- Cmind AI by Weihong Zhang

- Posts

- Cmind’s Earnings Outlook: Financials Set the Tone: 78 Earnings Forecasts | C (81%) vs Sector Median (66%)

Cmind’s Earnings Outlook: Financials Set the Tone: 78 Earnings Forecasts | C (81%) vs Sector Median (66%)

EPS Predictions for the Week of July 14th, 2025

Hi everyone,

As we head into one of the most consequential weeks of earnings season, Financials are firmly in the driver’s seat. With over 40 names reporting—including Citi (C), JPMorgan (JPM), Wells Fargo (WFC), and Bank of America (BAC)—our model highlights Financials as the sector to watch.

Below, we unpack the week’s predictions and highlight why our signals are particularly bullish on Citi, which leads its peer group with an 81% beat probability.

Sector Spotlight: Financials Dominate This Week’s Lineup

Financials account for more than half of all companies predicted to beat this week. Among the 65 names in our universe with upcoming earnings:

47 are Financials

Median beat probability across the sector: 66%

Citi stands out with an 81% probability, outperforming key peers (JPM: 68%, WFC: 69%)

Our model’s optimism toward Financials is driven by strong recent trends in earnings before tax, net income margins, and asset efficiency ratios—further supported by macroeconomic stabilization and broadly constructive analyst sentiment.

