- Cmind AI by Weihong Zhang

- Posts

- EPS Beats Outlook: Market Movers Ahead | LLY, AMD, DIS Set to Test Sentiment

EPS Beats Outlook: Market Movers Ahead | LLY, AMD, DIS Set to Test Sentiment

EPS Predictions for the Week of August 4th, 2025

This week’s earnings calendar is shaping up to be a sentiment driver.

With reports due from Palantir, AMD, Eli Lilly, Disney, Pfizer, Uber, Airbnb, and Block, the likelihood of a shift in investor tone is high. These are not only headline-generating companies but sector barometers that often dictate broader market direction. And according to our model, some of them may surprise positively.

This week’s note dives into the dynamics that make these names so influential, unpacks their latest earnings signals, and highlights the data behind sentiment shifts.

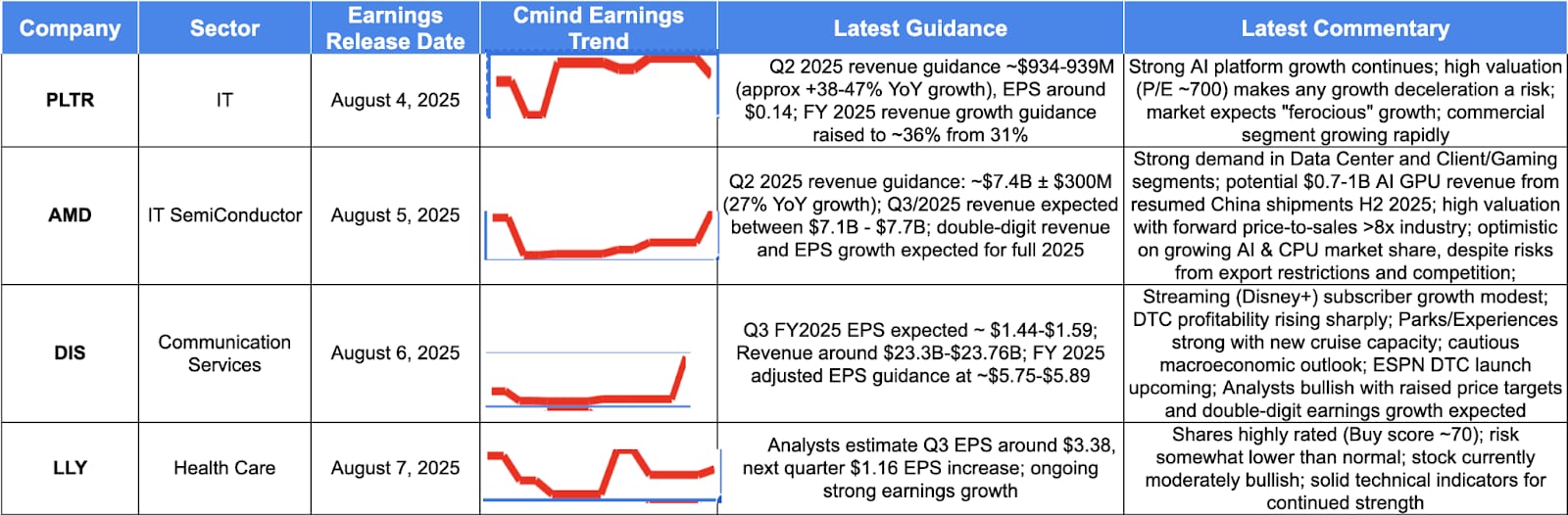

Deep Dive: These 4 Names Could Shift the Market

As earnings season heats up, our model highlights a set of influential companies reporting next week with the potential to drive sentiment far beyond their own stock performance. These are names with index weight, sector relevance, and increasingly bullish signals in our system.

