- Cmind AI by Weihong Zhang

- Posts

- Cmind EPS Beats Outlook: Adobe’s Big Test: Can AI Drive a Beat?

Cmind EPS Beats Outlook: Adobe’s Big Test: Can AI Drive a Beat?

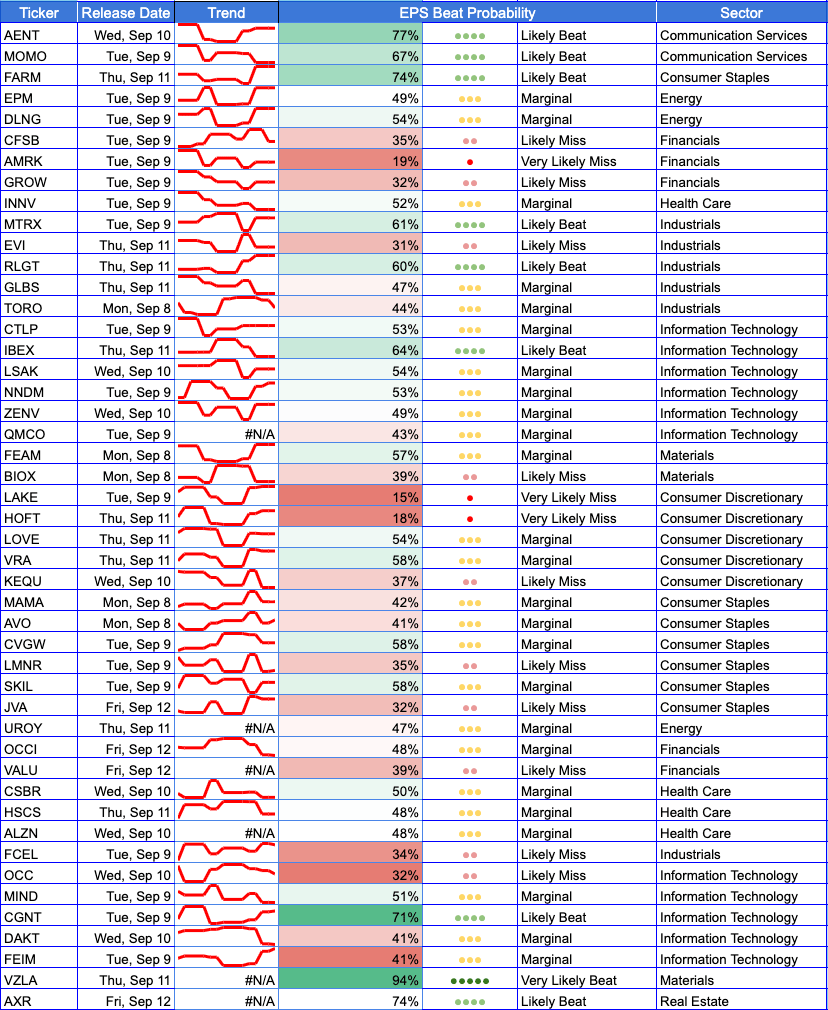

EPS Predictions for the Week of September 8th, 2025

Deep Dive: Adobe (ADBE): AI in Focus

Adobe reports on Thursday, September 11, and the stakes are high. Wall Street expects EPS of $4.21 on revenue of $5.91 billion (+11% and +9% YoY). Our model tilts toward a beat, but the real story is what the results say about AI adoption and enterprise spending.

Why it matters:

Tech Bellwether: Adobe’s Creative Cloud, Document Cloud, and Digital Experience platforms make it a proxy for software and creative tools demand globally. Its results ripple across both tech and creative industries.

AI Monetization: Products like Firefly and Acrobat AI Assistant are early tests of whether legacy software companies can capture value from generative AI. Management has already raised 2025 guidance, citing faster-than-expected adoption.

Enterprise Signals: With budgets tightening in some sectors, Adobe’s large enterprise deals offer a window into corporate IT spend and whether AI features are converting into higher contract values.

Stock Setup: Shares are down ~17% this past quarter, leaving investors looking for a rebound catalyst. A beat paired with strong forward guidance could drive a sharp re-rating.

Macro Context: Adobe reports alongside Kroger and close to other tech peers, meaning its tone on demand, pricing power, and retention could influence broader sector sentiment.

Our take:

Cmind’s model sees a high likelihood of a beat, with momentum supported by recurring revenue strength and peer reads from software and cloud companies. The risk lies in margins, as AI-related R&D and infrastructure investments may weigh in the near term.

Bottom line: Adobe’s Q3 results will be watched not only for their numbers, but as a referendum on whether AI is translating into real, durable growth for established software leaders.

Sector Breakdown

Information Technology leads with the strongest beat signals, driven by Oracle and Adobe, as well as several smaller-cap names. Consumer Discretionary and Staples show mixed signals, with MOMO standing out positively but retailers and growers under pressure. Industrials are broadly stable, while Financials and Health Care tilt toward misses, weighed down by names like LAKE and ZENV. Energy and Materials remain niche but net positive, thanks to upside in OCC and HIHO.

Market Cap Breakdown

Large Caps: Adobe and Oracle anchor the group, both with favorable beat probabilities.

Mid Caps: Mixed outlook—Synopsys shows stable beat potential, while mid-cap health care and industrials face headwinds.

Small Caps: The most volatile group, with strong positive signals for UROY, MOMO, and VZLA offset by steep downside in AVO, NNDM, and LAKE.

🔝 Top 5 Predicted Beats This Week

UROY (+36%) – Financials

QMCO (+29%) – Financials

KFY (+16%) – Industrials

MOMO (+14%) – Consumer Discretionary

VZLA (+12%) – Materials

🔻 Top 5 Predicted Misses This Week

LAKE (-35%) – Health Care

AVO (-32%) – Consumer Staples

NNDM (-28%) – Energy

ZENV (-27%) – Health Care

FEIM (-21%) – Information Technology

==> New Weekly Heatmap

Attached: probability change heatmap visualizing last week’s model updates across all reporting sectors.

Individual Stock Predictions

Large Caps

Adobe dominates the large-cap slate this week, with our model leaning toward a beat as AI adoption supports its Creative and Document Cloud franchises. Oracle also shows improved probability, reinforcing IT sector strength.

Mid Caps

Synopsys stands out in tech with solid demand visibility, while Korn/Ferry is flagged as a likely beat in Industrials. Conversely, ZENV shows a strong miss signal in Health Care.

Small Caps

The dispersion is widest here. UROY and QMCO post outsized positive moves, while AVO, NNDM, and LAKE signal caution. MOMO’s positive revision suggests upside in Chinese consumer tech, offsetting weakness in growers and industrials.

How Our EPS Beat Predictor Works

Cmind AI’s EPS predictions are powered by a machine learning model built for accuracy, objectivity, and transparency. It integrates five data modalities and over 150 variables—including historical financials, corporate governance factors, and earnings call transcripts—to generate early, company-specific forecasts. Predictions are updated daily following 10-Q filings, covering more than 4,400 publicly traded companies, far beyond the reach of most traditional analysts. Every forecast includes clear explanatory variables, offering not just a number, but insight. The model also enables trend analysis across tickers, sectors, indices, and portfolios—and backtesting shows it can significantly enhance investment performance, improving Sharpe and Sortino ratios.

To learn more about Cmind AI please contact us at [email protected]