- Cmind AI by Weihong Zhang

- Posts

- Cmind’s Earnings Outlook: Post‐Jobs Rally, Mixed Tech Signals | MNDY (97%) vs MDBH (4%)

Cmind’s Earnings Outlook: Post‐Jobs Rally, Mixed Tech Signals | MNDY (97%) vs MDBH (4%)

EPS Predictions for the Week of Agust 11th, 2025

Hi everyone,

The week of August 4–8 delivered a volatile but ultimately strong rebound for U.S. equities. The S&P 500 jumped 1.5% Monday after July’s soft jobs report (73k additions) spiked odds of a September Fed cut to north of 90% from ~38% pre‑print. Tech strength led the bounce—Palantir rallied on news of a multibillion Army deal, Apple buoyed sentiment with a large U.S. manufacturing commitment, gold bid on safety, and oil stayed steady despite geopolitical noise. Midweek tariff headlines dented risk, but earnings optimism and rate‑cut bets prevailed.

Bottom line: we enter Aug 11–15 cautiously optimistic—easing policy odds and big‑tech prints can support upside, but macro and policy headlines can still whipsaw risk.

Deep Dive: Four Companies to Watch

Monday.com (MNDY) — Information Technology

A high‑conviction AI‑enabled SaaS name. Q2 (Aug 11) will spotlight execution on AI feature monetization and the durability of growth. Street is looking for ~24% YoY revenue growth (~$293M) with some EPS pressure; our model currently assigns a 97% beat probability. A surprise either way could ripple through AI‑SaaS sentiment.

BBVA (Banco Bilbao Vizcaya Argentaria) — Financials

A useful lens on global banking amid shifting rate paths. Watch credit costs, loan growth, and NIM resilience. Results can sway appetite for financials across Europe and EM.

Tapestry (TPR) — Consumer Discretionary

Coach/Kate Spade/Stuart Weitzman owner offers a read on premium discretionary demand. We’re watching pricing power, inventory discipline, and China/U.S. mix as indicators for broader retail.

Cardinal Health (CAH) — Health Care

A defensive bellwether for distribution and provider demand. Supply chain normalization and reimbursement dynamics will color positioning across health‑care services.

Sector Breakdown

From the companies reporting this week in our file (marginals excluded), the signal tilts are clear:

Real Estate and Health Care lead on net positives, reflecting improving cash‑flow visibility and stable demand (Real Estate 18 beats vs 7 misses; Health Care 17 vs 4).

Information Technology is mixed to cautious overall (22 vs 38), despite standout outliers (e.g., MNDY). Communication Services and Industrials also skew negative (Comms 9 vs 19; Industrials 10 vs 18).

Financials lean risk‑off (25 vs 33) with dispersion by subsector; Consumer Staples and Energy remain selectively weak.

Market Cap Breakdown

Using the corrected cap buckets (marginals excluded):

Mid Caps: Brightest cohort with a modest upside skew (28 beats vs 23 misses), led by Financials and select tech.

Large Caps: Cautious setup (26 vs 46)—more idiosyncratic than thematic, favoring stock‑picking over beta.

Small Caps: Negative skew (7 vs 13) and higher dispersion; fertile for tactical longs/shorts but with elevated volatility.

🔝 Top 5 Predicted Beats This Week

SLI — Tue, Aug 12 — 97% — Materials

MNDY — Mon, Aug 11 — 97% — Information Technology

INTA — Tue, Aug 12 — 95% — Information Technology

SELF — Tue, Aug 12 — 92% — Real Estate

MUX — Mon, Aug 11 — 92% — Materials

🔻 Top 5 Predicted Misses This Week

MDBH — Tue, Aug 12 — 4% — Financials

HYMC — Tue, Aug 12 — 5% — Materials

LVO — Tue, Aug 12 — 5% — Communication Services

BOXL — Mon, Aug 11 — 5% — Information Technology

GXAI — Tue, Aug 12 — 6% — Communication Services

Weekly Heatmap

Our interactive heatmap for Aug 11–15 highlights where conviction clusters by sector and cap, and where dispersion is widest. Use it to spot outliers and confirm positioning before prints.