Deep Dive: Why Citi ($C) Tops Our Financials Forecast

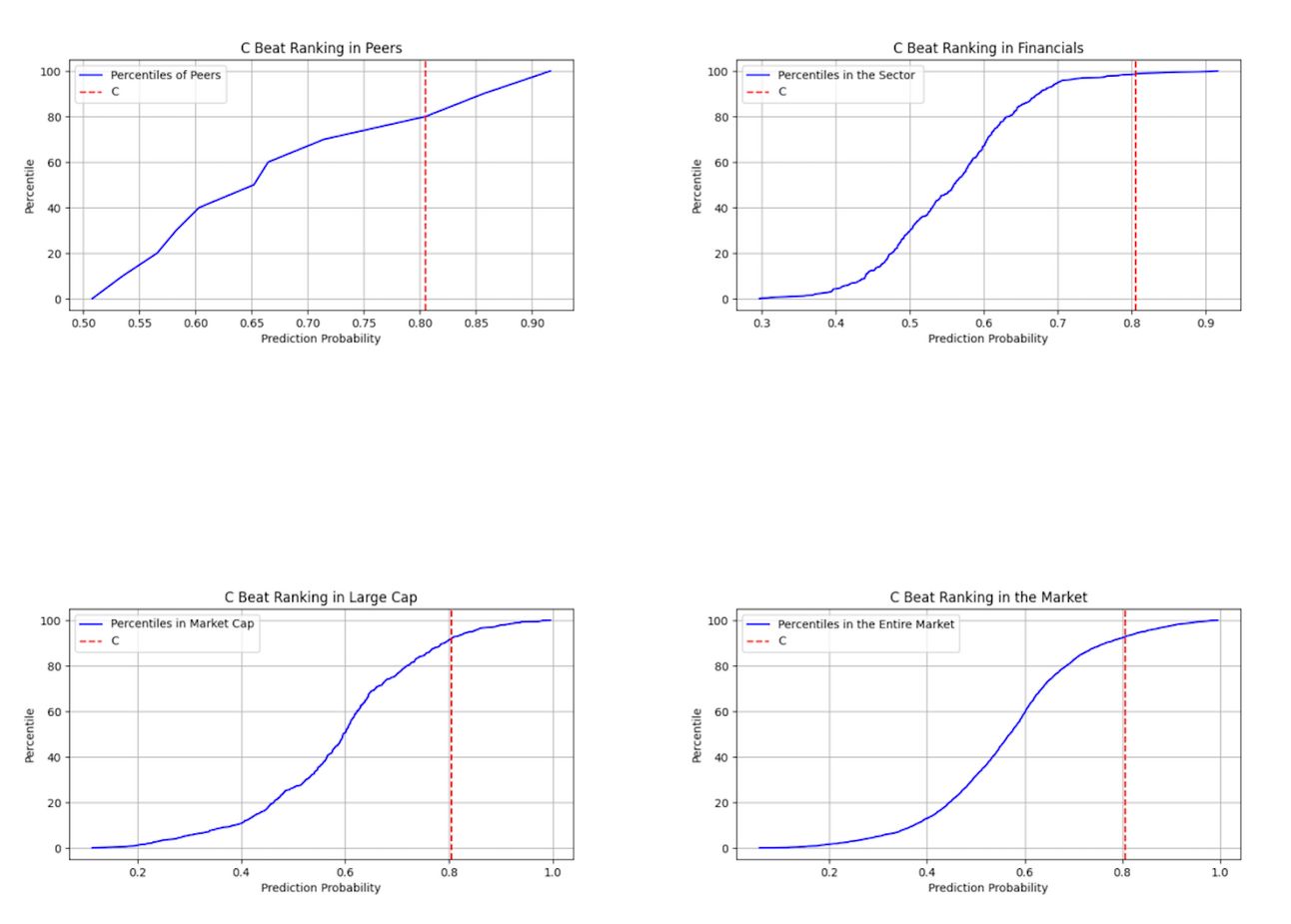

Cmind’s EPS model currently assigns Citi an 81% probability of beating consensus, making it one of the strongest signals this week, not just in Financials but across all large-cap names.

What’s driving the signal?

Strong fundamentals: Citi leads peers on historical EPS, gross profit margins, and EBT-to-assets ratios—core indicators in our model.

Favorable percentile rank: As of this week, Citi ranks in the:

