- Cmind AI by Weihong Zhang

- Posts

- The Most Important Earnings Cluster of Q4 Begins Now | CRM, SNOW, CRWD

The Most Important Earnings Cluster of Q4 Begins Now | CRM, SNOW, CRWD

High-probability signals favor Industrials and Tech as volatility stays elevated.

Hi to everyone!

The first week of December arrives with a market that feels both steady and unsettled—caught between fading November anxiety and a cautious return to fundamentals. Investors have spent the past two weeks recalibrating: AI multiples compressed, Treasury volatility eased, and the November risk-off pocket revealed a tape far more selective than it was even a month ago. Now, as December trading begins, the burden of proof shifts squarely to earnings—specifically to the enterprise-software and AI-infrastructure names whose results will set the tone for the final stretch of 2025.

Across the Cmind predictions, a precise pattern is emerging:

This is a dispersion week.

Strength is consolidating around Industrials, Financial, and AI Infrastructure.

Software trades on guidance; AI hardware trades on cycle strength.

Energy and Real Estate are structural shorts.

Large caps stabilize, mid caps drive alpha, small caps create convexity.

CRM / CRWD / SNOW set the tone for Q1 AI expectations.

This week’s cluster—led by Salesforce, CrowdStrike, Snowflake, MongoDB, Dollar Tree, Marvell, UiPath, and HPE—will shape expectations for Q4 earnings season, beginning in January, and preview whether enterprise budgets, cloud consumption, and AI adoption are accelerating or plateauing.

The final weeks of 2025 will be dominated by clarity, credibility, and cash flow—not theme-driven positioning.

CRM, CRWD & SNOW — Three Pillars Shaping AI’s Next Earnings Cycle

This week’s enterprise-software trifecta—Salesforce, CrowdStrike, and Snowflake—will determine whether AI-driven enterprise spend enters re-acceleration or levels off into year-end. The three companies control the narrative across applications, security, and data infrastructure, and the market treats them as the composite read-through for enterprise budgets into 2026.

Salesforce (CRM) - 61% Beat

Salesforce enters the print as the guidance barometer of enterprise software. Despite strong Data & AI revenue growth last quarter, the model places CRM in a guide-sensitive 60–65% band, meaning the print can land but still fail to trigger follow-through unless FY26 commentary tightens. The key is Agentforce monetization, not slideware around TAM. Investors want clean attach rates, tighter margin precision, and early pipeline signals for regulated verticals. CRM’s next quarter will hinge on whether management leans into visibility and discipline, not just AI optimism.

CrowdStrike (CRWD) - 53% Beat

CRWD remains the clearest test of AI-enabled security economics. ARR momentum is strong, and Falcon Flex continues to scale, but the stock now trades in a zone where beats don’t guarantee upside unless operating leverage and net retention stability show through. The Cmind model signals mid-60s “prove-it” territory ahead of earnings. Next quarter’s drift will depend on federal wins, cloud consolidation, and whether Falcon-for-AI drives incremental ticket uplift beyond consolidation.

Snowflake (SNOW) - 47% Beat

SNOW is the highest-volatility setup of the week. Historically, it is one of the most explosive post-earnings movers in the market. The model places SNOW in the path-dependent zone, where a clean beat and constructive guide can trigger multi-week drift. The print hinges on AI workload conversion and whether Snowpark/Cortex are driving real consumption uplift. Next quarter, SNOW will either enter the upper tier of AI monetizers or settle into a consumption-model grind, depending on this week’s guide clarity.

What’s at Stake?

Together, CRM, CRWD, and SNOW will set the tone for:

AI budget priorities for Q4 2025 and Q1 2026

Enterprise software revision trends

Whether high-multiple software remains investable into early 2026

Their combined signals will likely shape sector positioning for the next 8–10 weeks.

See how our model tracks the earnings beat, major commentaries, and corporate events daily since its last earnings release.

High-Probability Clusters (Green)

Financials

Financials remain the strongest overall cluster, with large regionals and diversified financials firmly in the 70-84% band.

