- Cmind AI by Weihong Zhang

- Posts

- Cmind’s Outlook: ~4k Q2 Predictions In | This Week: 41 Companies, 31 Beats, 8 Misses | SMPL (87%) vs KRUS (22%)

Cmind’s Outlook: ~4k Q2 Predictions In | This Week: 41 Companies, 31 Beats, 8 Misses | SMPL (87%) vs KRUS (22%)

EPS Predictions for the Week of July 7th, 2025

Hi everyone,

We’re kicking off Q2 earnings season with a relatively light slate, just 41 companies are set to report, but early signals are already pointing to compelling developments across the cap spectrum. But beneath the quiet lies some compelling movement: Cmind’s EPS model shows early Q2 beat strength in large and mid-caps, while small-caps begin to slide.

We’ll also spotlight a few names that stand out this week, including 23andMe, Simply Good Foods, and AEHR Test Systems, for their volatility, strategic positioning, or sector significance.

In this edition you’ll find:

Q2 Outlook vs. Q1 Review: Large and Mid Caps Climb

Sector Watch: Health Care Leads; Staples and Financials Show Risk

Market Cap Breakdown (Weekly)

Top 5 Predicted Beats and Misses

Individual Stock Predictions by Market Cap

Stock Highlights: 23andMe, SMPL, AEHR

Full Q2 EPS Prediction Heatmap

About the Model

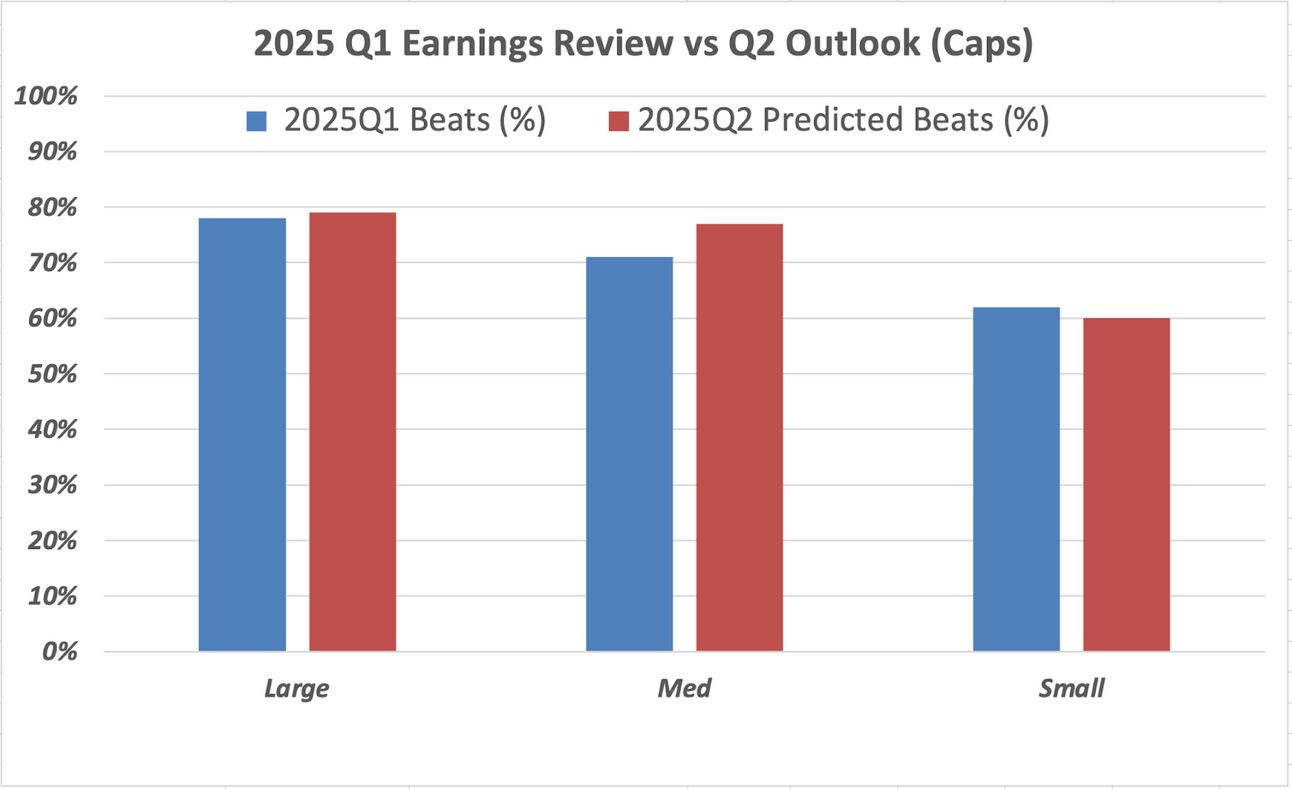

Q2 Outlook vs. Q1 Review: Large and Mid-Caps Climb

Cmind’s model predicted Q1 beats with 78% accuracy in large caps and 71% in mid caps. As we preview Q2, signals remain strong—large cap predicted beats tick up to 79%, while mid caps jump to 77%, suggesting catch-up momentum in that tier.

Small caps, however, show a modest decline: from 62% actual beats in Q1 to 60% predicted for Q2, reflecting rising uncertainty in that cohort.