83rd percentile among all large caps

91st percentile within Financials

Top 20% vs a peer group of 20 major banks

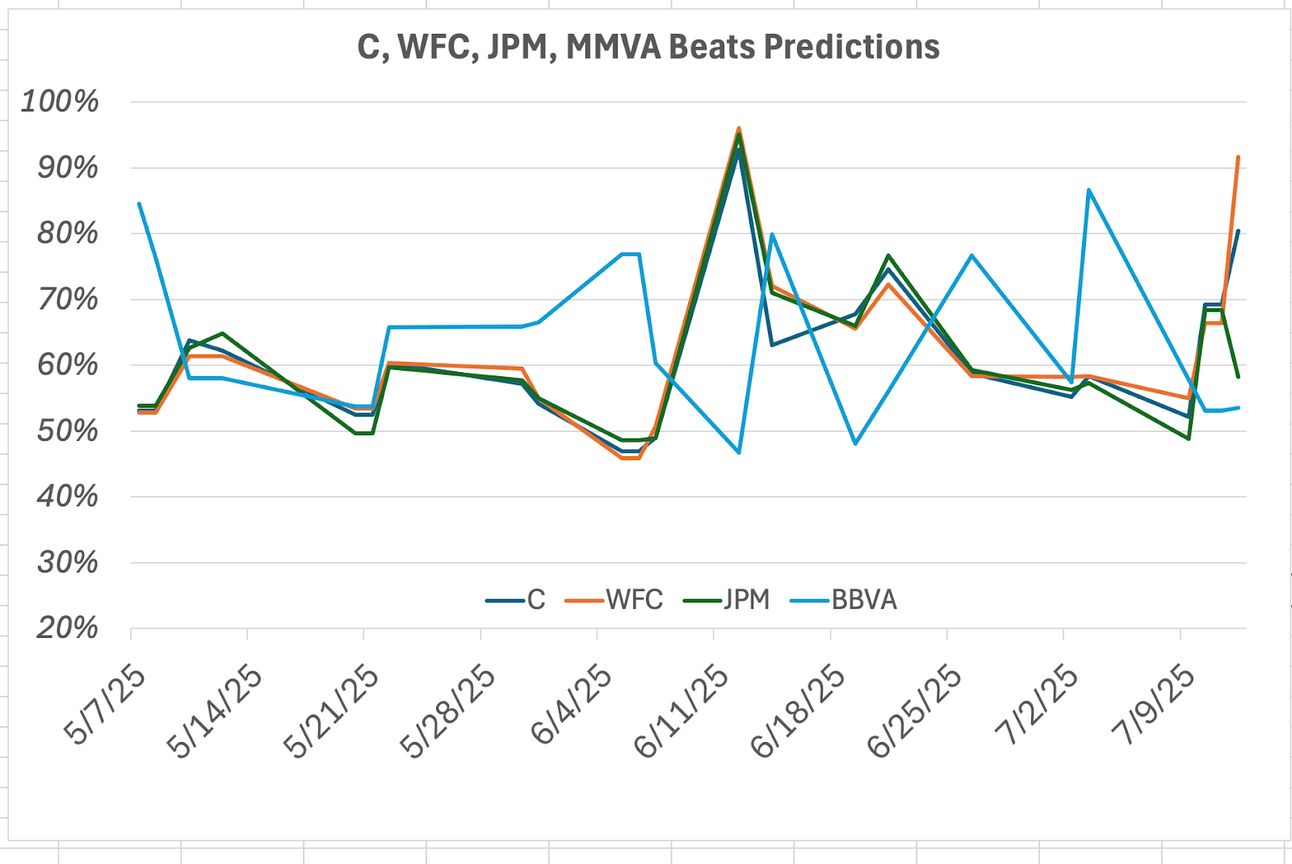

Stable trend vs peers: Compared to WFC, JPM, and BBVA, Citi’s beat probability has remained consistently high over the past quarter, even as volatility hit others.

