- Cmind AI by Weihong Zhang

- Posts

- Cmind EPS Outlook: META, MSFT, AAPL & AMZN on Deck | SPOT, UNH, HOOD, and XOM Under the Microscope

Cmind EPS Outlook: META, MSFT, AAPL & AMZN on Deck | SPOT, UNH, HOOD, and XOM Under the Microscope

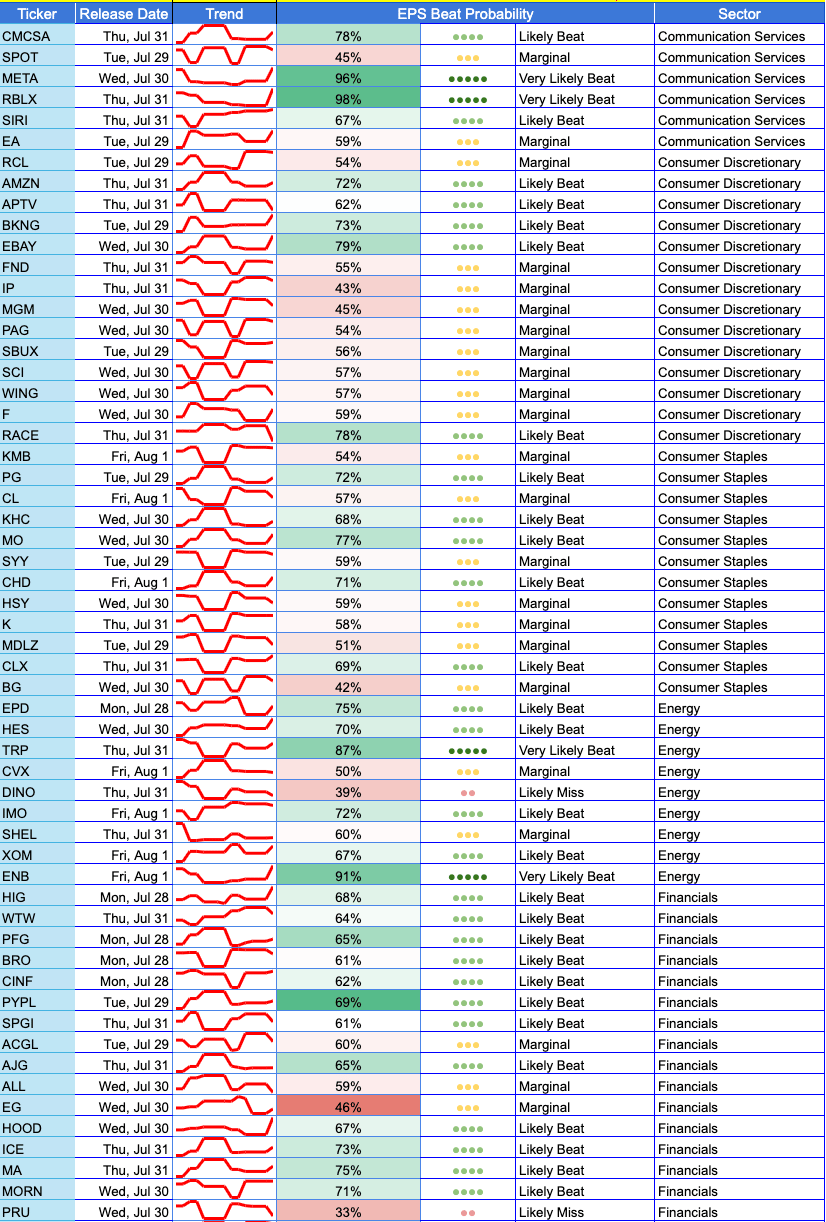

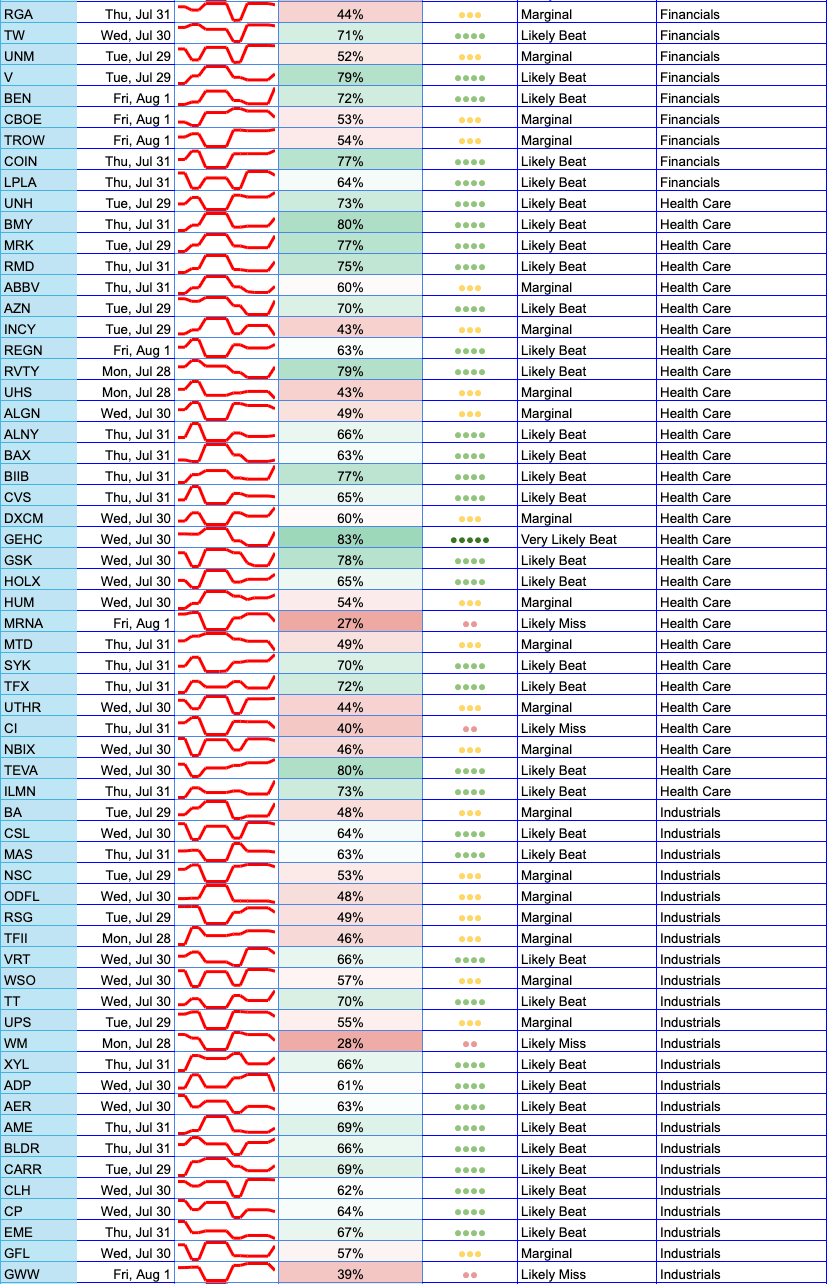

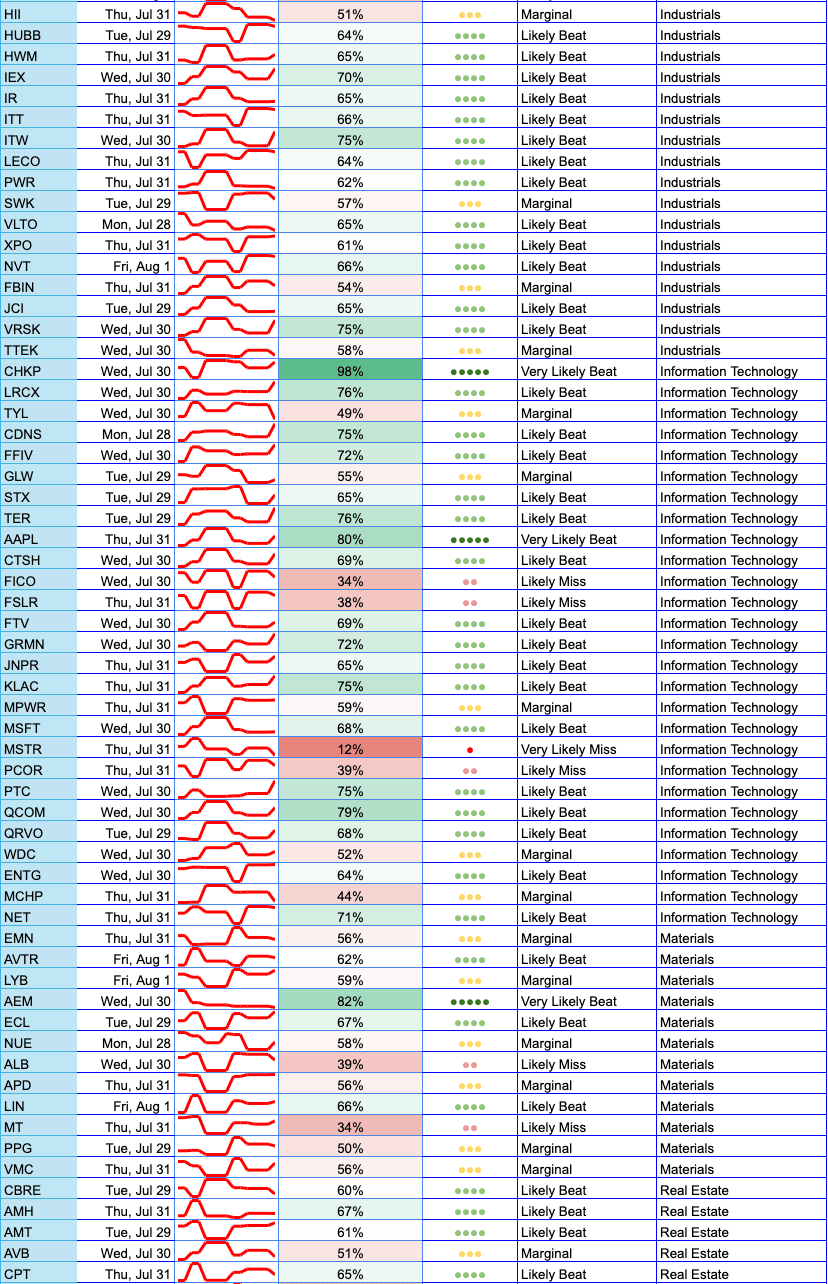