Strength stems from:

Stabilizing credit costs

Firm net-interest margins

Early signs of capital-markets thaw (IB, ECM, DCM flows

Industrials

Industrials remain the model’s most balanced sector. Broad green coverage reflects:

Backlog durability

Pricing power

Short-cycle stabilization in logistics and manufacturing

Information Technology

AI infrastructure remains the engine of sustainability in the model, with strong signals in:

Semiconductor capital equipment

Enterprise infrastructure

Select network/silicon suppliers

Low-Probability Clusters (Amber/Red)

Energy

The softest sector in this week’s lineup. Slower utilization trends, mixed pricing, and rising break-even costs push the cohort toward the low 40s and upper 30s.

Real Estate

REITs cluster tightly between 45-55%, reflecting:

Refinancing risk

Higher operating leverage

Slower rent growth in coastal markets

Selective Consumer Weakness

While top-tier staples (e.g., PG) remain firm, discretionary and subscale, there are consumer names showing fragility.

Top Predictions for the Week of December 1-6, 2025

🔝Top Predicted Beats This Week

IMPP (Dec 1) - 93% - Energy - Small Cap

GTLB (Dec 2) - 91% - Information Technology - Mid Cap

BOX (Dec 2) - 90% - Information Technology - Mid Cap

DAKT (Dec 3) - 89% - Information Technology - Small Cap

WLY (Dec 4) - 83% - Communication Services - Mid Cap

🔻Top Predicted Misses This Week

HOFT (Dec 4 ) — 10% - Consumer Discretionary - Small Cap

LESL (Dec 2) — 18% - Consumer Discretionary - Small Cap

VMAR (Dec 1) — 23% - Consumer Discretionary - Small Cap

GCO (Dec 4) — 25% - Consumer Discretionary - Small Cap

S (Dec 4) - 23% - Information Technology - Mid Cap

Market Cap Breakdown

Three Tiers, Three Different Stories

Large Caps: The Stability Anchor

Large caps continue to serve as the market’s gravitational center, carrying the strongest and most uniform green clusters on the heatmap. Staples leaders (PG, PM) remain in the high-80s probability band, while Infrastructure and Industrials (IBM, AMAT, LMT, HON) signal durable earnings power supported by AI build-outs and backlog strength. These names are less about upside surprises and more about consistency—a trait investors have begun to prize again after November’s turbulence.

Yet even in the strongest cohort, it’s clear the market cares more about guidance precision than individual beats. Large-cap software and cloud names (Salesforce, SAP, HPE) now trade in a zone where “meeting the quarter” isn’t enough. For the mega-cap and large-cap complex, the story going into next quarter is simple: visibility over vision.

The model shows:

Strong beat probabilities for PG, PM, IBM, AMAT, HON, LMT

Mixed signals for large-cap cloud and software ahead of earnings (CRM, HPE)

Energy and large REITs remain the drag

Large caps remain the “stability anchor” of December—drift patterns favor quality and visibility, not beta.

Mid Caps: Selectivity Over Beta

Mid-caps present the sharpest contrast in the market: pockets of strength anchored by disciplined execution, surrounded by weakness driven by leverage or refinancing exposure. Companies like WAB, PNR, ROG, DGX, ITGR sit in strong territory—lean operating models and solid contract conversion underpin their elevated probabilities.

On the other side, mid-cap Real Estate and Energy names remain fragile, with amber and red signals reflecting both capital-structure realities and sensitivity to macro conditions. This is where the model’s dispersion widens, making mid-caps one of the most fertile hunting grounds for pair-trades and spread capture into year-end.

Mid-caps show the most execution-based alpha, particularly where pricing power and backlog conversion converge. Strength clusters in:

Industrials

Healthcare operators

Select software names with improving retention metrics

Weak tails sit in:

Refinancing-sensitive Real Estate

Discretionary names reliant on promotions (retail seasonality risk)

Small Caps: The Convexity Frontier

Small caps tell the most dynamic—and volatile—story on the heatmap. Regional banks (FRME, ACNB, OFG, WSFS) cluster in green, benefiting from stabilized credit conditions and improving fee trajectories. Niche Tech and Industrial suppliers (OSIS, NTCT) also screen well, supported by backlog clarity and firm order books.

