- Cmind AI by Weihong Zhang

- Posts

- EPS Beats Outlook: Communication Services and Staples Lead as Earnings Season Accelerates

EPS Beats Outlook: Communication Services and Staples Lead as Earnings Season Accelerates

EPS Predictions for the Week of April 28th, 2025

This week’s highest-confidence beat signals are coming from unexpected sectors—Consumer Staples and Communication Services are leading the pack.

Hi everyone!

As earnings season continues to pick up pace, here’s a fresh snapshot from our EPS Beats model.

As of April 23, our predictor has generated updated EPS forecasts for 452 companies scheduled to report during the week of April 28, 2025. These are early signals powered by Cmind’s EPS Beats methodology, which integrates new filings and market data daily. Forecasts may continue to evolve as we approach each earnings release.

Below is a breakdown of predictions by sector and confidence cohort.

Among sectors with meaningful volume, Communication Services leads the way: 70% of companies reporting in the sector are flagged as likely to beat. Consumer Discretionary follows, with a 67% beat rate, and Consumer Staples stands out as well with a 69% beat rate—though like last week, some dispersion is emerging within discretionary names.

Real Estate and Industrials also show relatively strong signals, with 62% and 50% beat rates, respectively. However, caution is warranted: sectors like Materials are showing mixed signals, with both beat and miss probabilities clustering closer together. Energy, too, remains muted with a 35% beat rate and a relatively high number of likely misses.

While Financials once again dominate by volume with 102 companies reporting, higher-probability opportunities this week may lie in more selective sectors like Communication Services, Consumer Staples, and Real Estate—particularly among large-cap names showing stronger signals.