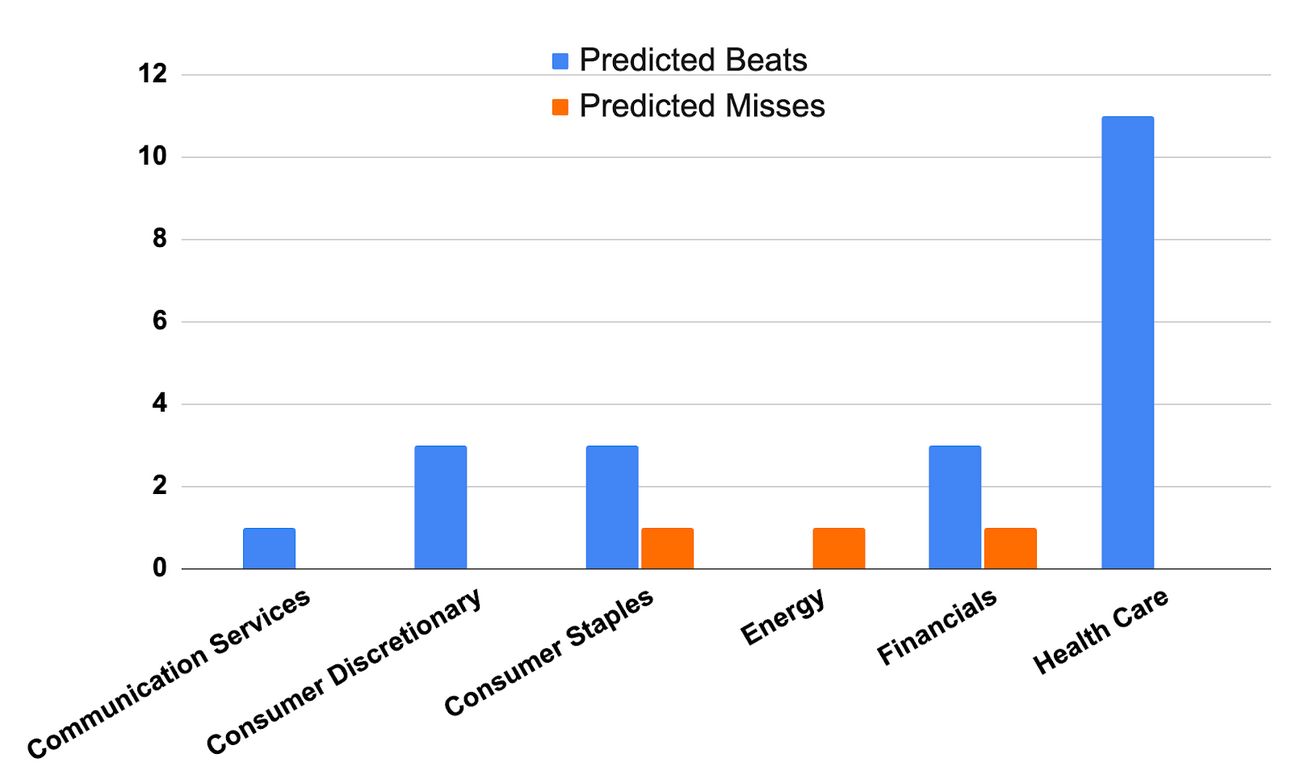

Sector Watch: Health Care Leads; Staples and Financials Show Risk

This week’s sector distribution is narrow, but clear trends are visible:

Health Care dominates with 11 predicted beats and 0 misses