But much of the small-cap universe remains deeply bifurcated. Consumer names reliant on promotions, Energy services firms wrestling with utilization, and small REITs with refinancing cliffs all map to the lower end of the probability spectrum. For small caps, liquidity is the factor—not an afterthought—and earnings reactions could swing sharply as holiday trading thins out.

This remains the convexity frontier. The Cmind model highlights:

Strong clusters in regional banks and niche industrial suppliers

High dispersion in consumer and energy

Significant liquidity constraints that amplify moves both ways

Small-cap dispersion is widening into year-end—favorable for pair trades, spreads, and post-print drift capture.

Individual Stock Predictions

Large Caps

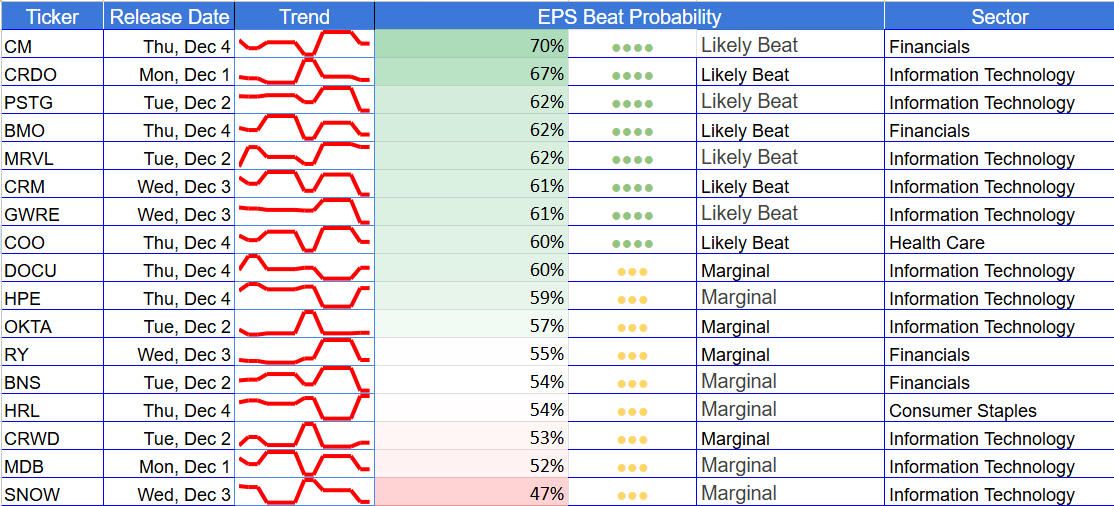

Large caps lean decisively toward the positive side of the distribution, with consistent “likely beat” signals across CM (70%), CRDO (67%), PSTG (62%), BMO (62%), and MRVL (62%). These names benefit from stable institutional demand, resilient margins, and cleaner operating models into year-end. However, dispersion increases within enterprise software: CRM (61%), GWRE (61%), COO (60%), and DOCU (60%) sit in the guidance-sensitive zone where beats may not translate into immediate upside.

Meanwhile, CRWD (53%), MDB (52%), and SNOW (47%) cluster around the marginal category, reflecting elevated volatility and market focus on AI monetization clarity rather than print quality alone. Large caps remain the most stable category overall, but forward-looking commentary will drive reactions more than results as Q4 approaches.

MidCaps

Mid caps display a cleaner upward skew, with a broad green cluster led by GTLB (91%), BOX (90%), WLY (83%), and KFY (83%), all benefiting from strong backlog conversion, subscription durability, or enterprise visibility. Solid positive signals from PATH (72%), FIZZ (69%), and SIG (66%) point to pockets of consumer strength and execution within IT services.

Yet the bottom half of the cohort shows softer conviction, with AI (40%), UEC (38%), CXM (42%), and SAIC (33%) indicating increased miss risk tied to elongating sales cycles or revenue concentration. This bifurcation reinforces that mid-caps will increasingly trade on execution, not narrative, as investor tolerance for guide slippage narrows into December. With liquidity still healthy, this tier offers the cleanest opportunities for high-quality factor rotation and post-print drift capture.