Sector Breakdown

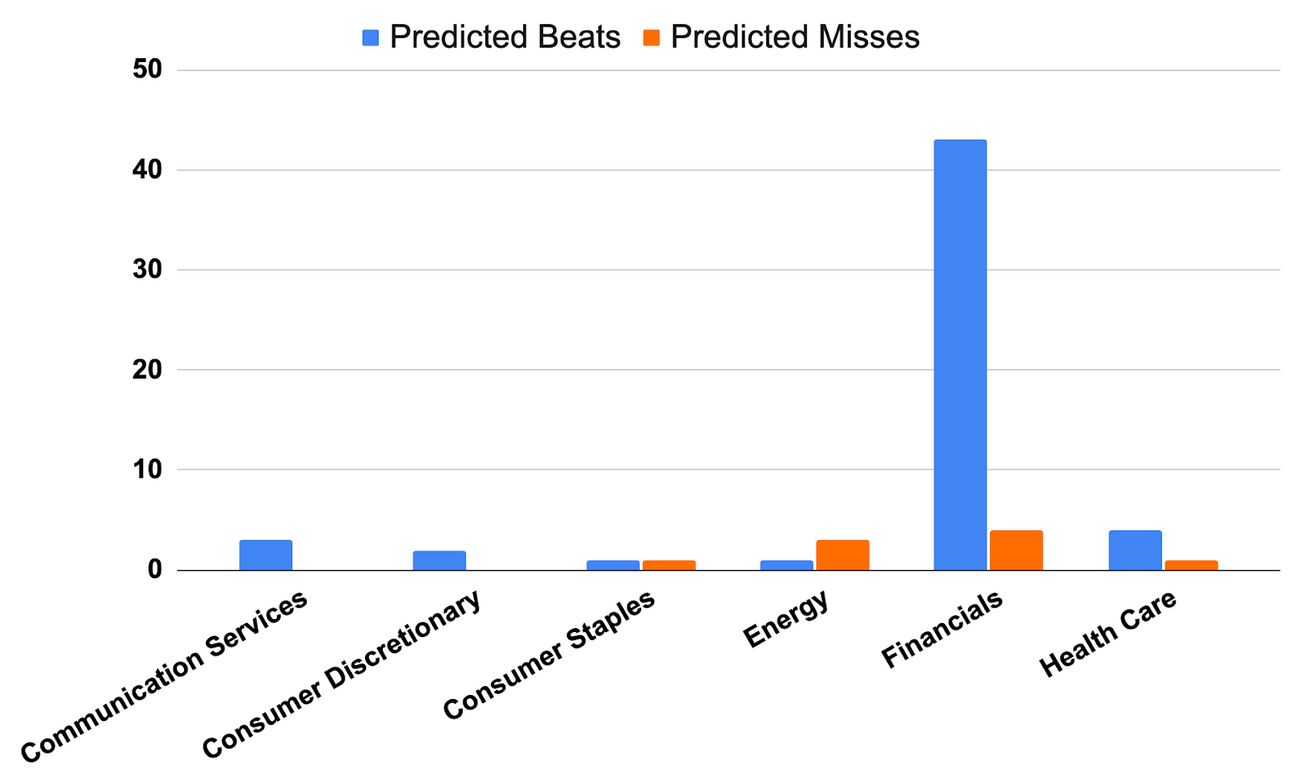

Cmind’s model is flagging Financials as the dominant source of upside this week:

43 companies in Financials are predicted to beat consensus, dwarfing other sectors.

Health Care, while smaller in volume, shows strong directional conviction, with 6 likely beats vs just 1 miss.

Most other sectors are mixed or muted:

Energy and Materials show weak signals and elevated risk of misses.

