- Cmind AI by Weihong Zhang

- Posts

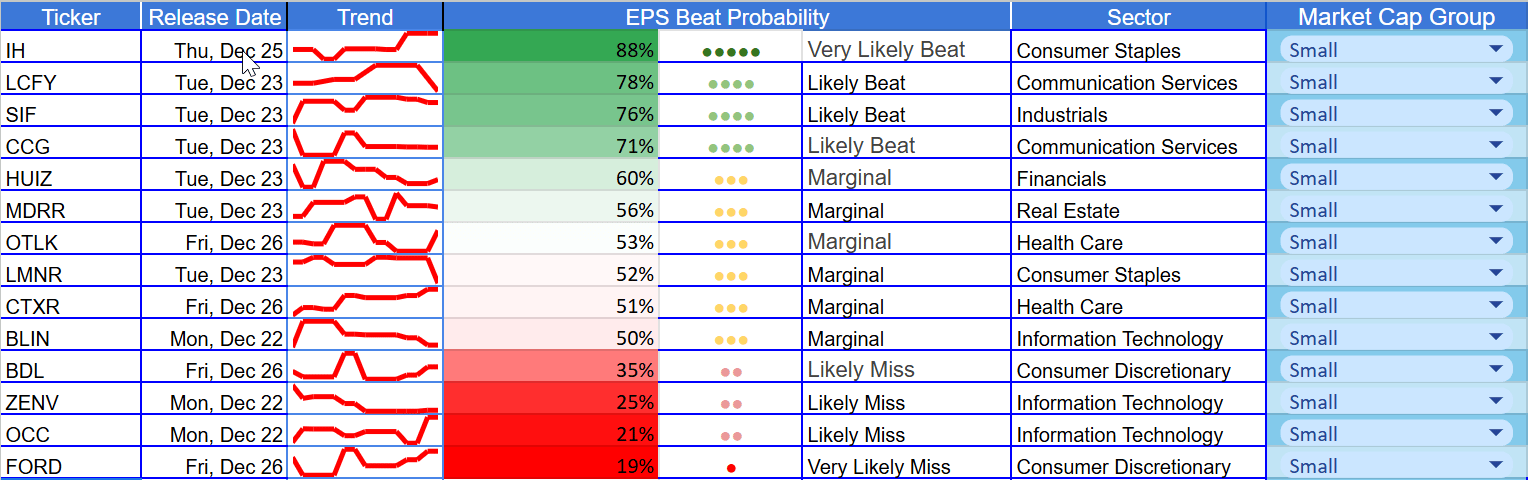

- The week’s reddest names: FORD 19%, OCC 21%, ZENV 25%

The week’s reddest names: FORD 19%, OCC 21%, ZENV 25%

Miss risk is clustering—what the model is flagging and what to watch | Feature: Q4 earnings recap - who was rewarded

Hi everyone — welcome to this week’s Cmind Earnings Outlook.

This is a tail-risk week by design. The calendar is holiday-shortened and dominated by 14 small-cap prints across 8 sectors, which creates an important imbalance: dispersion can look “quiet” at the index level while single-name moves get amplified on any real surprise. In a thinner tape, the market doesn’t need a big macro catalyst to produce large outcomes—it just needs one earnings call that changes the confidence curve.

The market’s scoring rubric remains consistent with what we saw through Q4: investors are still rewarding execution + cash-flow clarity and punishing hand-wavy narratives, particularly where funding needs or discretionary demand uncertainty are in play. Year-end mechanics only intensifies that dynamic—trading volumes typically thin out, positioning becomes more fragile, and the “surprise penalty” can be steep when a print introduces ambiguity. That’s why this week’s heatmap matters: it’s not trying to predict index direction—it’s mapping where outcomes are most asymmetric, and right now the left tail is clustering in a way that deserves respect.

Feature of the Week: Q4 Earnings Recap

If there was one consistent lesson from the past quarter of earnings, it’s this: the market stopped pricing stories and started pricing conversion. We saw repeated examples of resilient demand paired with heightened sensitivity to guidance quality—where “good numbers” weren’t enough if the forward bridge wasn’t clean, quantified, and credible. In other words, investors increasingly treated the quarter as the receipt, and the outlook as the product.

3 takeaways from the past quarter

1 - Guidance did more work than the EPS line.

Across Q4 prints, investors increasingly treated reported EPS as backward-looking arithmetic and the guide as the true decision point. That showed up in both sector rotation and single-stock reaction functions: the market rewarded visibility (cadence, backlog conversion, margin bridge, and confidence in timing) and punished uncertainty (timing slips, range widening, and vague ROI framing).

2 - “AI spend” became a cash-flow debate, not a narrative debate.

The quarter reinforced a pivot we’ve been flagging: investors are less interested in AI ambition and more focused on CapEx → revenue → free cash flow conversion. That’s why we saw pressure in certain AI-adjacent pockets even as broader indices stabilized—rotation punished weak conversion framing and rewarded proof points. The market’s question became simple: when does the spend turn into repeatable, margin-accretive revenue?