Small Caps

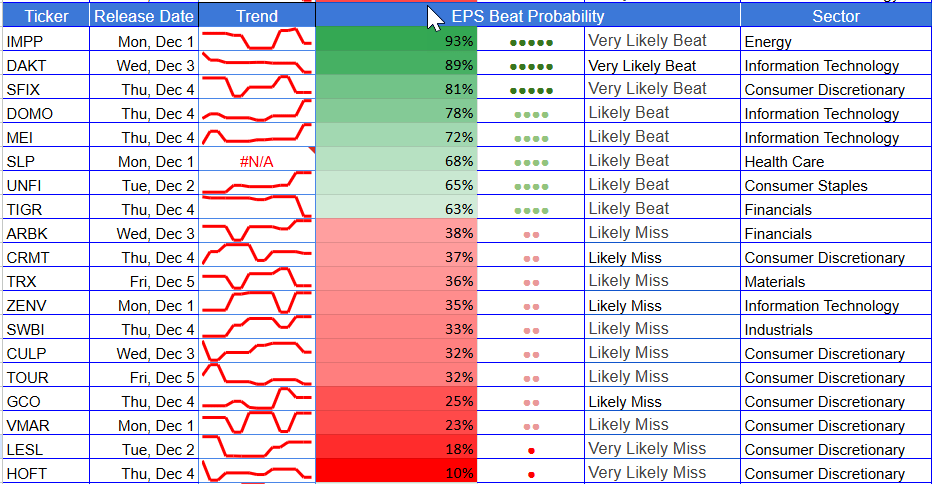

Small caps show the widest dispersion of the week, with a sharp divide between high-confidence beats and deep-red miss candidates. Names like IMPP (93%), DAKT (89%), and SFIX (81%) anchor the right tail, reflecting strong short-term momentum and clear operating leverage signals. The mid-pack cluster—UNFI (65%), TIGR (63%), and MEI (72%)—suggests stabilizing fundamentals but weaker visibility relative to the upper tier.

On the downside, HOFT (10%), LESL (18%), and VMAR (23%) screen as the most fragile, reflecting margin pressure, low velocity trends, and softer demand setups into year-end. This is the highest-convexity segment of the market, ideal for dispersion and targeted long/short structures ahead of thin holiday liquidity.

Looking Ahead: Next Week & the Q4 Earnings Season

Next week, the focal point shifts squarely toward retail and software, where reactions will be guided by forward commentary more than headline beats. In retail, margin quality will matter far more than comps—names like DLTR, DG, and PLCE will be judged on promo intensity, freight discipline, and wage pressure rather than top-line optics. In software, investors will pay up for visibility, pricing power, and clean net retention, not TAM slides; that puts CRM, CRWD, SNOW, and PATH in the spotlight, each entering prints where guide precision will dictate whether strength follows through.

Across large caps, NVDA remains the central swing factor for the AI complex. Its supply cadence, customer breadth, and accelerator mix will set the tone for whether the platform ecosystem (names like AMAT, LRCX, AVGO) continues to lead into year-end or reverts to a more selective tape.

Mid-caps will continue to reward execution-first operators—companies such as WAB, PNR, ROG, and DGX, where pricing power, backlog conversion, and cost control drive the strongest right-tail signals. Meanwhile, small caps remain the most convex part of the market, especially in regional banks (FRME, ACNB, OFG) and niche suppliers (OSIS, NTCT), but also the most fragile in energy services and promotional consumer names heading into thin holiday liquidity.

Q4 earnings season (January–February) is expected to deliver 7–8% EPS growth, marking the 10th straight quarter of positive earnings, with analysts projecting re-acceleration into Q1 2026. Companies showing credible AI monetization (e.g., SNOW, CRWD, MDB), firm cost discipline (e.g., PG, ITW), and capital-efficient growth (e.g., MCO, AMP) will be best positioned for post-print drift as investors shift from story-driven positioning toward measurable operating leverage.

About the Model

Cmind AI’s EPS predictions are powered by a machine learning model built for accuracy, objectivity, and transparency. We ingest over 150 variables across six data modalities—including real-time 10-Q filings, earnings transcripts, governance metrics, and peer signals—to provide early, company-specific EPS forecasts.

Updated daily, our model covers 4,400+ public companies, with proven backtests demonstrating improvements in Sharpe and Sortino ratios across portfolios.

📩 To learn more, contact us at [email protected]

1