- Cmind AI by Weihong Zhang

- Posts

- EPS Beats Outlook: NVDA’s $4T Test + AFRM and Canadian Banks on Deck

EPS Beats Outlook: NVDA’s $4T Test + AFRM and Canadian Banks on Deck

EPS Predictions for the Week of August 25th, 2025

This week, NVIDIA ($NVDA) dominates the conversation. The company reports earnings on August 27, 2025, and its results are poised to move not just the tech sector, but the entire market. Since its last release on May 28, NVIDIA has crossed the $4 trillion valuation mark, faced evolving U.S.–China chip restrictions, and remained the backbone of the global AI infrastructure build-out.

Cmind’s EPS model currently places NVDA’s beat probability around 64%, but the trend has been volatile (see chart below). Spikes near 100% in June and subsequent declines reflect market nervousness around AI exuberance, hyperscaler spending patterns, and shifting export policy. NVIDIA’s guidance on AI/data center demand, China exposure, and supply chain dynamics will be critical for sentiment across both technology and equity markets.

Why does this matter?

Massive Market Influence: NVIDIA now represents ~8% of the S&P 500. A beat or miss could swing the entire index.

AI Industry Leadership: Its GPUs remain the cornerstone of generative AI infrastructure.

Barometer for Tech Spending: Hyperscalers’ capex is directly tied to NVIDIA’s results.

Market Psychology: With tech volatility rising, NVIDIA earnings may move markets more than the Fed’s Jackson Hole speeches.

Consensus calls for $45.9B in revenue (+53% YoY) and EPS of ~$1.00 (+47% YoY). Analysts remain broadly bullish, with risks centered on China sales and already lofty expectations.

Sector Breakdown

The Information Technology sector continues to dominate signals this week, with over 20 predicted beats led by NVIDIA and peers like SMTC, AMBA, and CRWD. Health Care also posts strong breadth, while Financials and Consumer Discretionary show selective strength. Industrials and Energy remain mixed, with multiple small-cap misses predicted.

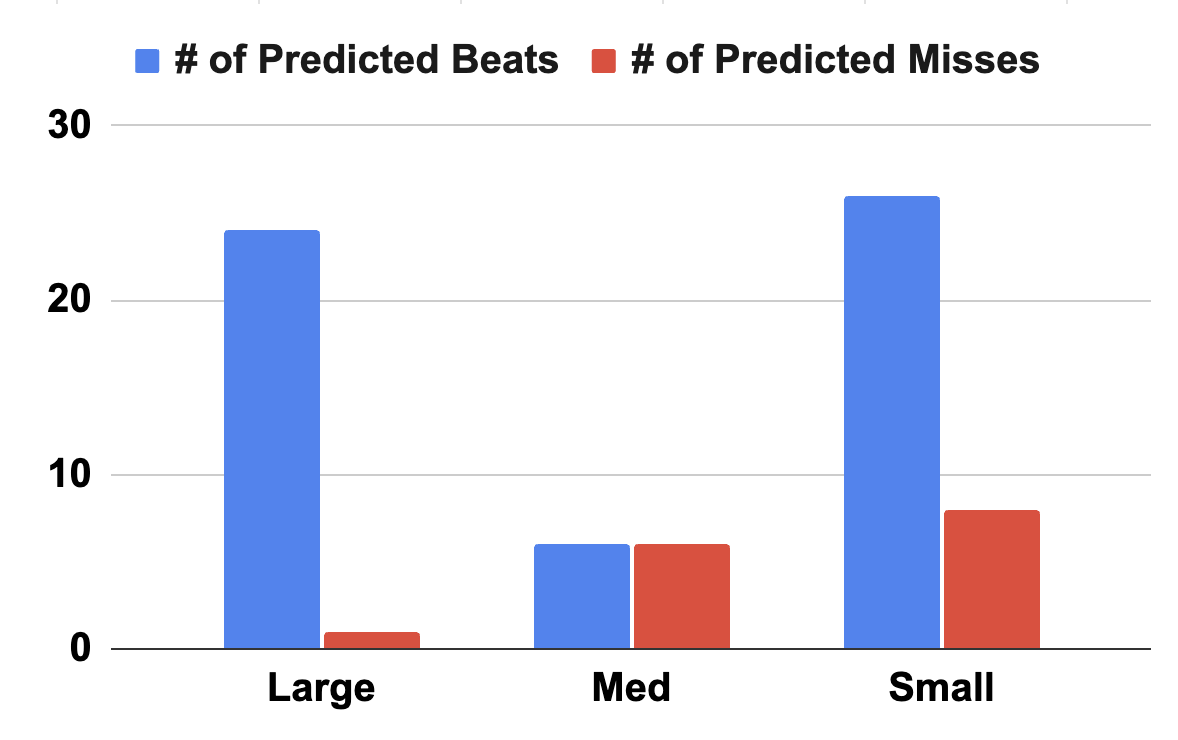

Market Cap Breakdown

Large caps (anchored by NVIDIA, BMO, CM, and TD) are heavily skewed toward beats, reinforcing broad stability among market leaders. Mid caps are evenly split between beats and misses, showing sensitivity to sector-specific pressures. Small caps post the widest dispersion — nearly 3:1 beats to misses — but also carry the highest risk, as names like JKS and IMPP are flagged for likely underperformance.

🔝 Top 5 Predicted Beats This Week

PAHC (Phibro Animal Health) – 82% – Health Care

RGS (Regis Corp.) – 79% – Consumer Discretionary

SMTC (Semtech) – 75% – Information Technology

OOMA (Ooma) – 75% – Communication Services

ELMD (Electromed) – 75% – Health Care

🔻 Top 5 Predicted Misses This Week

JKS (JinkoSolar) – 18% – Information Technology

GOGL (Golden Ocean Group) – 26% – Industrials

IMPP (Imperial Petroleum) – 27% – Energy

CISS (C3is Inc.) – 36% – Industrials

PSEC (Prospect Capital) – 39% – Financials

Weekly Heatmap

Our interactive heatmap highlights strong signals across Information Technology and Health Care, while Industrials, Energy, and select Financials lean toward misses. NVIDIA remains the single most influential release on deck. Check the heatmap here.

Individual Stock Predictions

Large Caps

NVIDIA is the clear focal point with a 64% beat probability, driving sector and market-wide sentiment. Canadian banks (CM, TD, BMO, RY) show modestly positive signals, reinforcing stability in North American financials.

Mid Caps

Performance is mixed. Semtech (SMTC) stands out with a strong 75% beat likelihood, while NCNO (43%) tilts negative. Mid-cap health names like Electromed (ELMD, 75%) and Enlivex (ENLV, 61%) strengthen the Health Care narrative.

Small Caps

As usual, small caps carry both upside optionality and elevated downside risk. Regis (RGS, 79%) posts one of the highest probabilities this week, while JinkoSolar (JKS, 18%) and Imperial Petroleum (IMPP, 27%) underscore volatility in energy and solar-linked names.

How Our EPS Beat Predictor Works

Cmind AI’s EPS predictions are powered by a machine learning model built for accuracy, objectivity, and transparency. It integrates five data modalities and over 150 variables—including historical financials, corporate governance factors, and earnings call transcripts—to generate early, company-specific forecasts. Predictions are updated daily following 10-Q filings, covering more than 4,400 publicly traded companies, far beyond the reach of most traditional analysts. Every forecast includes clear explanatory variables, offering not just a number, but insight. The model also enables trend analysis across tickers, sectors, indices, and portfolios—and backtesting shows it can significantly enhance investment performance, improving Sharpe and Sortino ratios.

To learn more about Cmind AI please contact us at [email protected]