Palantir Technologies (PLTR) – August 4

Sector: Information Technology

Signal Trend: Stable high zone with slight taper

Latest Guidance: Revenue of ~$934–939M (+38–47% YoY); FY25 revenue growth guidance raised to ~36%

Why it matters:

Palantir’s AI platform growth has been explosive, and expectations are sky-high. With a valuation near 700x P/E, the market is pricing in ferocious growth. Any upside surprise could ignite bullish momentum, but any softness could trigger sharp corrections.

AMD – August 5

Sector: IT – Semiconductor

Signal Trend: Recently jumped higher

Latest Guidance: Q2 revenue ~$7.4B ± $300M; Q3 revenue range $7.1B–$7.7B

Why it matters:

AMD’s AI GPU business is in focus, especially given resumed China shipments. Valuation remains steep, but strong guidance and segment growth could support a broader rally in AI-exposed tech names.

Walt Disney (DIS) – August 6

Sector: Communication Services

Signal Trend: Breakout to upside in recent days

Latest Guidance: Q3 EPS $1.44–$1.59; FY revenue ~$23.3B–$23.76B

Why it matters:

Disney is a bellwether for both consumer sentiment and streaming economics. Parks & cruise strength, plus optimism around ESPN’s DTC strategy, make this a key event for discretionary and media sectors.

Eli Lilly (LLY) – August 7

Sector: Health Care

Signal Trend: Stable with recent uptick

Latest Guidance: Q3 EPS ~$3.38; next quarter expected EPS increase of $1.16

Why it matters:

LLY has been a high-momentum name, driven by weight loss drugs and broader growth. Strong ratings and technical strength make it a name to watch—especially for the health care sector, which our model shows as heavily skewed toward beats.