Consumer Staples and Discretionary are sparse and unconvincing.Communication Services is quiet but modestly constructive.

The overwhelming bias toward Financials suggests this sector could help stabilize market sentiment, especially if key banks post clean beats and conservative guidance.

Market Cap Breakdown

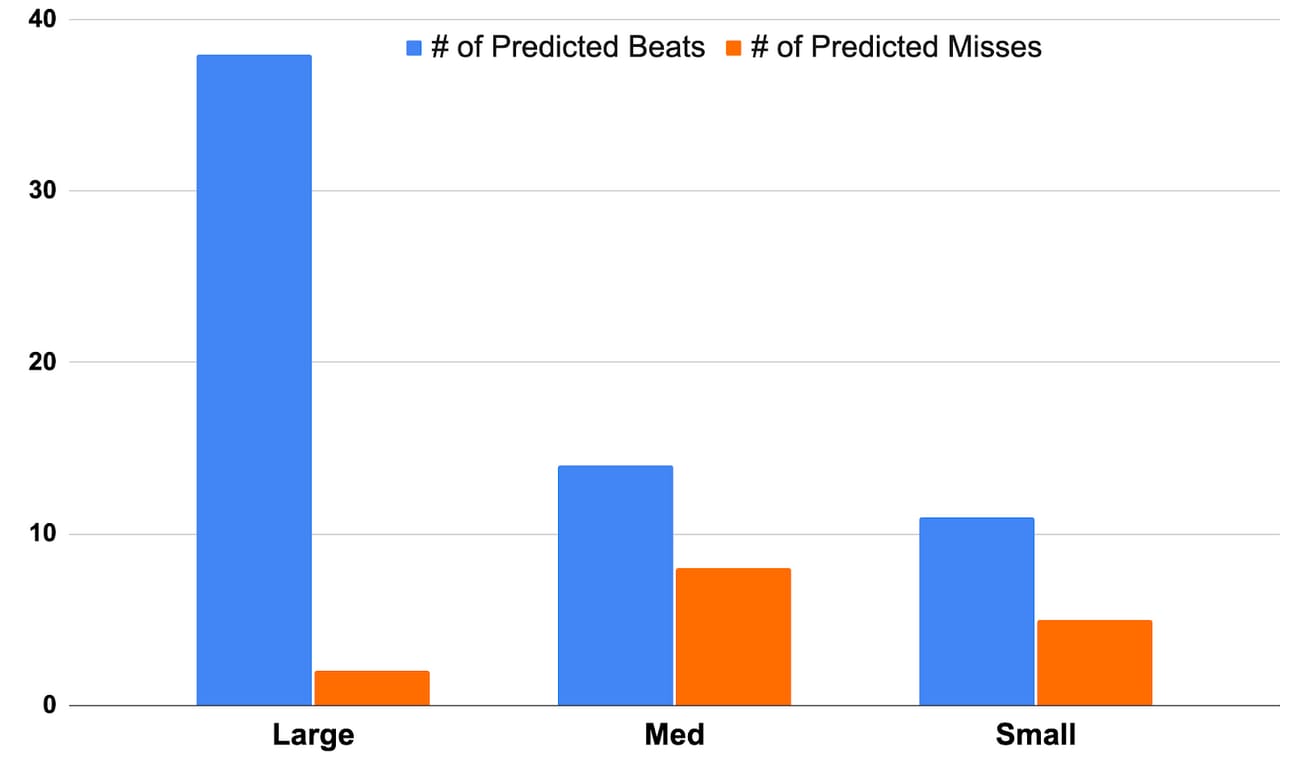

Earnings strength this week is also concentrated in large caps, particularly across the Financials sector:

