- Cmind AI by Weihong Zhang

- Posts

- Cmind’s Outlook: Walmart Sets the Consumer Tone, Crypto’s BTDR Faces the Heat

Cmind’s Outlook: Walmart Sets the Consumer Tone, Crypto’s BTDR Faces the Heat

EPS Predictions for the Week of August 18th, 2025

Hi everyone,

This week’s earnings lineup brings a cross-sector spotlight: crypto, big-box retail, cybersecurity, and cloud software. Together, these names carry signals well beyond their tickers.

Bitdeer Technologies Group (BTDR) is a key player in crypto mining infrastructure. Our model leans toward a likely miss, but sentiment around blockchain is so hot that volatility could be high.

Walmart (WMT), the world’s largest retailer, is expected to show marginal weakness, but its results remain a barometer for consumer strength.

Workday (WDAY) is well-positioned for a likely beat, continuing strong subscription growth and margin expansion in cloud enterprise software.

Palo Alto Networks (PANW) looks set for a likely beat, reinforcing cybersecurity as one of the fastest-growing corners of enterprise IT.

Below, we unpack this week’s sector and market-cap outlooks, followed by our top predicted beats and misses.

Why Walmart’s Earnings Matter

Walmart’s results are pivotal because they reveal the pulse of consumer health, inflation trends, and supply chain dynamics. With EPS growth expected at +7.5% YoY and revenues up +3.7%, WMT’s guidance on consumer demand, cost pressures, and e-commerce momentum could move the retail sector and broader indices.

Why Palo Alto Networks Matters

PANW has become the bellwether for cybersecurity demand. With consensus revenue at $2.5B (+14.2% YoY) and momentum in subscription-based ARR, Palo Alto’s earnings provide a sector-wide readout on enterprise IT budgets and security priorities.

Why Workday Matters

Workday’s SaaS-based enterprise platform continues to post double-digit subscription growth and improving operating margins. Its results are a key gauge of enterprise cloud adoption, AI-driven analytics demand, and the competitive landscape in ERP and HCM.

Why Bitdeer Matters

BTDR’s mining centers and hash-rate solutions make it a proxy for blockchain infrastructure economics. While our model leans to a miss, analysts remain constructive, citing capital raises, buybacks, and technology innovation. This release is a rare public look into the financial heartbeat of crypto mining.