3 - Defensive wasn’t “risk-off”—it was “visibility-on.”

Staples and parts of Health Care behaved less like pure safety trades and more like earnings-visibility trades. The late-year posture has been selective: stable earnings power with clearer forward language got paid; everything else had to re-earn credibility.

Weekly heatmap — The Green, The Red, and where surprise risk is clustering

This week is all small-cap, so think of the heatmap less as a “market view” and more as a risk map for outsized single-name reactions.

Sector-level takeaways

● Communication Services: LCFY (78%) and CCG (71%) screen constructive, suggesting resilient demand signals in communications infrastructure/services.

● Consumer Staples: IH (88%) is the standout high-confidence beat setup of the week; LMNR is closer to coin-flip but improving.

● Industrials: SIF (76%) gives this week a clean “execution” proxy.

● Information Technology: OCC (21%) and ZENV (25%) are the “reddest” tech setups, with BLIN (~50%) sitting near coin-flip but skewing cautious.

● Consumer Discretionary: FORD (19%) is the most extreme miss-risk name this week; BDL (35%) is also miss-leaning.

● Health Care : OTLK (53%) and CTXR (51%) are marginal; reaction will likely be driven by updates and tone more than “beat/miss by a penny.”

EARNINGS CALENDAR

Monday 🎯: Small-cap Tech opens the week with the red cluster

We start the week with a clean test of the heatmap’s “miss pocket” in Information Technology. BLIN (50%) is the coin-flip gatekeeper, while ZENV (25%) and OCC (21%) sit firmly in left-tail territory—exactly the kind of names that can gap on cash runway language, conversion timelines, or any hint that fundamentals are slipping faster than consensus. If this trio prints weakly (or guides cautiously), it sets a risk-off tone inside small-cap tech even if the broader indices look calm.

Tuesday ⚖️: The week’s busiest day—communication services vs. the “prove it” names

Tuesday is the real event day with six prints, and it’s where dispersion shows up most clearly:

● Communication Services splits into a clean green vs. risk-outlier setup:

LCFY (78%) is the week’s strongest comm-services “likely beat,” while CCG is the wild card (listed here at 21%)—a stark contrast that makes this a perfect intra-sector spread day. If LCFY confirms repeatability (demand cadence + margins) and CCG disappoints, the market will likely

● LMNR (52%) sits in the marginal zone—where reaction will be driven by guidance tone more than the quarter.

● HUIZ (60%) is a modest beat-leaning Financials print where stability language matters most.

● SIF (76%) is the clean Industrial execution proxy—beats in Industrials usually hold best when management quantifies the margin bridge and backlog/throughput cadence.

● MDRR (56%) is a “still-green but needs confirmation” Real Estate name—especially sensitive to balance-sheet and cash-flow framing.

Bottom line: Tuesday is where the week’s best long/hedge pairing opportunities show up—greens that can drift vs. fragile names that can gap.

Wednesday 💤: No prints, but positioning risk still builds

Wednesday has no announcements, which doesn’t mean nothing happens. In holiday weeks, the “quiet day” often becomes a positioning day—where traders de-risk ahead of Thursday/Friday small caps. The key is what Monday/Tuesday delivered: if the IT cluster disappoints early, Wednesday can turn into a “reduce exposure” session even without fresh earnings.

Thursday 🎁: IH is the week’s right-tail anchor

Thursday features IH (88%), the standout high-conviction signal of the week. This is your classic “visibility-on” setup: if IH beats and management’s tone confirms durability (demand cadence + margins + forward bridge), it’s the kind of print that can hold gains even in thin liquidity. If it beats but guidance hedges, it becomes a “sell-the-beat” risk—so the reaction function will hinge on clarity more than EPS.

Friday 🎄: Discretionary + Health Care closes the week—watch the gap risk

Friday closes with a classic year-end combo: discretionary fragility + health-care headline sensitivity.

● FORD (19%) is the most extreme miss-risk name of the week—this is where demand uncertainty and margin pressure can show up quickly, and thin liquidity can exaggerate the move.

● BDL (35%) is also miss-leaning in discretionary, reinforcing the week’s consumer fragility pocket.

● CTXR (51%) and OTLK (53%) are coin-flip Health Care prints—where updates, timelines, and cash posture can overwhelm the EPS line.

Friday’s framing: if discretionary misses cluster, the market will treat it as a “visibility penalty”, not just a one-off miss.

________________________________________________

Biggest score movers (10+ point shifts)

These are the best “why now?” tickers—either new information hit the tape, or the model re-weighted meaningfully as signals updated:

✅ Upward shifts

● IH +21 pts to 88% — the biggest confidence ramp of the week.

● LMNR +11 pts to 52% — still marginal, but the trajectory is improving.

⚠️ Downward shifts

● MDRR -21 pts to 56% — still beat-leaning, but conviction collapsed; this is a classic “confirmation required” setup.

● OCC -18 pts to 21% — the model materially de-risked; miss-cluster behavior.

● CCG -10 pts to 71% — still green, but the signal cooled; look at watch guide language closely.

_____________________________________________________