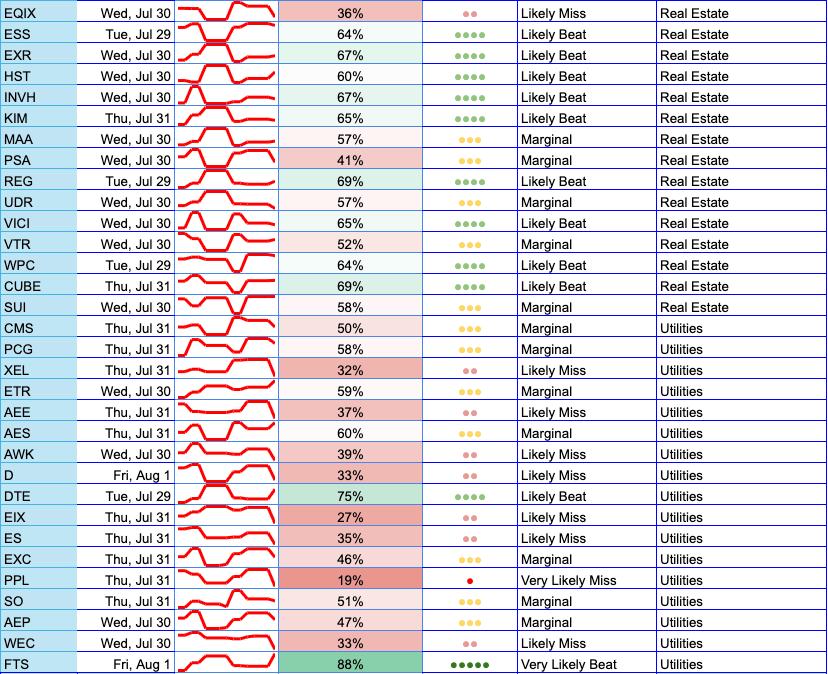

EPS Predictions for the Week of July 28th, 2025

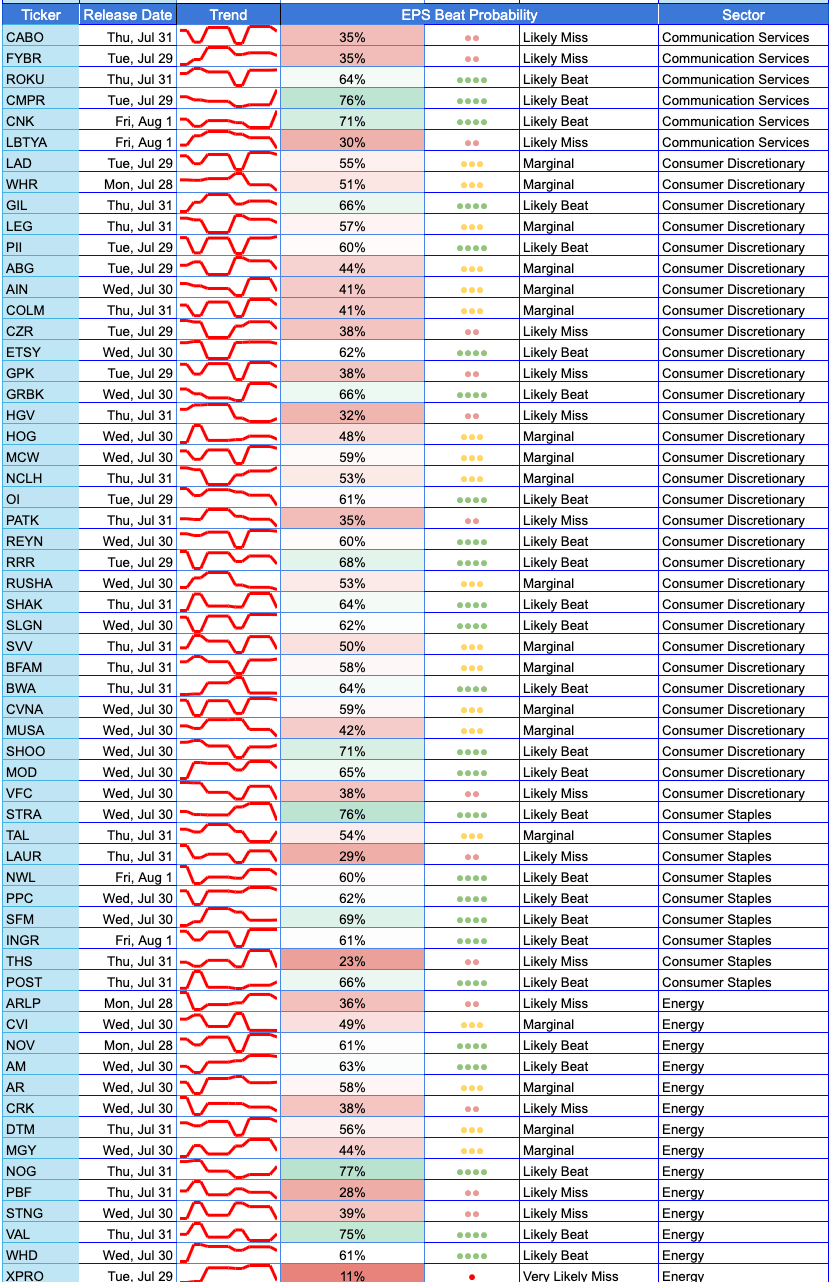

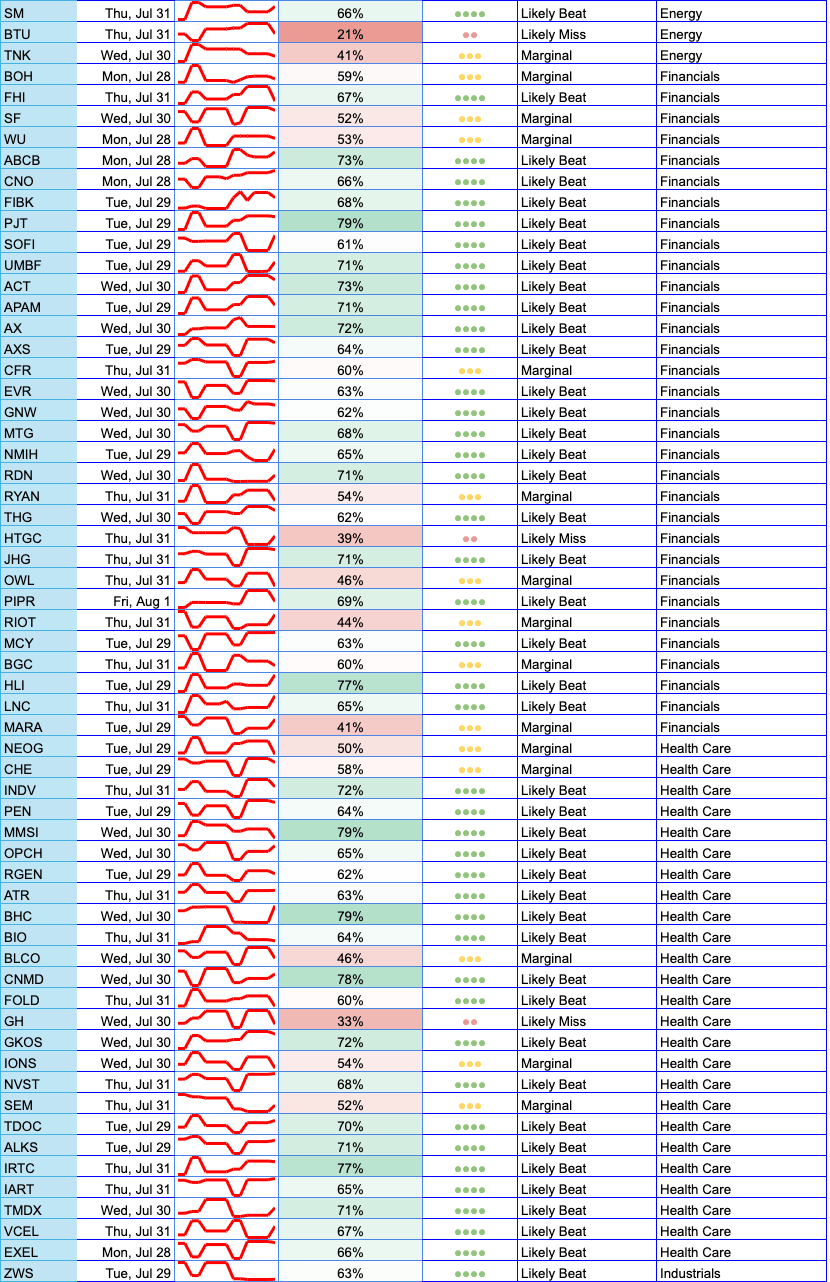