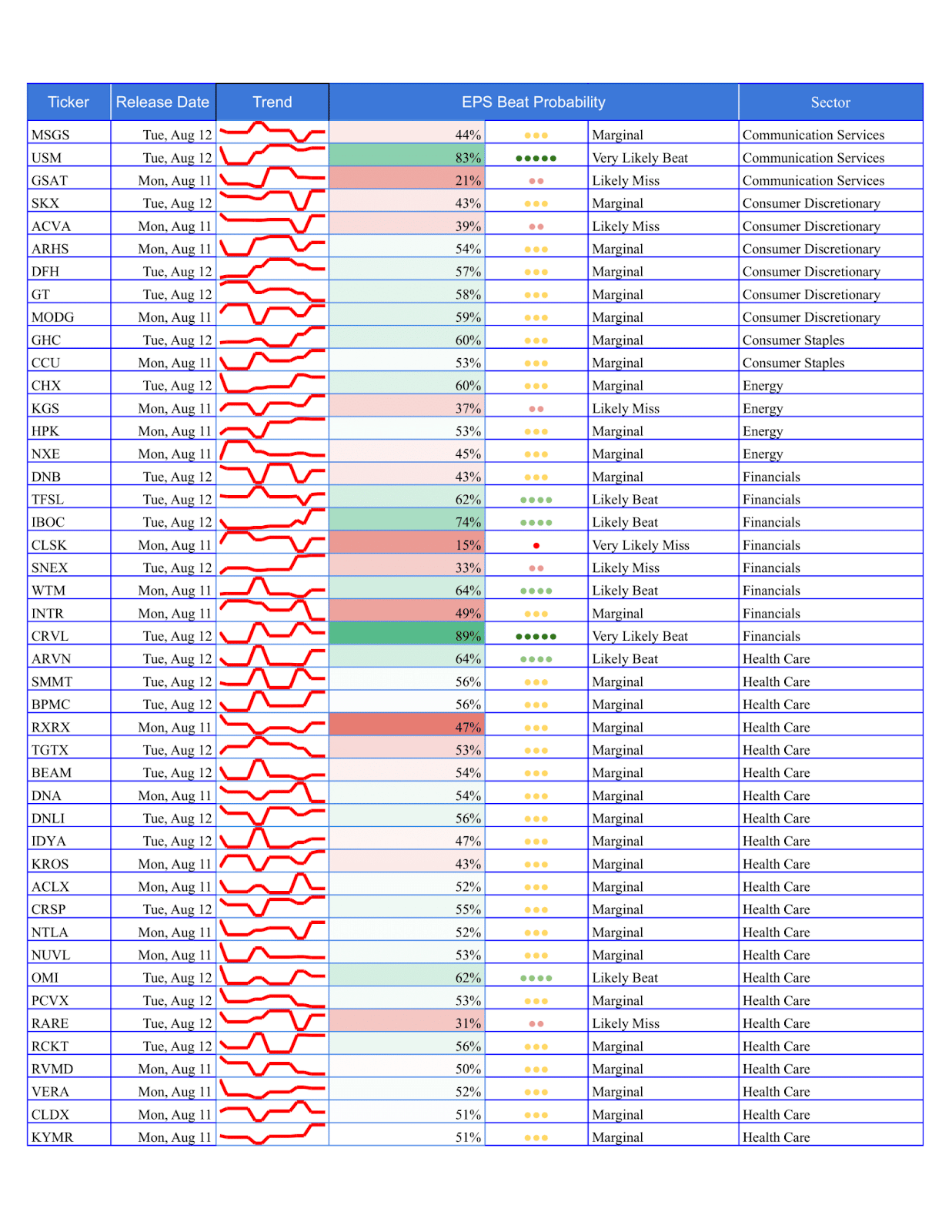

Individual Stock Predictions

Large Caps

Directional conviction is selective. Upside leadership includes CRVL (89%), USM (83%), INUV (83%); on the caution side, LVO (5%) and GXAI (6%) screen as very likely misses. Net: prioritize idiosyncratic setups rather than broad factor bets.

Mid Caps

The healthiest breadth this week. Standouts on the upside: GDOT (89%), VINP (82%), ATLC (80%)—all Financials, pointing to pockets of resilience. Laggards include MDBH (4%), HNNA (14%), HIVE (15%).

Small Caps

Skew is negative with notable dispersion. Upside is led by Industrials: GFF (68%), ALG (67%), DXPE (65%), while potential downside includes SPR (19%), PLUG (30%), SMHI (36%). Position sizing matters here.

About the Model

Cmind AI’s EPS predictions are powered by a machine learning model built for accuracy, objectivity, and transparency. We ingest over 150 variables across six data modalities—including real-time 10-Q filings, earnings transcripts, governance metrics, and peer signals—to provide early, company-specific EPS forecasts.

Updated daily, our model covers 4,400+ public companies, with proven backtests demonstrating Sharpe and Sortino ratio improvements across portfolios.

📩 To learn more, contact us at [email protected]