- Cmind AI by Weihong Zhang

- Posts

- 359 EPS Predictions: Staples Lead, Small-Caps Scatter, and Tech Signals Strength

359 EPS Predictions: Staples Lead, Small-Caps Scatter, and Tech Signals Strength

EPS Predictions for the Week of May 12th, 2025

Hi everyone,

As of May 7, our EPS Beats predictor has issued updated forecasts for 359 companies reporting earnings during the week of May 12, 2025. These early signals leverage Cmind’s proprietary methodology, integrating daily fresh filings and market data. Forecasts remain dynamic and may adjust closer to the earnings dates, ensuring our clients have real-time insights.

What’s New This Week

This week’s lineup features a diverse range of sectors and market caps, with notable strength in Consumer Staples and Communication Services. Small-cap names dominate the high-confidence forecasts, with several poised for significant post-earnings moves. Large-cap companies, while fewer in number, offer strategic signals essential for portfolio considerations.

Consumer Staples emerges as the strongest sector, with multiple high-conviction predictions, closely followed by Communication Services, both displaying robust beat probabilities.

Prediction Quality and Confidence

Our model highlights six names in the Very Likely Beat category, the highest confidence tier:

EWCZ (Consumer Staples, Small Cap) – 97%, May 14

APEI (Consumer Staples, Small Cap) – 94%, May 12

GROV (Consumer Staples, Small Cap) – 92%, May 14

PERI (Communication Services, Small Cap) – 91%, May 13

DOLE (Consumer Staples, Small Cap) – 91%, May 12

XNET (Communication Services, Small Cap) – 90%, May 15

Conversely, nearly 70% of predictions this week fall into the Marginal category, suggesting a cautious approach and closer monitoring is necessary as earnings announcements approach.

Market Outlook

Small Caps lead the week’s volume, highlighted by the highest-confidence opportunities. While they carry greater volatility, the potential for substantial earnings-driven moves is notable.

Mid Caps exhibit mixed signals this week, warranting careful selection with individual name scrutiny recommended.

Large Caps, though fewer, include significant high-confidence names, particularly within Information Technology and Health Care sectors, providing strategic opportunities for concentrated positions.

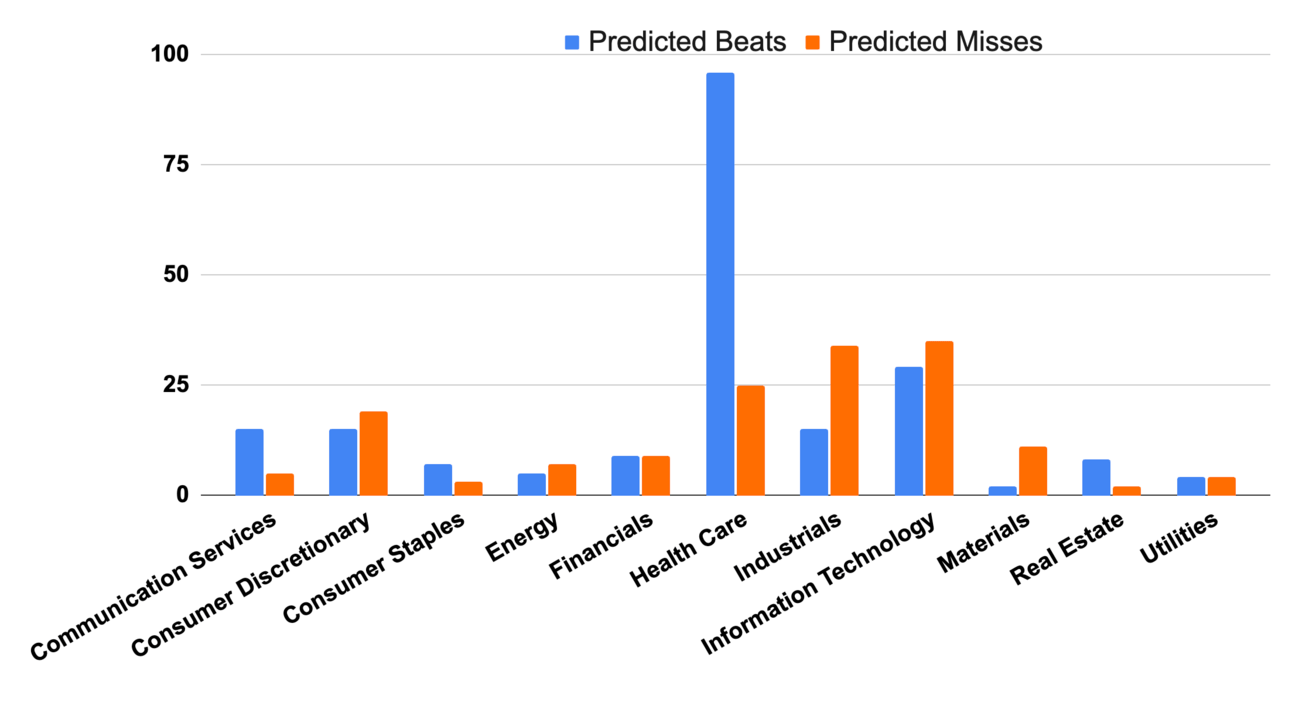

Sector Outlook

Consumer Staples: Strongest sector this week, with high-confidence opportunities and a favorable beat average of 65%.

Communication Services: Strong second place, with an average beat probability of 63%, highlighting notable small-cap digital media firms.

Real Estate: Steady signals, maintaining a solid position with a 60% beat probability.

Health Care & Information Technology: Mixed signals with moderate confidence, these sectors benefit from targeted, selective analysis, as there’s a big concentration in the marginal group, with moderate beat probability.

Energy: Remains notably weak, reflecting broader macro challenges and limited upside signals.