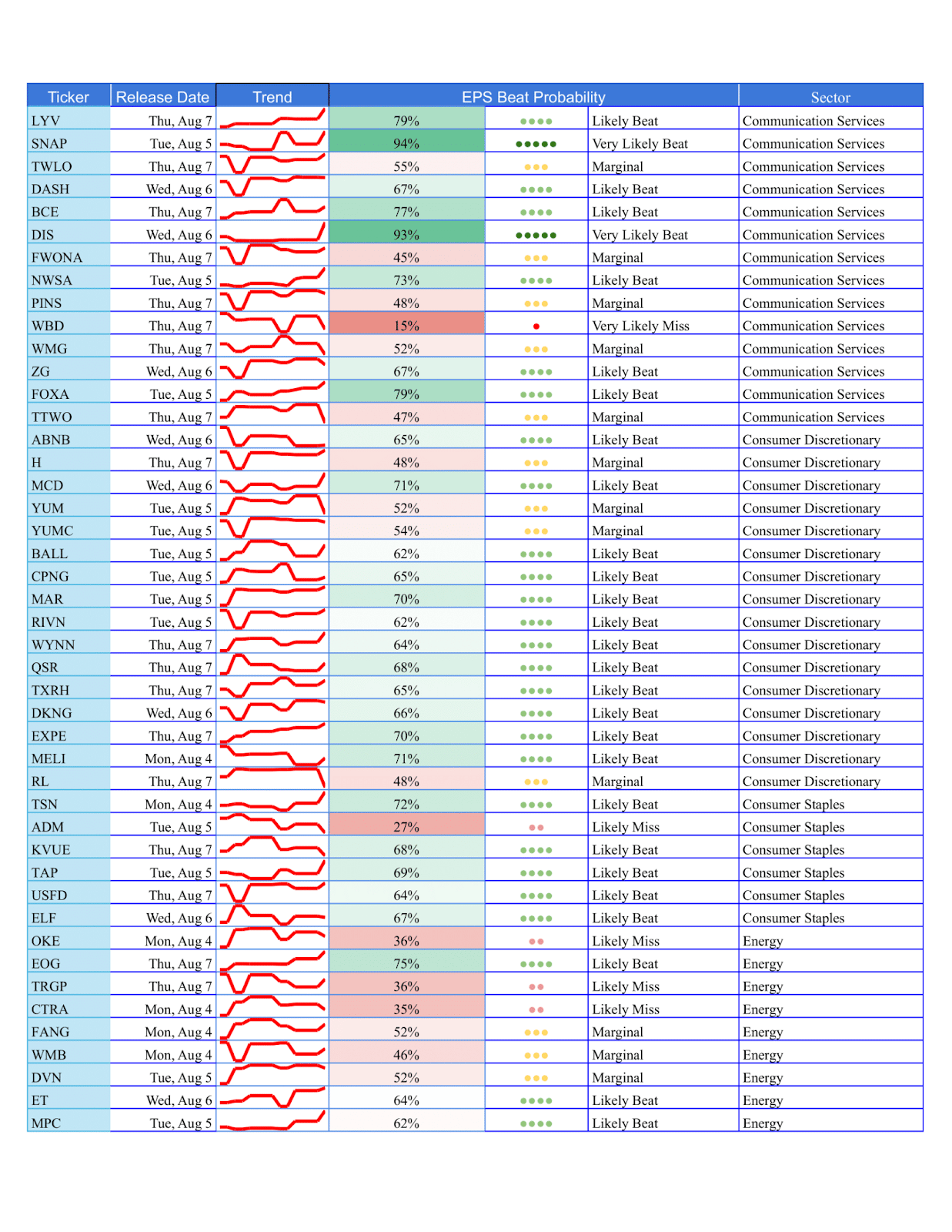

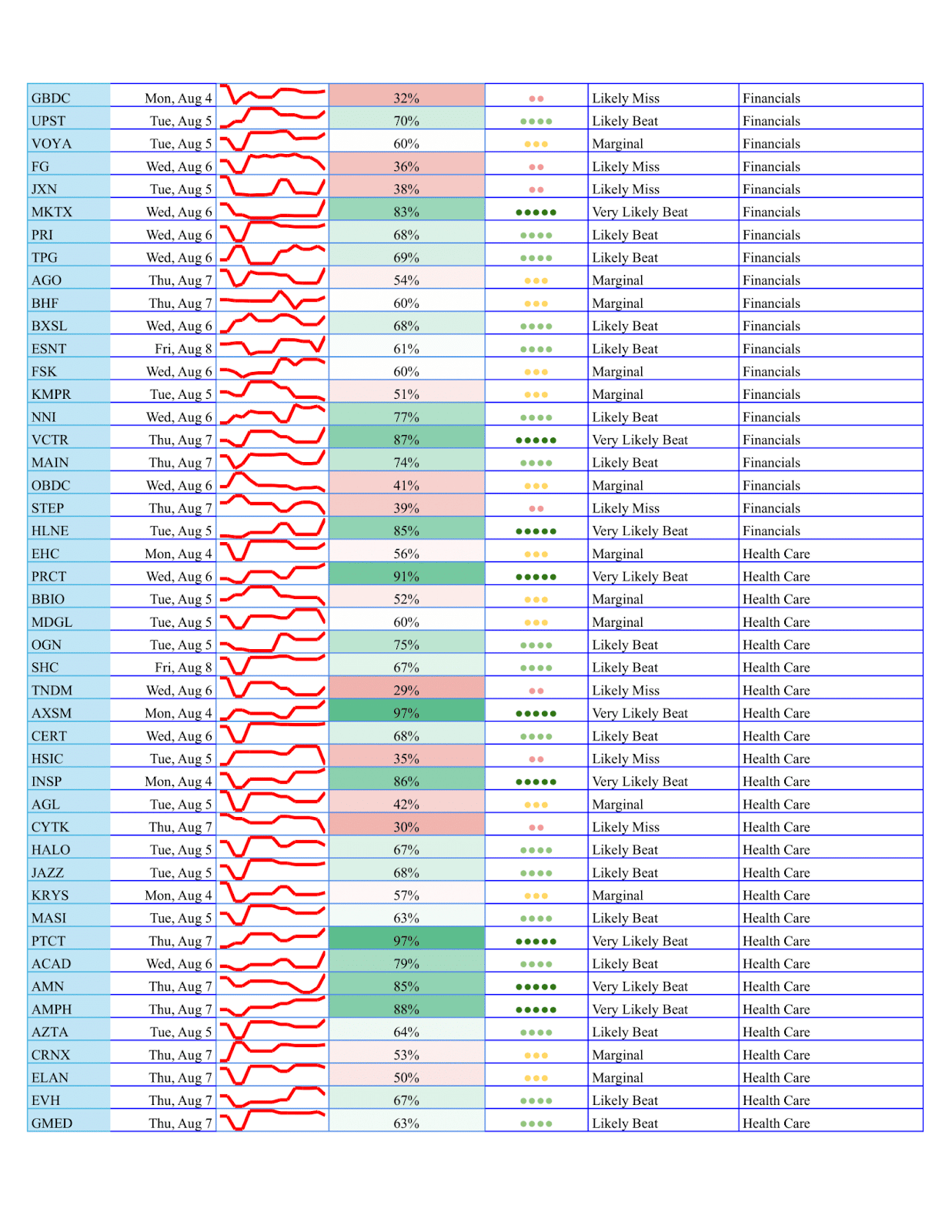

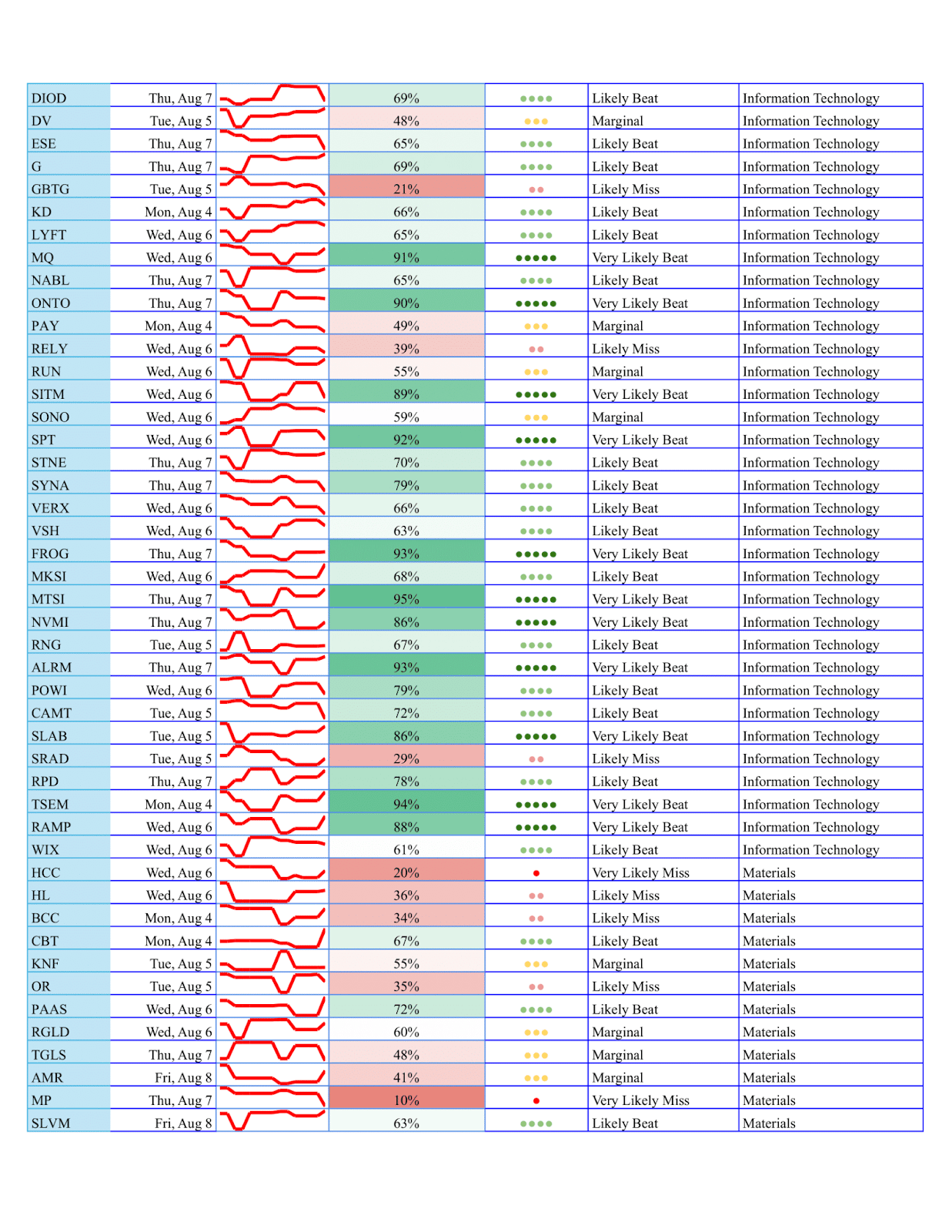

Sector Breakdown

Our model flags Health Care and Information Technology as the sectors with the strongest beat potential this week. Together, they account for nearly half of all likely beats.

Health Care leads with 172 predicted beats versus just 70 misses, a strong signal of upside bias heading into a week that includes Eli Lilly and Pfizer.

Information Technology also shows strength, with over 140 predicted beats and favorable trends from AI-linked names like Palantir and AMD.

Consumer Discretionary and Communication Services present mixed signals, but a few influential names—such as Disney and Airbnb—could swing sentiment either way depending on earnings and guidance.

Market Cap Breakdown

Predicted EPS outcomes this week tilt toward small and mid-cap names, though large caps carry outsized market implications:

Small Caps dominate the volume: 377 predicted beats vs. 202 misses. High volatility, high reward.

Mid Caps are solid with 240 predicted beats and 78 misses—relatively clean signals.

Large Caps, while fewer in number, offer sharper directional impact, particularly with names like LLY, AMD, and DIS, all showing strong upward trends in beat probability.

🔝Top 5 Predicted Beats This Week

TALK – 98% – Health Care

AXSM – 97% – Health Care

CPRX – 97% – Health Care

HRMY – 96% – Health Care

RXST – 94% – Health Care

🔻Top 5 Predicted Misses This Week

PHGE – 0.04 – Health Care

VYNE – 0.07 – Health Care

IPHA – 0.08 – Health Care

HOLO – 0.08 – Information Technology

TFFP – 0.10 – Health Care

Weekly Heatmap

Below is the prediction probability heatmap for all companies reporting the week of August 4. The darker green the cell, the stronger the model's beat signal; deeper reds flag likely misses.

