy (19%) represents the weakest, with a continued disappointing performance trajectory and massive write-offs from the company's acquisitive strategy may have destroyed significant shareholder value.

Small Caps

The dispersion continues to be the widest here. AZZ and RGP (82%) lead all names this week, joined by APOG (75%) and ODC (71%). However, there are multiple likely misses—APLD (39%), EDUC, (38%), and GLDG (37%)—that highlight risk remains within the cohort.

About the Model

Cmind AI’s EPS predictions are powered by a machine learning model built for accuracy, objectivity, and transparency. It integrates five data modalities and over 150 variables—including historical financials, corporate governance factors, and earnings call transcripts—to generate early, company-specific forecasts. Predictions are updated daily following 10-Q filings, covering more than 4,400 publicly traded companies, far beyond the reach of most traditional analysts. Every forecast includes clear explanatory variables, offering not just a number, but insight. The model also enables trend analysis across tickers, sectors, indices, and portfolios—and backtesting shows it can significantly enhance investment performance, improving Sharpe and Sortino ratios.

To learn more about Cmind AI please contact us at [email protected]