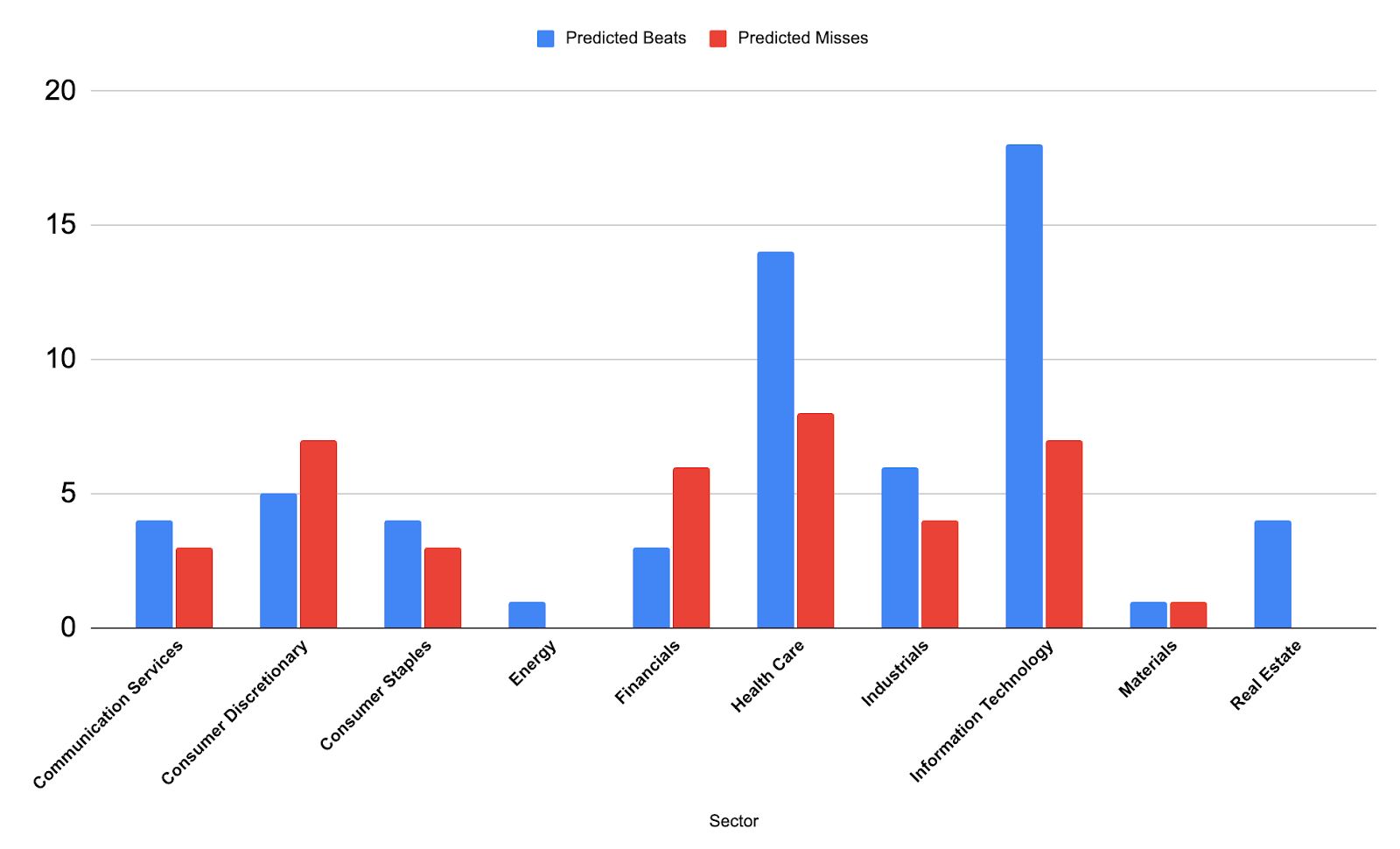

Sector Breakdown

Information Technology leads the week with the highest number of predicted beats, particularly in cybersecurity and enterprise software. Health Care and Industrials also show strong signals, while Consumer Discretionary remains mixed, with several likely misses. Financials and Real Estate are quieter, with signals balanced but less numerous.

Market Cap Breakdown

Large Caps: Predicted beats dominate, with high-conviction signals in PANW and WDAY. Walmart leans toward a marginal miss, tempering the large-cap read.

Mid Caps: A balanced set of beats, with Health Care and Industrials contributing most of the strength.

Small Caps: As usual, the most volatile group. Predicted beats and misses are nearly evenly split, highlighting dispersion-driven opportunities for traders.

🔝 Top 5 Predicted Beats This Week

ALBT – 93% – Real Estate

JHX – 93% – Materials

OPRA – 86% – Communication Services

PAGS – 87% – Information Technology

ITRN – 88% – Information Technology

🔻 Top 5 Predicted Misses This Week

BTCS – 11% – Financials

XP – 14% – Financials

BRID – 15% – Consumer Staples

FTFT – 16% – Information Technology

VNET – 28% – Information Technology

Weekly Heatmap

Cmind Interactive Heatmap for Week of August 18, 2025

(as of August 17, 2025)

Individual Stock Predictions

Large Caps

This week’s large-cap cohort is dominated by high-impact names. Palo Alto Networks (PANW) and Workday (WDAY) are both flagged as likely beats, reinforcing bullish sentiment in cybersecurity and SaaS. Walmart (WMT), however, leans toward a marginal miss, introducing caution in retail.

Mid Caps

Signals are mixed, with select Health Care and Industrial names tilting toward beats. Consumer Discretionary mid-caps remain under pressure, with several names in the likely miss category.

Small Caps

The dispersion in small caps is high this week. Predicted beats such as OPRA and PAGS contrast sharply with very likely misses like BTCS and XP. Crypto-linked volatility adds another layer of uncertainty, especially with BTDR in the mix.

How Our EPS Beat Predictor Works

Cmind AI’s EPS predictions are powered by a machine learning model built for accuracy, objectivity, and transparency. It integrates five data modalities and over 150 variables—including historical financials, corporate governance factors, and earnings call transcripts—to generate early, company-specific forecasts. Predictions are updated daily following 10-Q filings, covering more than 4,400 publicly traded companies, far beyond the reach of most traditional analysts. Every forecast includes clear explanatory variables, offering not just a number, but insight. The model also enables trend analysis across tickers, sectors, indices, and portfolios—and backtesting shows it can significantly enhance investment performance, improving Sharpe and Sortino ratios.

To learn more about Cmind AI please contact us at [email protected]