Consumer Staples, Financials, and Energy show mixed signals with elevated miss rates

Communication Services and Consumer Discretionary offer select upside

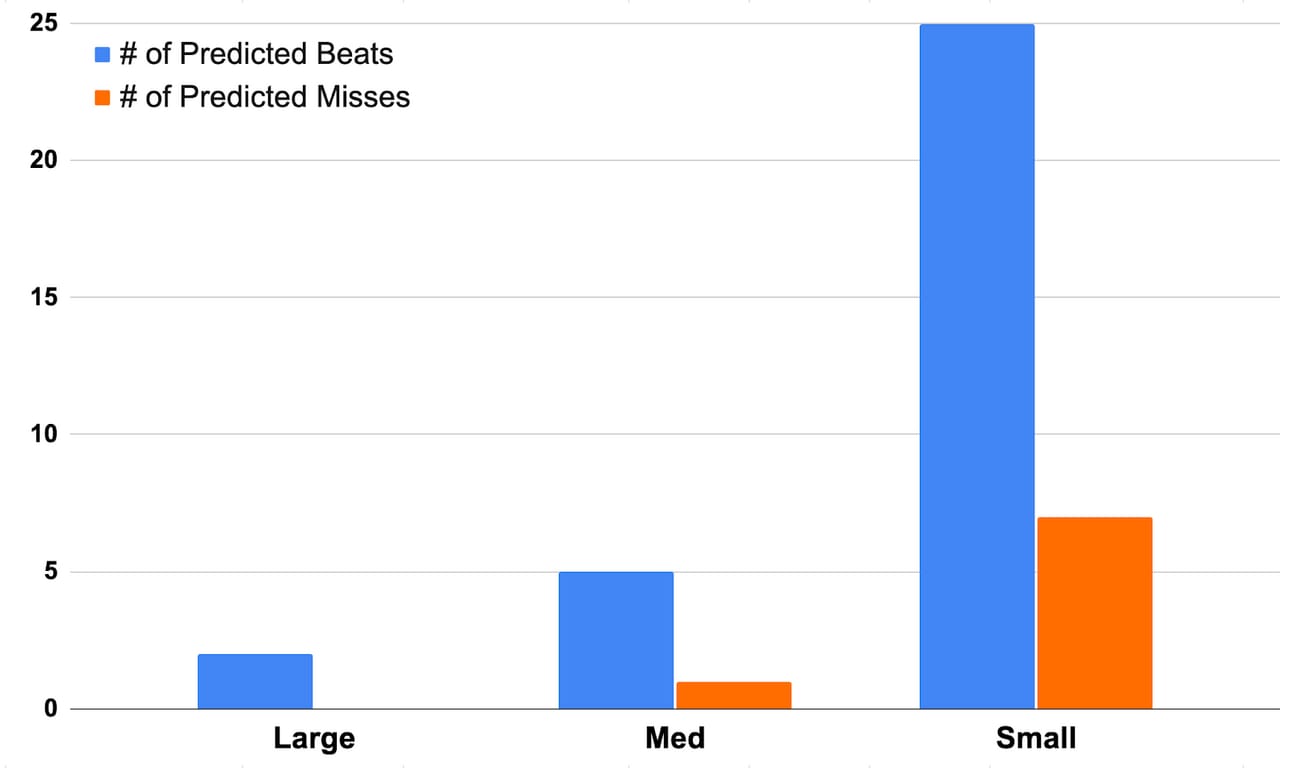

Market Cap Breakdown (Weekly)