Large Caps: 38 likely beats vs 3 likely misses

These are high-confidence signals with broader macro implications—especially among the large banks.Mid Caps: 15 beats vs 9 misses

Signals are more dispersed, with both high-upside names like TCBI (76%) and high-risk ones like JBHT (33%).Small Caps: 11 beats vs 6 misses

Small caps continue to exhibit volatility. MCRI (75%) stands out, but dispersion remains high.

Overall, investors looking for signal strength should prioritize large-cap financials and healthcare names this week.

See the percentile ranking and trend chart below for full context.

🔝 Top 5 Predicted Beats This Week

Citi (C) – 81% – Financials

ASML – 80% – Information Technology

MCRI – 75% – Consumer Discretionary

GSBC – 71% – Financials

JNJ – 71% – Health Care

🔻 Top 5 Predicted Misses This Week

RMCF – 23% – Consumer Staples

LBRT – 23% – Energy

PDCO – 26% – Health Care

AA – 34% – Materials

JBHT – 33% – Industrials

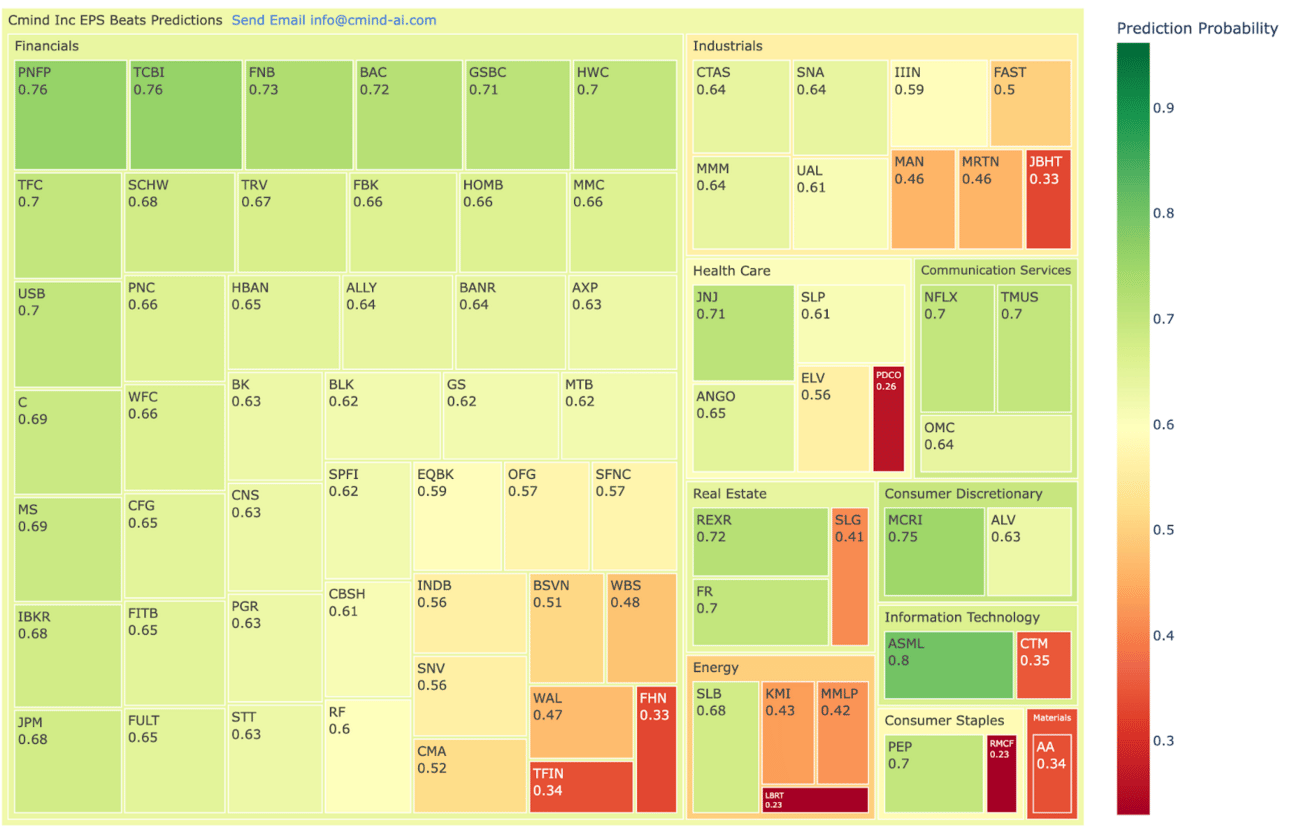

📈 Weekly Heatmap Snapshot

*Heatmap as of July 12th, 2025 |

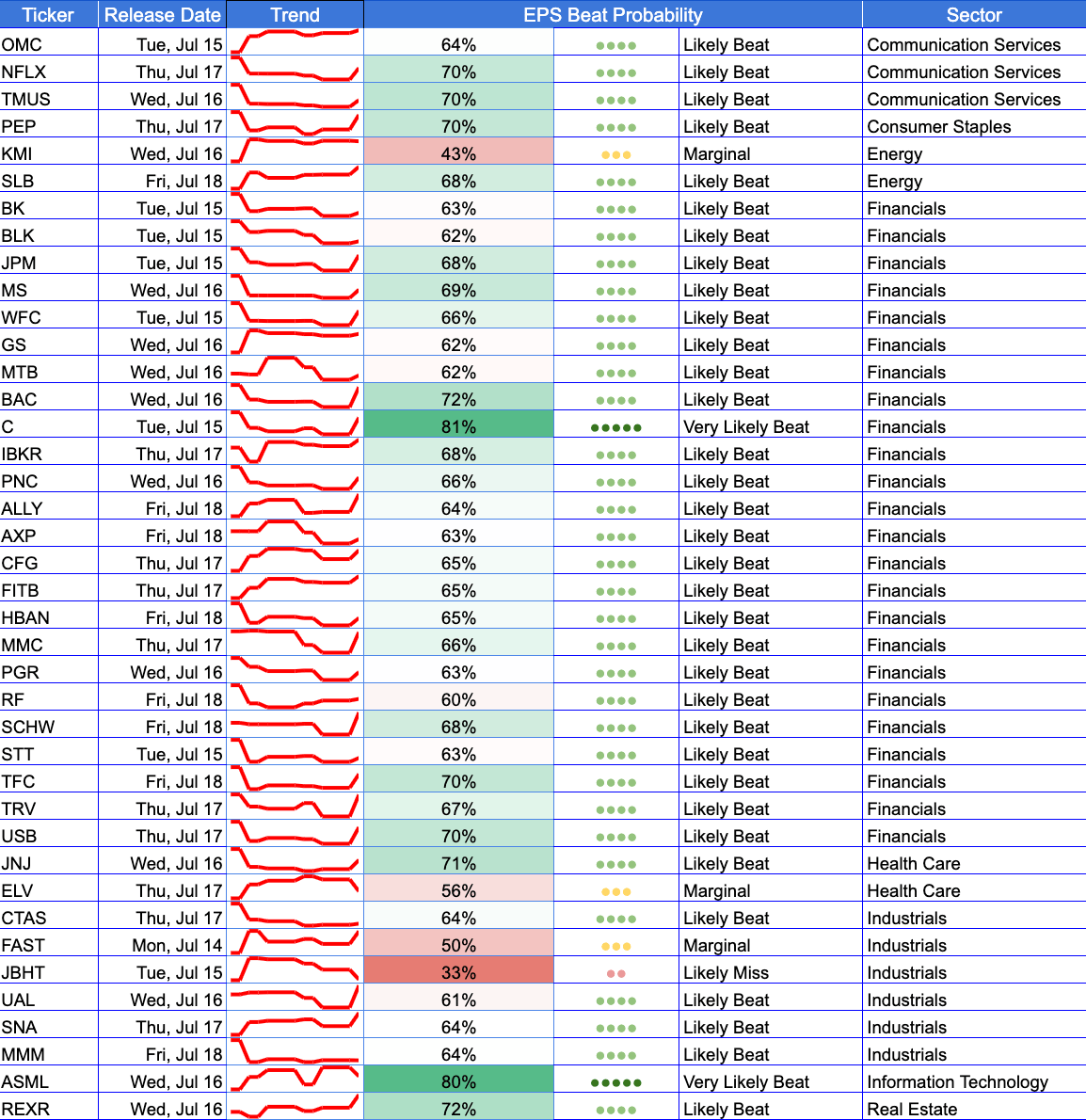

📈 Individual Stock Predictions

Large Caps

This week’s large-cap cohort is heavily tilted toward Financials, where high-conviction beat signals dominate. Citi (C) leads the pack with an 81% beat probability, followed closely by BAC (72%), ASML (80%) in Information Technology, and JNJ (71%) in Health Care. The consistency across these names reflects strong underlying fundamentals and favorable macro drivers. Misses are rare in this tier, with only a handful of names—like JBHT (33%) and AA (34%)—flagged as likely underperformers.

