- Cmind AI by Weihong Zhang

- Posts

- When Earnings Go Quiet, Signal Quality Speaks

When Earnings Go Quiet, Signal Quality Speaks

How Cmind identifies expectation drift and pre-positions alpha before Q1 earnings begin.Week of December 29, 2025

What does an earnings-prediction model do when there are effectively no earnings?

This week provides a clean test case.

With the calendar largely empty of large-cap or benchmark-relevant prints, Cmind’s model continues to refresh daily—capturing probability drift driven by expectation changes rather than reported results. In environments like this, signal quality is revealed not by reaction, but by how the model updates in the absence of new fundamentals.

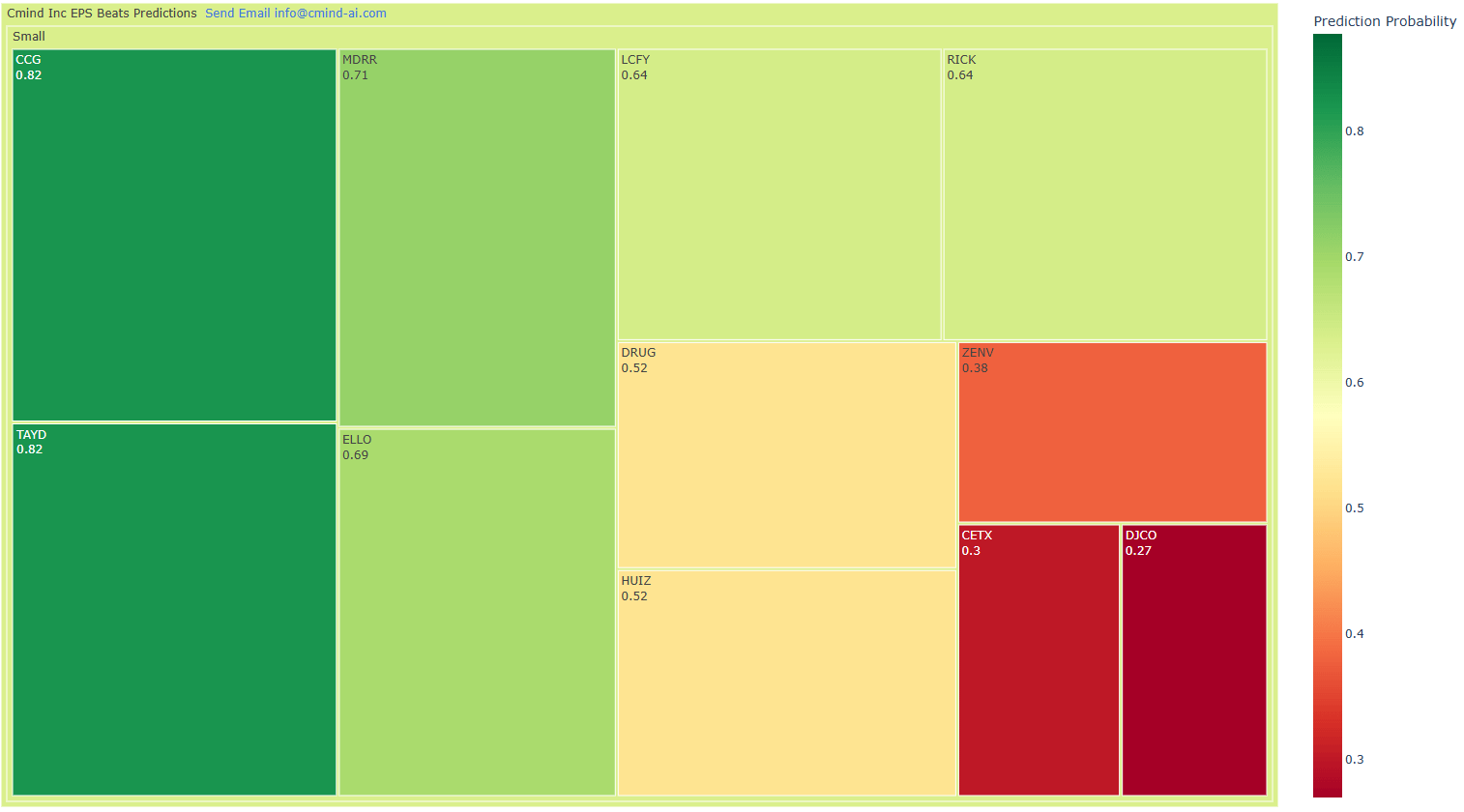

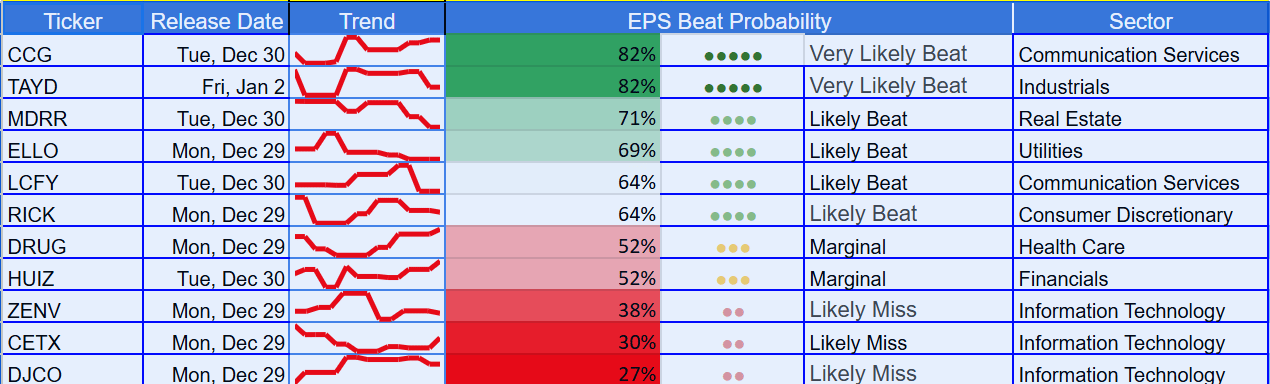

This week’s heatmap highlights several meaningful week-over-week probability moves (±8–12 pts) despite no new earnings events. Notably, names such as CCG, TAYD, and MDRR saw upward probability adjustments as sentiment and operating-tone factors stabilized, while DJCO, CETX, and ZENV experienced continued downside drift, reflecting rising execution and demand-risk signals ahead of early-Q1 reporting.