Of the 41 companies reporting this week:

Large Caps: 2 beats

Mid Caps: 5 beats, 1 miss

Small Caps: 24 beats, 7 misses

Once again, small caps dominate the count but also carry the most dispersion risk.

Top 5 Predicted Beats This Week

SMPL (Simply Good Foods) – 87% – Consumer Staples – Mid Cap

NRIX (Nurix Therapeutics) – 80% – Health Care – Small Cap

PCYO (Pure Cycle Corp) – 76% – Utilities – Small Cap

LEVI (Levi Strauss) – 75% – Consumer Discretionary – Mid Cap

BSVN (Bank7 Corp) – 73% – Financials – Small Cap

Top 5 Predicted Misses

KRUS (Kura Sushi USA) – 22% – Consumer Discretionary – Small Cap

GNLN (Greenlane Holdings) – 26% – Consumer Staples – Small Cap

CELH (Celsius Holdings) – 34% – Consumer Staples – Mid Cap

PSMT (PriceSmart) – 50% – Consumer Staples – Mid Cap

DAL (Delta Air Lines) – 55% – Industrials – Large Cap

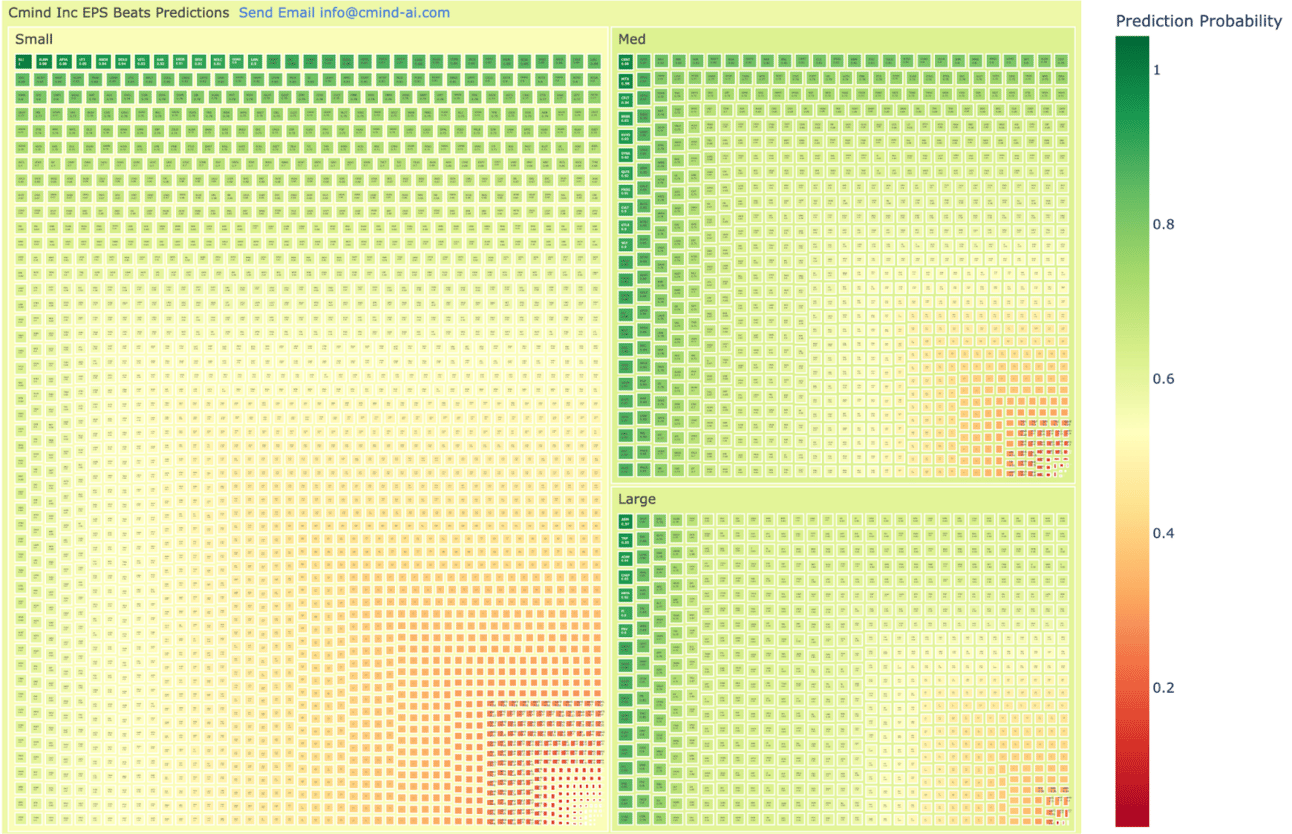

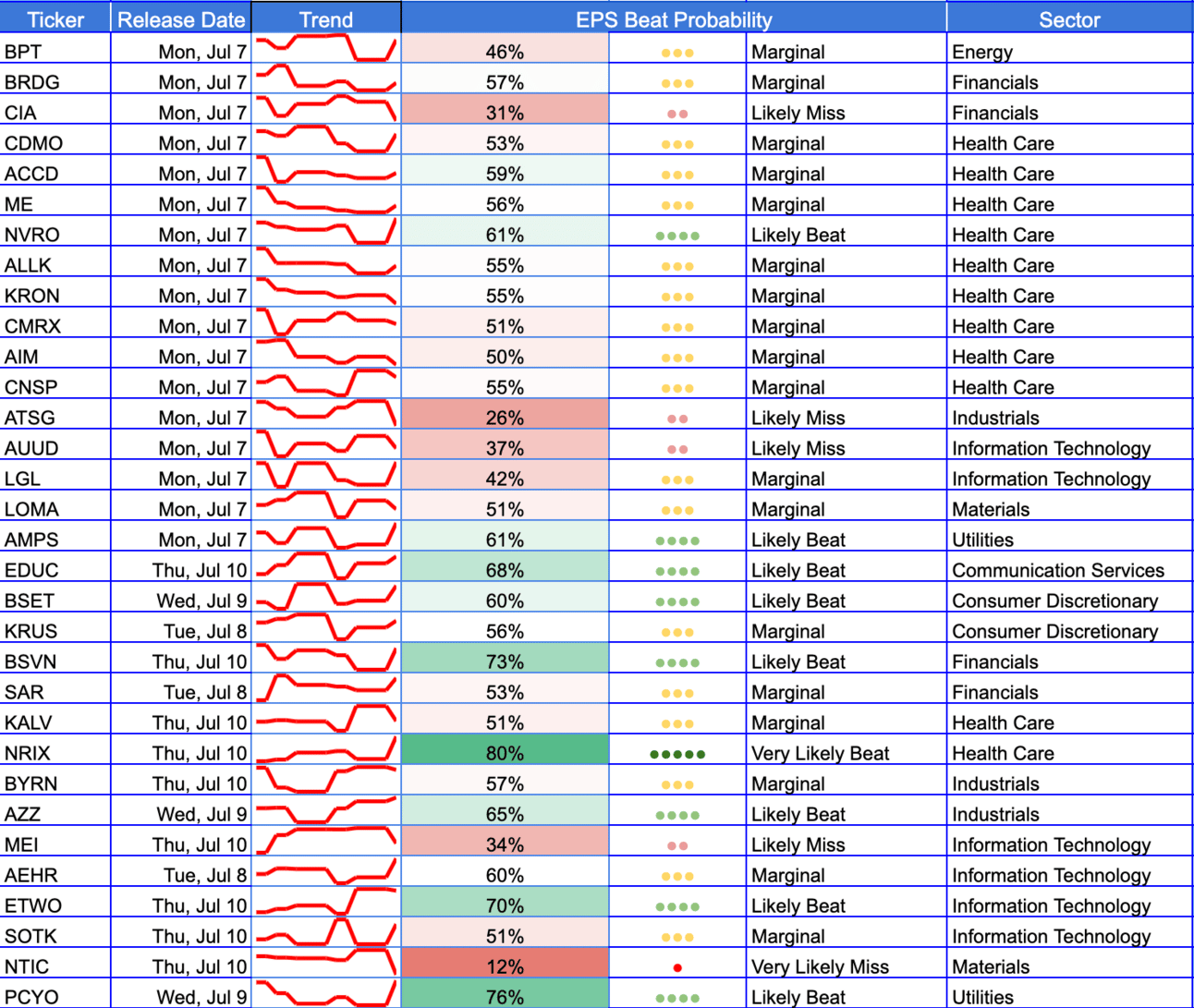

Full Q2 EPS Prediction Heatmap

Our latest Q2 heatmap spans 3,972 companies. While crowded, it signals the depth and breadth of Cmind’s early model coverage.