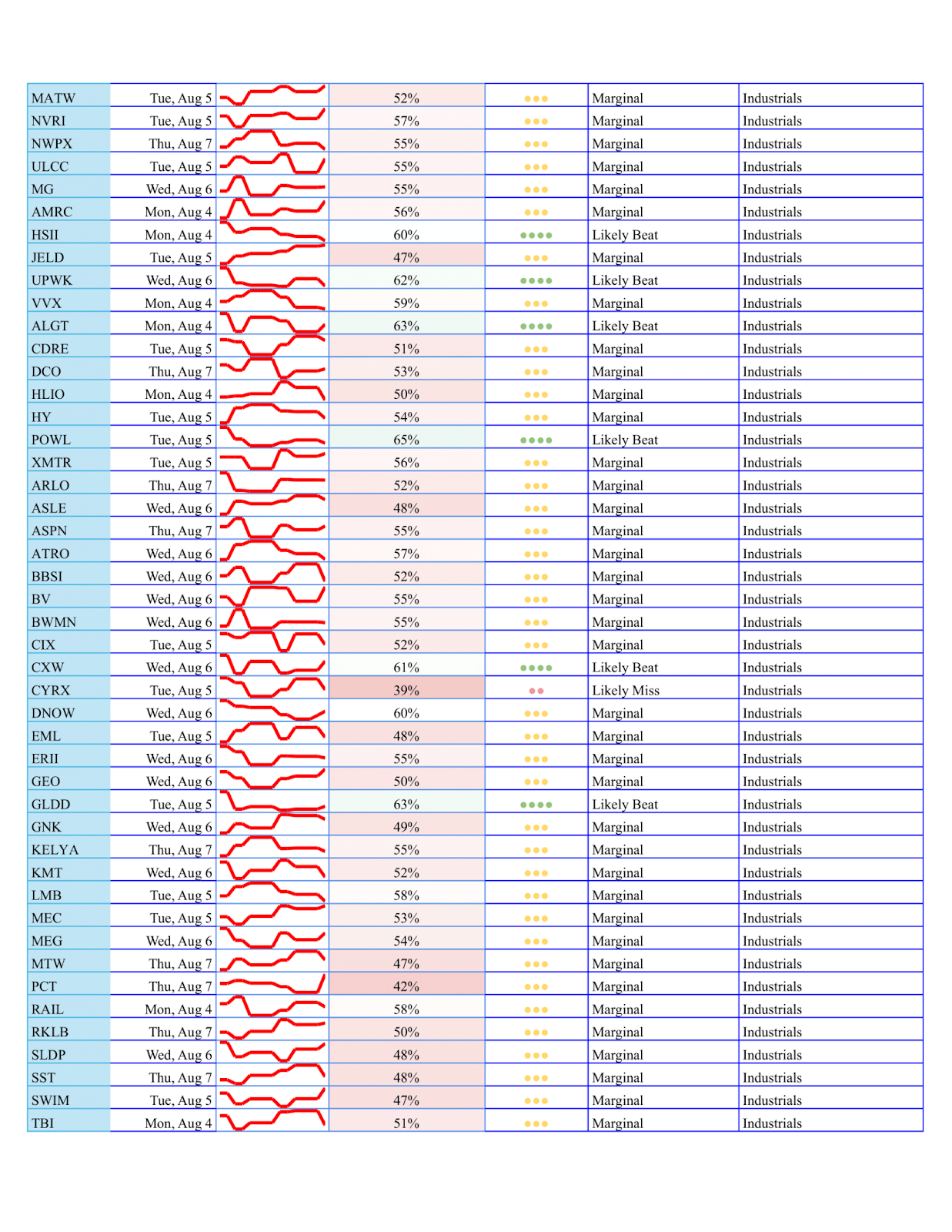

Individual Stock Predictions

Large Caps

Next week’s large-cap cohort is high-impact and sentiment-sensitive.

Eli Lilly (LLY): Signals show continued beat strength backed by analyst revisions and technical momentum.

AMD: Our model shows an upward trend in beat probability tied to AI GPU and data center demand.

Disney (DIS): Turnaround in streaming profitability and bullish analyst guidance push it into positive territory.

These names carry the potential to shift both sector and index-level sentiment; watch them closely.

Mid Caps

ON Semiconductor (ON) stands out with a sharp ~17% earnings surprise potential and upward forecast revisions.

SBLK and ZIM show extremely high historical surprise rates and model strength, especially in shipping.

Nutrien (NTR) is flagged with caution due to inconsistent surprise history, but if it beats, the upside could be meaningful.

Small Caps

Small caps remain volatile, but some names flash clear signals:

TALK, AXSM, and CPRX post top-tier beat probabilities in Health Care, with strong peer validation and prior surprise consistency.

At the other end, PHGE, VYNE, and HOLO sit deep in the miss zone—these names reflect deteriorating financials and bearish sentiment trends.

About the Model

Cmind AI’s EPS predictions are powered by a machine learning model built for accuracy, objectivity, and transparency. We ingest over 150 variables across six data modalities—including real-time 10-Q filings, earnings transcripts, governance metrics, and peer signals—to provide early, company-specific EPS forecasts.

Updated daily, our model covers 4,400+ public companies, with proven backtests demonstrating Sharpe and Sortino ratio improvements across portfolios.

📩 To learn more, contact us at [email protected]