These are not post-print reactions—they are pre-positioning signals forming ahead of January earnings season. When announcements pause, expectation formation doesn’t. Models that update daily continue to surface where consensus is shifting before it shows up in estimates or price.

This is where positioning starts—not when the press release hits.

🔍 Heatmap Commentary

This week’s heatmap is less about volume and more about signal concentration.

A few key takeaways:

Probability dispersion is wide despite a light calendar, reinforcing that this is a stock-selection environment, not an index-driven one.

The right tail (high beat probabilities) is tight and clustered, while the left tail (miss risk) is steep and unforgiving—a classic year-end setup where execution matters more than narratives.

Several names sit in the “fragile middle” (50–60%), where even modest tone changes or guidance nuance could swing outcomes materially once liquidity returns in January.

The heatmap below maps 11 companies reporting between Dec 29 and Jan 3, ranked by Cmind’s EPS beat/miss probability.

Top EPS Predictor Beats for this week:

CCG — 82%

TAYD — 82%

MDRR — 71%

ELLO — 69%

LCFY / RICK — 64%

These names cluster in Communication Services, Industrials, Utilities, and Select REITs, reflecting improving tone around demand stability, margin discipline, and balance-sheet visibility.

Top EPS Predictor Misses for this week:

DJCO — 27%

CETX — 30%

ZENV — 38%

Notably, the “likely miss” cohort skews toward small-cap IT / software-adjacent names, where spending scrutiny and execution risk remain elevated heading into early 2026.

Importantly, the heatmap reflects expectation drift, not just reported fundamentals. These probabilities have been updating daily—meaning they already embed post-guidance digestion, sector read-throughs, and late-December positioning behavior.

Market-Cap Exposure Breakdown

🔵 Large Cap: Quiet on the Surface, Building Underneath

Large caps are largely absent from this week’s earnings activity, but that absence is itself informative.

Probability dispersion in large caps is currently compressed, consistent with low index volatility and “wait-for-January” positioning.

That said, second-derivative signals are beginning to form, particularly around:

Margin sustainability vs. revenue growth

AI capex ROI scrutiny

Normalization of demand expectations after strong 2025 comps

This is typically the phase where options markets remain complacent, while underlying expectations quietly reset. Large caps aren’t the trade this week—but they’re being re-priced in advance of mid-to-late January prints.

🟠 Mid Cap: Transitional Zone, Rising Sensitivity

Mid-caps are showing early signs of bifurcation:

Names tied to industrial demand, utilities, and select services are stabilizing or improving.

Tech-adjacent and software-infrastructure exposures remain more vulnerable, particularly where cost discipline or backlog visibility is unclear.

Mid-caps often act as the bridge between small-cap signal and large-cap confirmation. Historically, probability shifts here tend to precede broader sector moves by 1–3 weeks.

This makes mid-caps a critical monitoring zone heading into January.

🟢 Small Cap: Where the Signal Lives This Week

This week’s actionable information is overwhelmingly in small caps.

Why that matters:

Thin coverage + thin liquidity = wider expectation gaps

Small caps react first to changes in demand tone, pricing power, and cost pressure

Miss risk is asymmetric when confidence erodes

The heatmap shows:

Clear clustering of high-probability beats in non-glamour sectors

Concentrated miss risk in IT / software-adjacent names

Very little “neutral gray,” which tells us expectations are already polarized

In quiet weeks, this is where alpha tends to form early—before narratives get written.

📅 Looking Ahead: Earnings Setup for Jan 5–11, 2026

The week of January 5–11 marks the transition from holiday positioning to earnings reality.

What to Expect

Earnings calendars begin to repopulate, initially with:

Financials signaling the health of credit, deposits, and capital markets

Industrials and cyclicals offering early reads on demand elasticity

Liquidity improves quickly as institutional desks return

Options markets begin to reprice front-month risk, especially in names with January report dates

What We’re Watching at Cmind

Probability acceleration rather than absolute levels — sharp week-over-week moves often matter more than raw scores

Sector-level clustering: whether early reporters confirm or contradict small-cap signals seen this week

Narrative alignment: where management tone diverges from consensus expectations

Historically, the first full week of January is when mispriced confidence gets exposed.

This week isn’t about reacting—it’s about pre-positioning.

Small caps are already signaling where expectations may be wrong

Mid-caps are starting to transmit those signals upward

Large caps remain calm—but not static

As earnings season approaches, dispersion is likely to expand faster than volatility, favoring selective exposure over broad market bets.

About the Model

Cmind AI’s EPS predictions are powered by a machine learning model built for accuracy, objectivity, transparency, and daily updates with latest market information. We ingest over 150 variables across five data modalities—including real-time 10-Q filings, earnings transcripts, governance metrics, and peer signals—to provide early, company-specific EPS forecasts.

Updated daily, our model covers 4,400+ public companies, with proven backtests demonstrating improvements in Sharpe and Sortino ratios across portfolios.

Cmind content is provided for informational purposes only and does not constitute investment research or advice.

📩 To learn more, contact us at [email protected]