If you'd like sector-specific or curated heatmaps for your portfolio, reply to this email and we’ll share tailored views.

Individual Stock Predictions by Market Cap

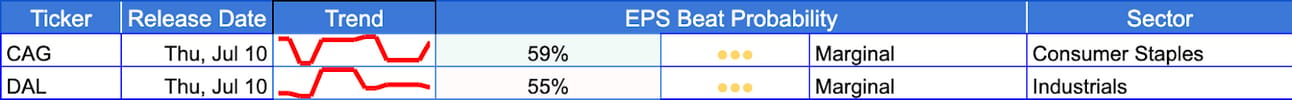

Large Caps

While limited in number, this week’s large-cap cohort includes high-conviction signals. Both AEHR Test Systems (AEHR) and SMPL are flagged as likely beats, driven by strong fundamentals and sector trends in semiconductors and consumer health.

Mid Caps

The mid-cap group sees notable upside from Rush Enterprises (RUSHA) and Transcat (TRNS), both in Industrials. These signals reflect broader strength in operational efficiency and supply chain leverage. However, Neogen (NEOG) is flagged as a likely miss, suggesting potential risk in Health Care names with weaker momentum.

Small Caps

Small caps dominate this week’s release count and show wide dispersion. 23andMe (ME) emerges with strong upside despite recent volatility. Other likely beats include niche players with strong segment momentum. Meanwhile, KRUS and GNLN are among the most likely to miss, reflecting consumer and balance sheet pressures in their respective sectors.

Stock Highlights This Week

1. 23andMe (ME)

Why it’s interesting: A heavily shorted, volatile biotech with exposure to consumer health data and genomics.

Cmind’s angle: Could serve as a speculative earnings mover in a thin week, watch for surprises. Marginal beats probability (56%).

2. Simply Good Foods (SMPL)

Why it’s interesting: Parent of Atkins and Quest. Quietly growing in the protein/snack nutrition space.

Cmind’s angle: A bellwether for health-conscious consumer trends amid macro headwinds. High beats probability (85%).

3. AEHR Test Systems (AEHR)

Why it’s interesting: Provides test systems for EV-grade silicon carbide chips.

Cmind’s angle: Picks-and-shovels exposure to EV and chip cycles. Marginal beats probability (60%).

About the Model

Cmind AI’s EPS predictor integrates over 150 variables—including 10-Qs, governance factors, transcripts, and peer signals—across 4,400+ public companies. Predictions are updated daily, and backtests show significant Sharpe and Sortino ratio improvements when used in portfolio construction.

Want access to the full dataset or enterprise use cases?

Reach out to us at: [email protected]