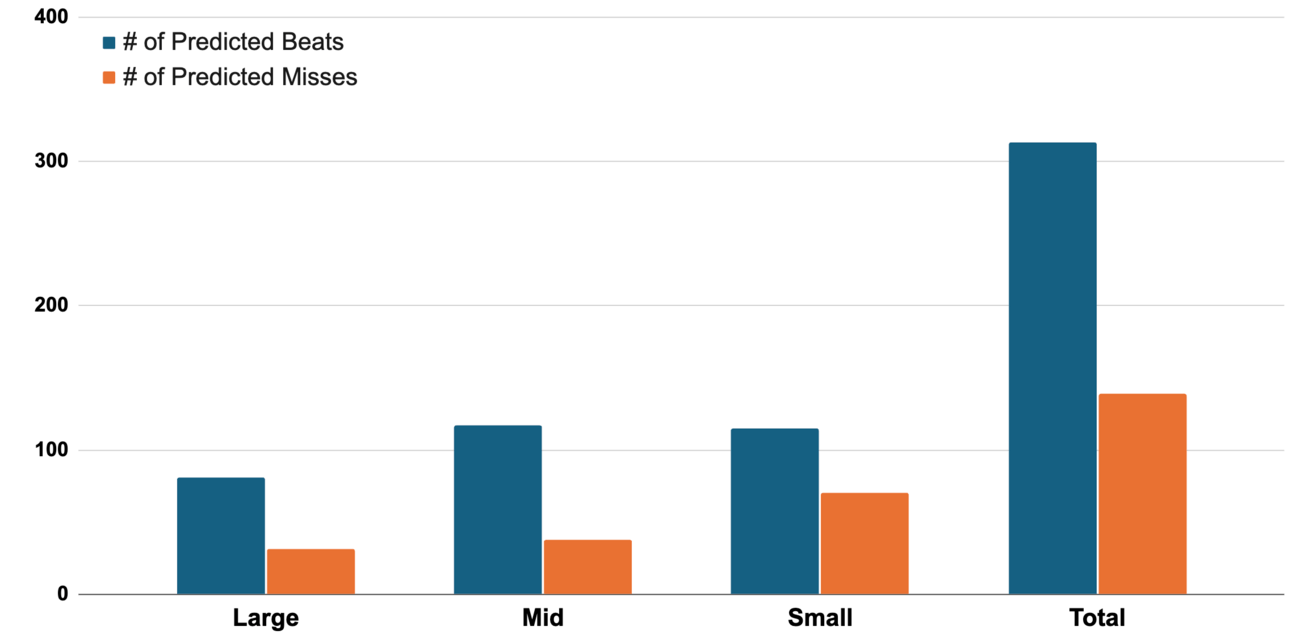

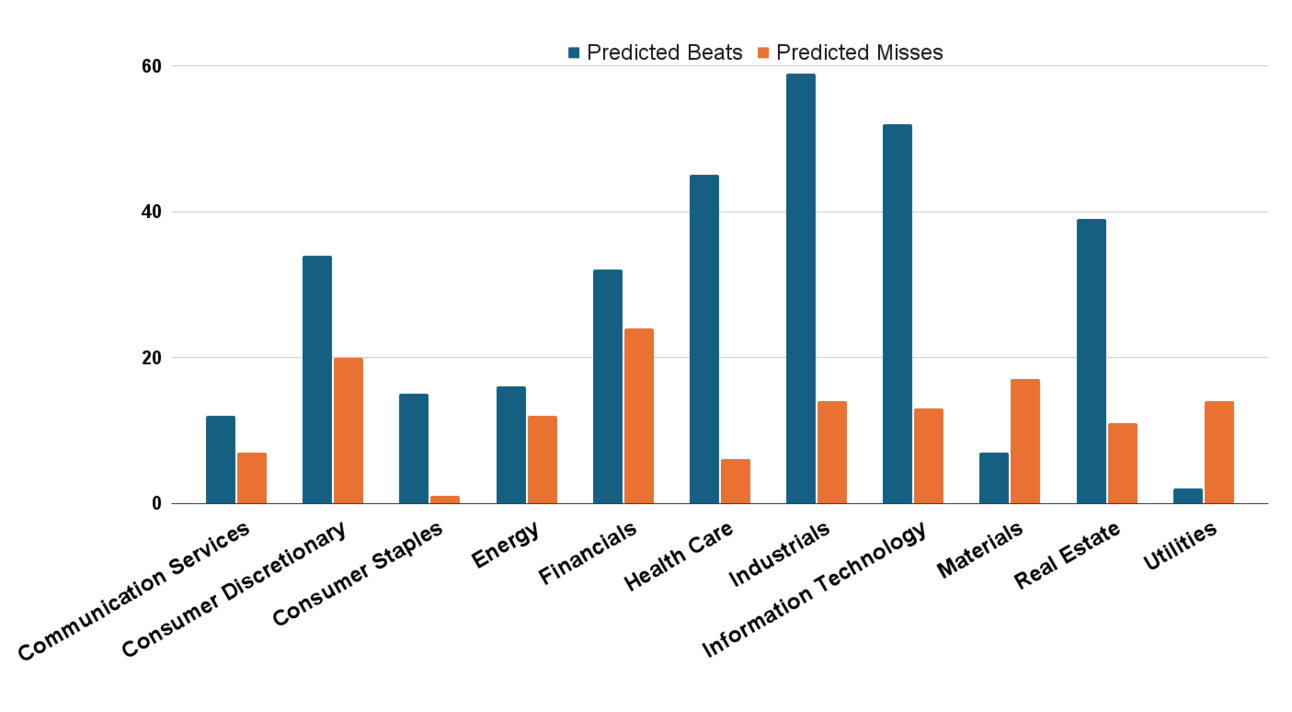

The following charts show how predicted beats and misses are distributed across market caps and sectors, using a 50% probability cutoff.

The chart below provides a visual breakdown of predicted beats and misses across major sectors. Industrials and Information Technology lead in expected beats, followed by strong showings in Health Care and Real Estate. On the caution side, Materials, Energy, and Utilities are showing a more balanced risk profile, with misses nearly matching beats.

Sectors Mostly to Beat or Miss Expectations

Top 10 EPS Beat Probabilities of the Week:

Real Estate names dominate the top 10, with strong signals across mid- and small-cap companies.

Instacart (CART) – 88% – Consumer Discretionary – Mid Cap

Green Brick Partners (GRBK) – 87% – Consumer Discretionary – Mid Cap

Centerspace (CSR) – 86% – Real Estate – Small Cap

Tanger Factory Outlet Centers (SKT) – 85% – Real Estate – Mid Cap

Apple Hospitality REIT (APLE) – 85% – Real Estate – Mid Cap

SNDL (SNDL) – 84% – Consumer Staples – Small Cap

Healthcare Realty Trust (HR) – 84% – Real Estate – Mid Cap

UMH Properties (UMH) – 83% – Real Estate – Small Cap

Cushman & Wakefield (CWK) – 83% – Real Estate – Mid Cap

BrightSpire Capital (BRSP) – 82% – Real Estate – Small Cap

Top 10 EPS Miss Probabilities of the Week:

Materials and Consumer Discretionary names dominate the top 10 misses, with weakness concentrated in small- and mid-cap companies.

Sachem Capital (SACH) – 10% – Real Estate – Small Cap

Big 5 Sporting Goods (BGFV) – 12% – Consumer Discretionary – Small Cap

Olympic Steel (ZEUS) – 13% – Materials – Small Cap

Ternium (TX) – 14% – Materials – Mid Cap

Barfresh Food Group (BRFH) – 19% – Consumer Staples – Small Cap

Stoneridge (SRI) – 21% – Consumer Discretionary – Small Cap

Quaker Chemical (KWR) – 21% – Materials – Mid Cap

Asbury Automotive Group (ABG) – 23% – Consumer Discretionary – Mid Cap

Stepan Company (SCL) – 24% – Materials – Small Cap

Horizon Technology Finance (HRZN) – 26% – Financials – Small Cap