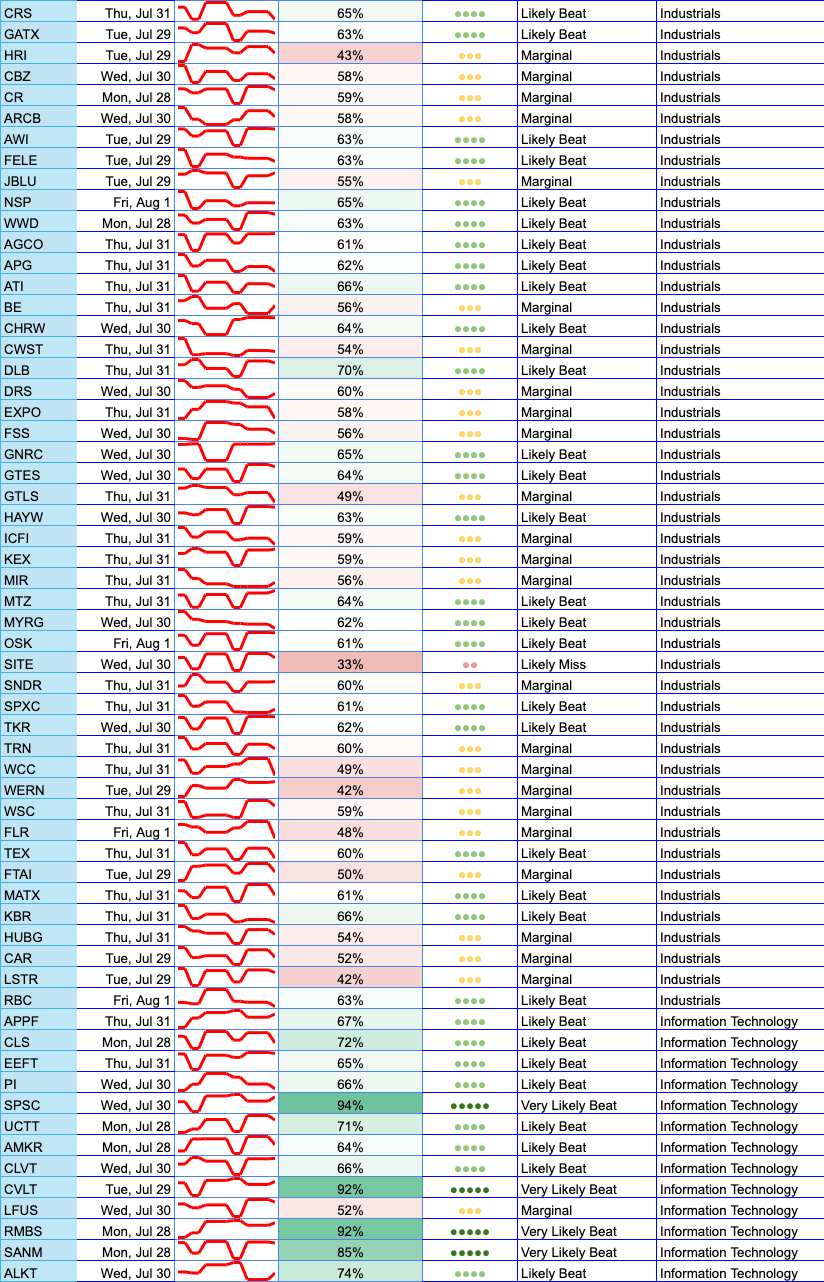

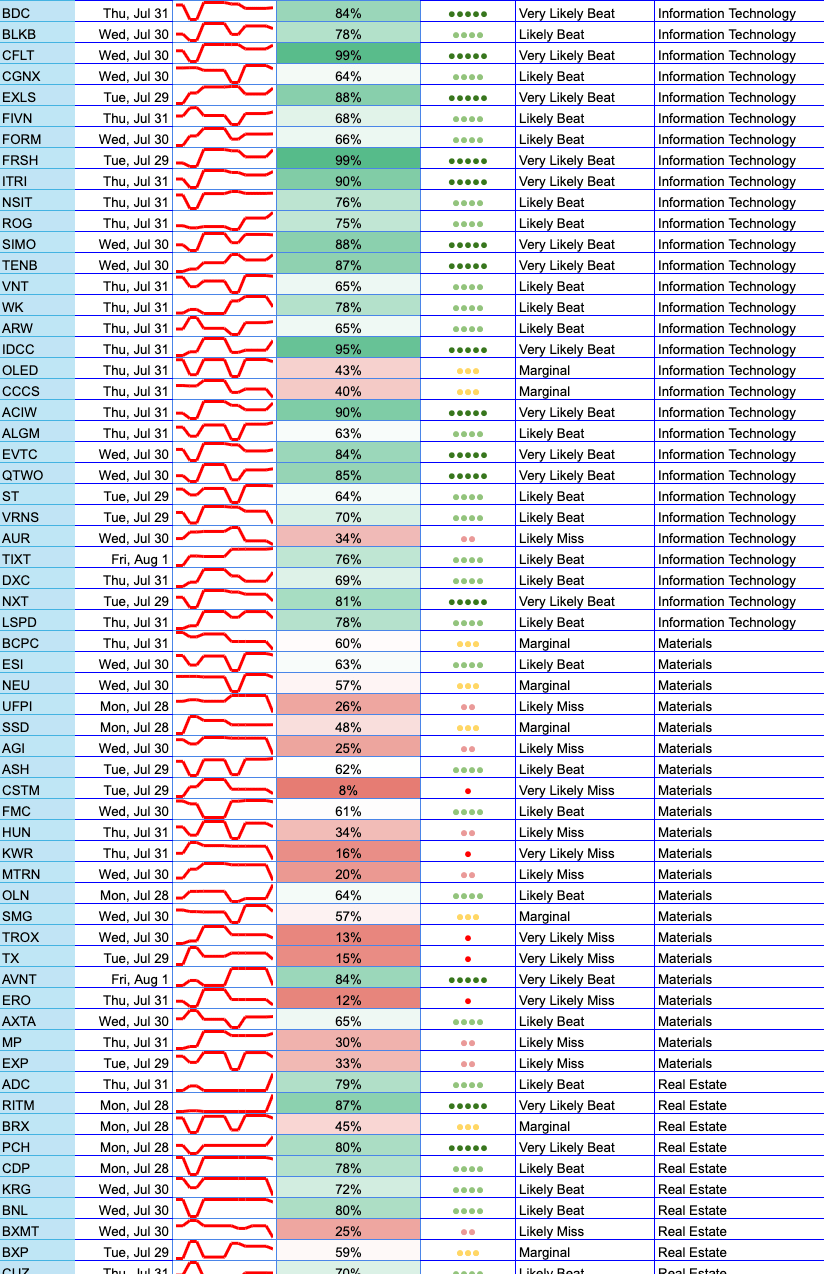

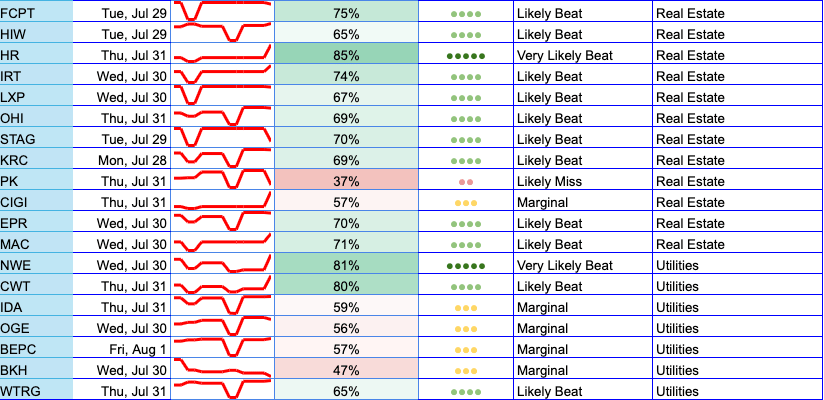

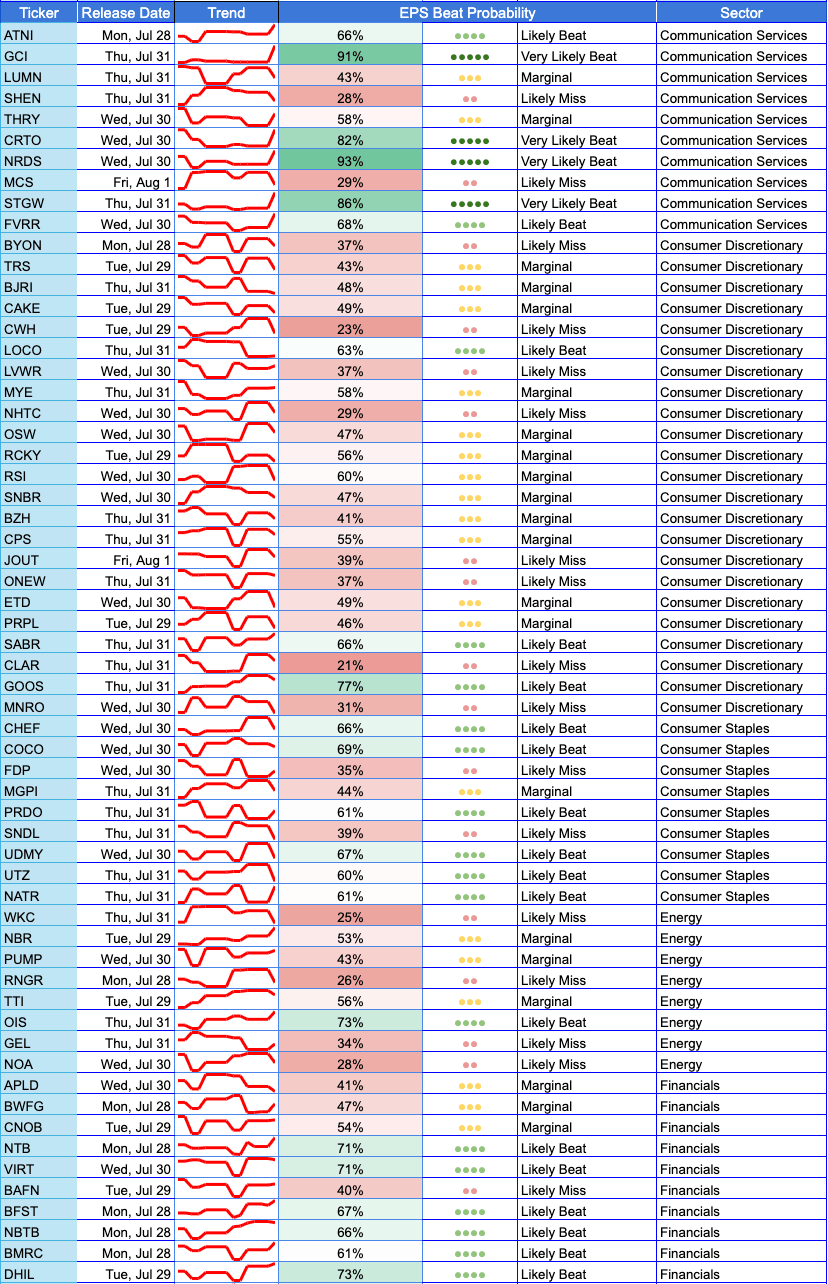

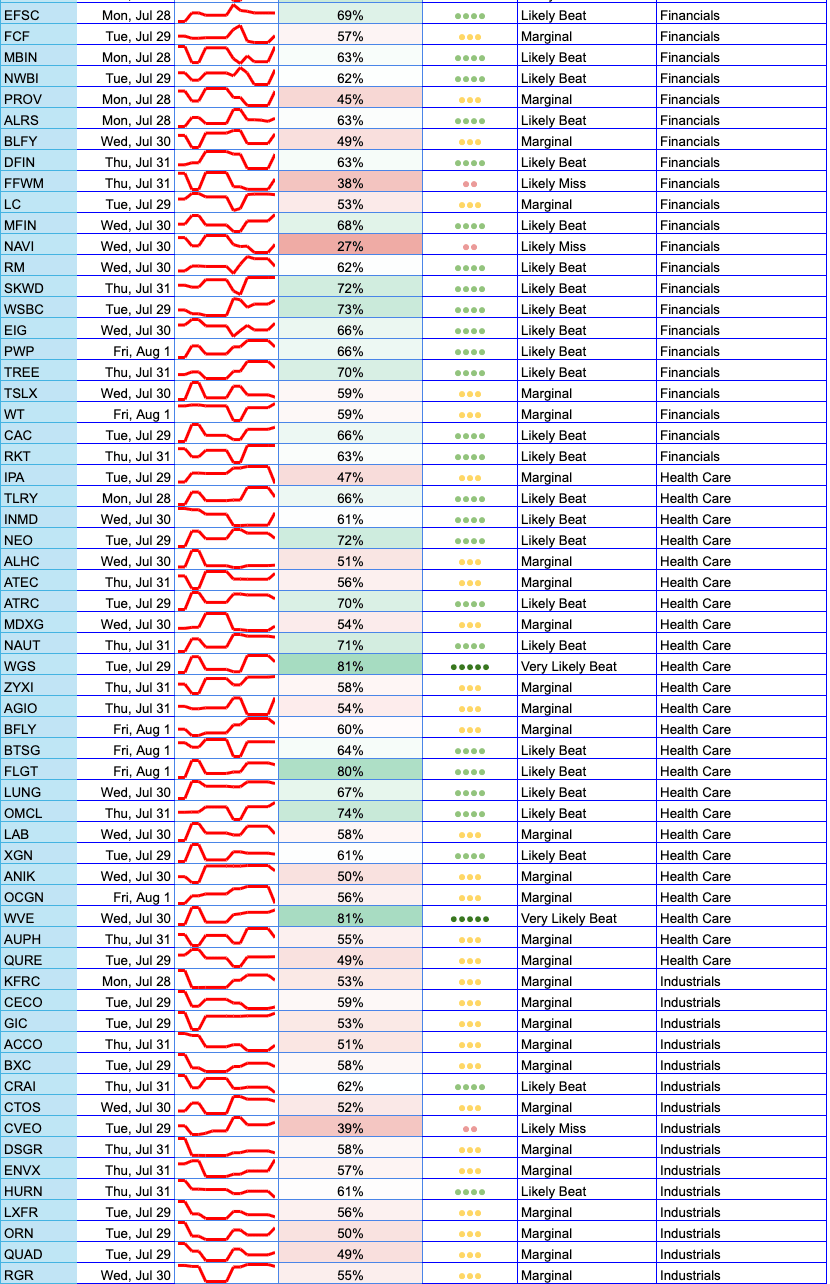