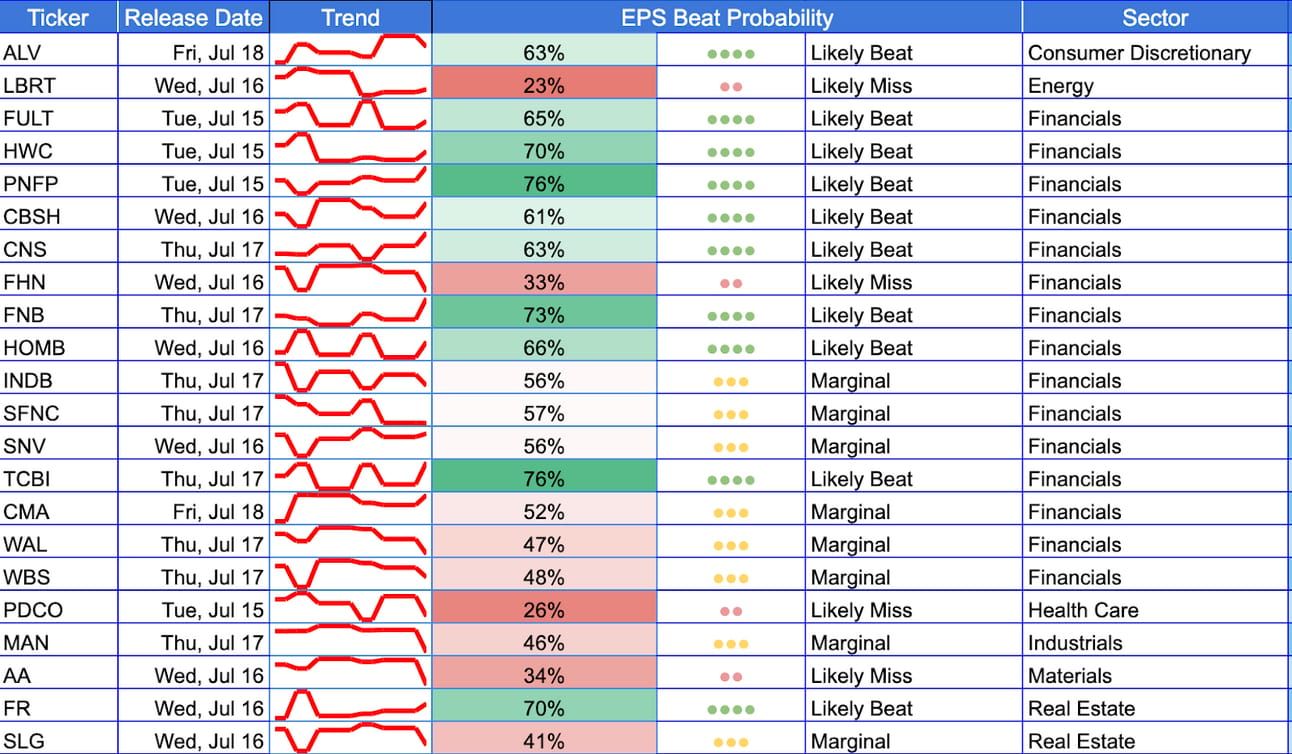

Mid Caps

Mid-cap signals are more mixed, with standout upside names including TCBI (76%) and PNFP (76%) in Financials. These regional banks are showing stable earnings drivers despite broader rate volatility. On the risk side, PDCO (26%) in Health Care and MAN (46%) in Industrials illustrate where fundamentals and sentiment diverge from historical norms. This group requires more careful selection, as dispersion remains elevated.

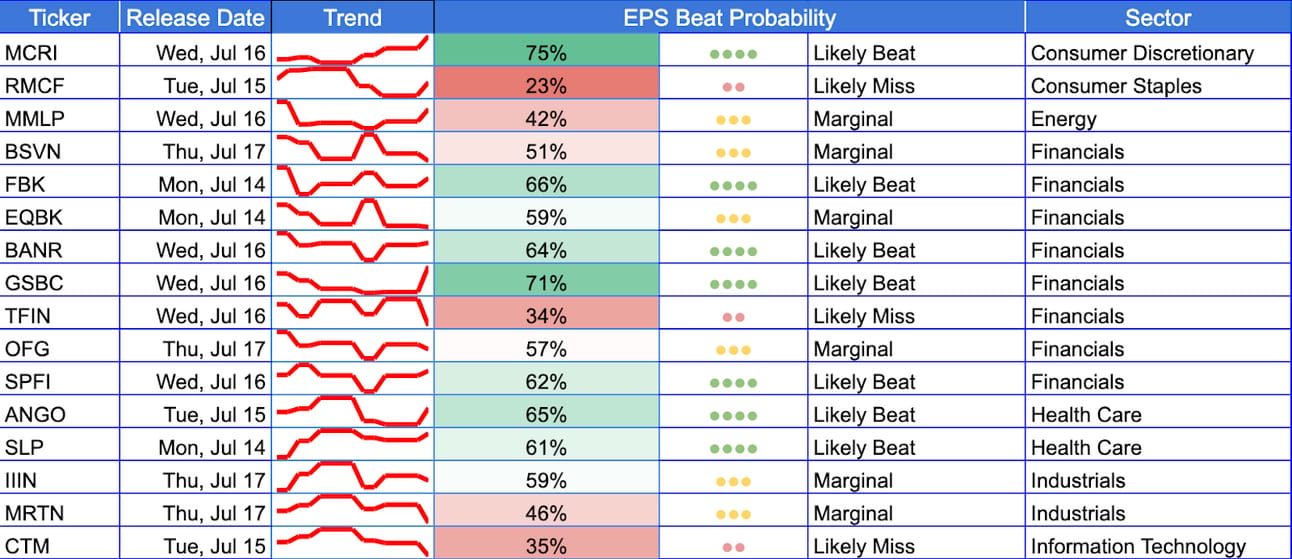

Small Caps

Small caps remain the most volatile group. MCRI (75%) in Consumer Discretionary and GSBC (71%) in Financials offer high-confidence upside potential. However, the lower end of the distribution is well represented too: RMCF (23%) in Consumer Staples and LBRT (23%) in Energy are both flagged as likely misses. The signal gap within this cohort reinforces the importance of targeting high-probability names while remaining cautious around structurally weaker equities.

About the Model

Cmind AI’s EPS predictor integrates over 150 variables—including 10-Qs, governance factors, transcripts, and peer signals—across 4,400+ public companies. Predictions are updated daily, and backtests show significant Sharpe and Sortino ratio improvements when used in portfolio construction.

Want access to the full dataset or enterprise use cases?

Reach out to us at: [email protected]