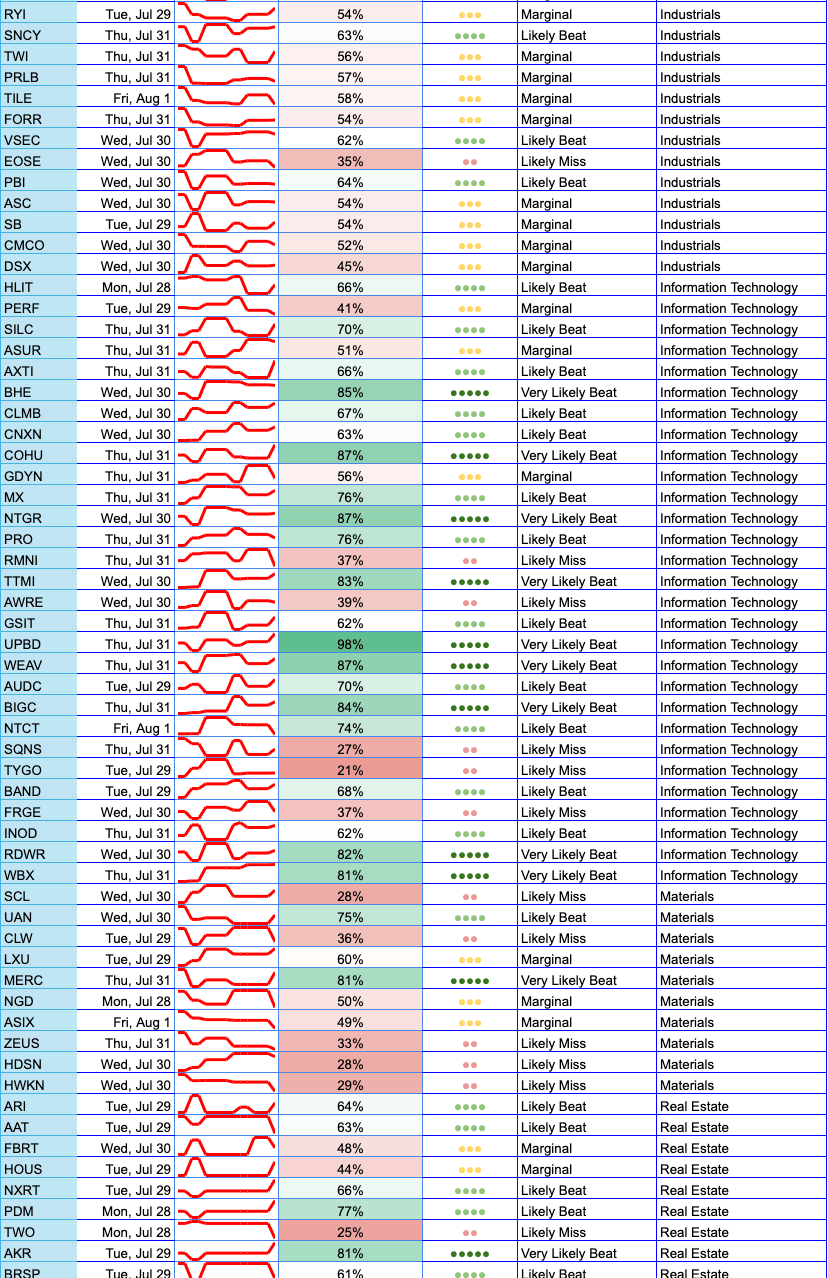

Earnings season heats up with headline releases from Apple (AAPL) and Amazon (AMZN), but the story extends across multiple sectors. Our model is tracking over 350 companies this week, with Information Technology, Health Care, Financials, and Energy leading the release count.

We spotlight four names—SPOT, UNH, HOOD, and XOM—that combine elevated volatility, sector impact, and investor interest. Below, you’ll find this week’s full breakdown, including top beats/misses, sector trends, and our updated heatmap.

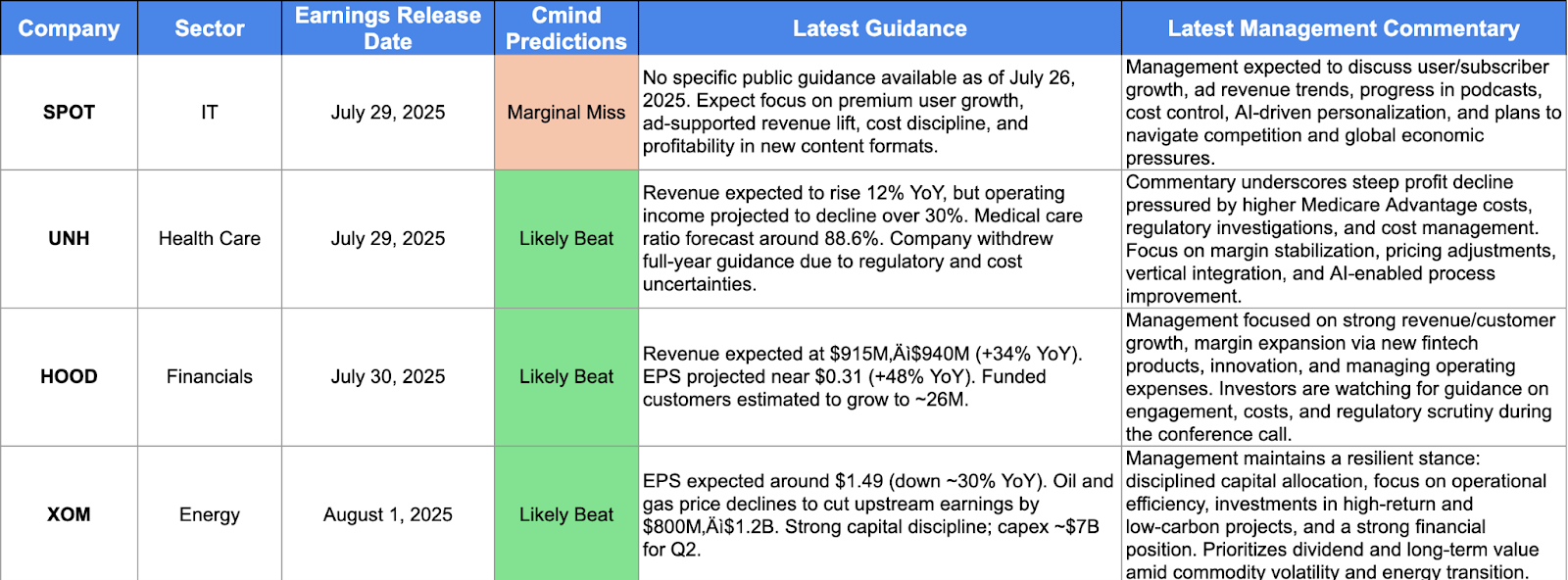

SPOTLIGHTS: 4 Earnings to Watch

Spotify (SPOT) – Marginal Miss Expected

No specific guidance yet, but expect focus on ad-supported revenue, premium growth, and cost control. AI personalization and new formats may be discussed.UnitedHealth (UNH) – Likely Beat

Despite rising costs and withdrawn FY guidance, margin stabilization and vertical integration efforts signal upside.Robinhood (HOOD) – Likely Beat

Strong YoY growth in revenue and EPS. Watch for commentary on regulatory overhang and fintech expansion.Exxon Mobil (XOM) – Likely Beat

Lower gas prices pressure upstream earnings, but capital discipline and low-carbon investment position XOM as resilient.

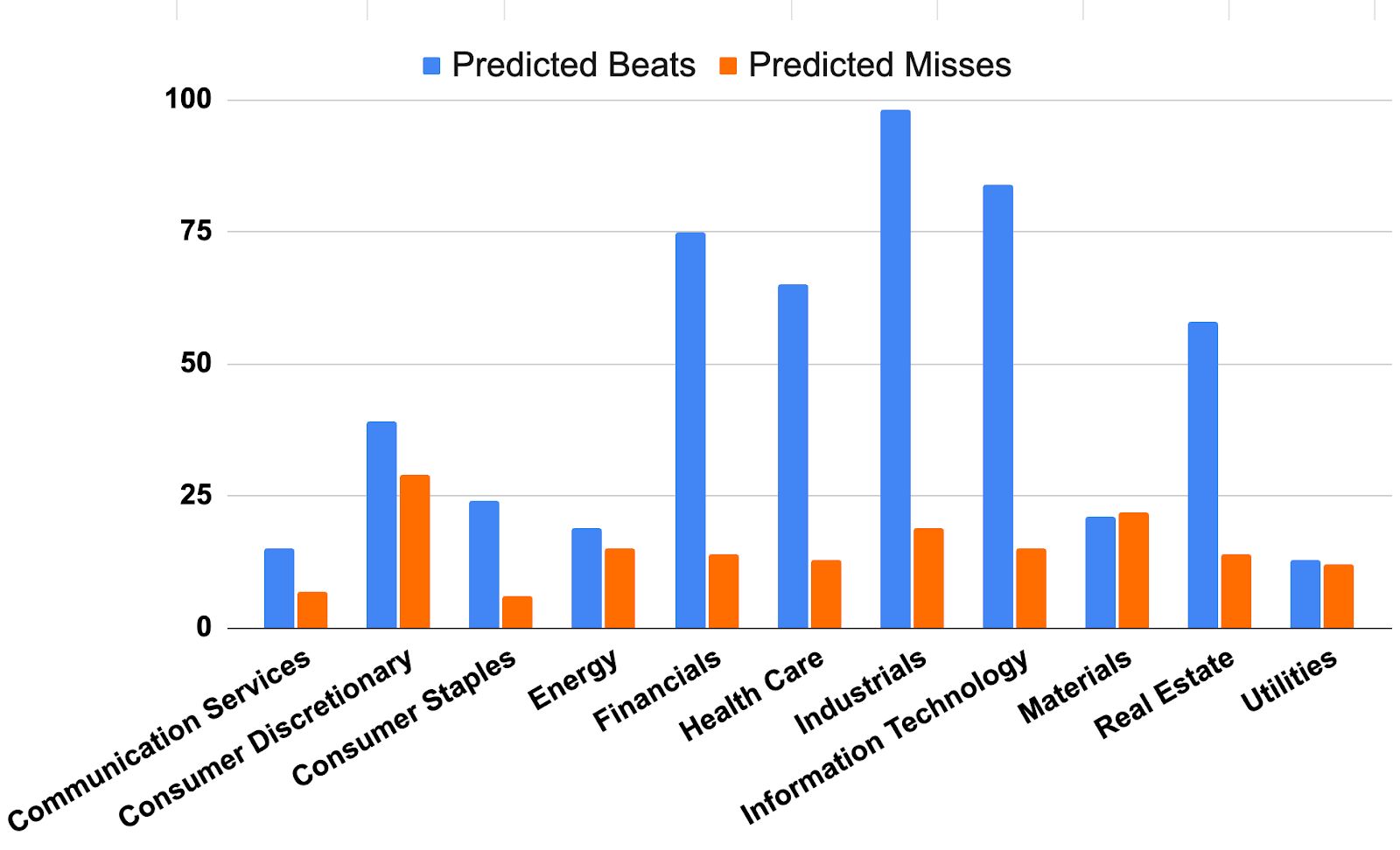

Sector Breakdown

This week, Information Technology, Health Care, Financials, and Energy dominate the earnings calendar.

Information Technology shows strong signals, especially in software and semiconductor names.

Health Care is more mixed, with select pharma and insurers expected to outperform.

Financials show a high number of likely beats, driven by fintech and services firms.

Energy remains a battleground: companies like XOM and CVX appear resilient, but volatility remains elevated due to commodity swings.

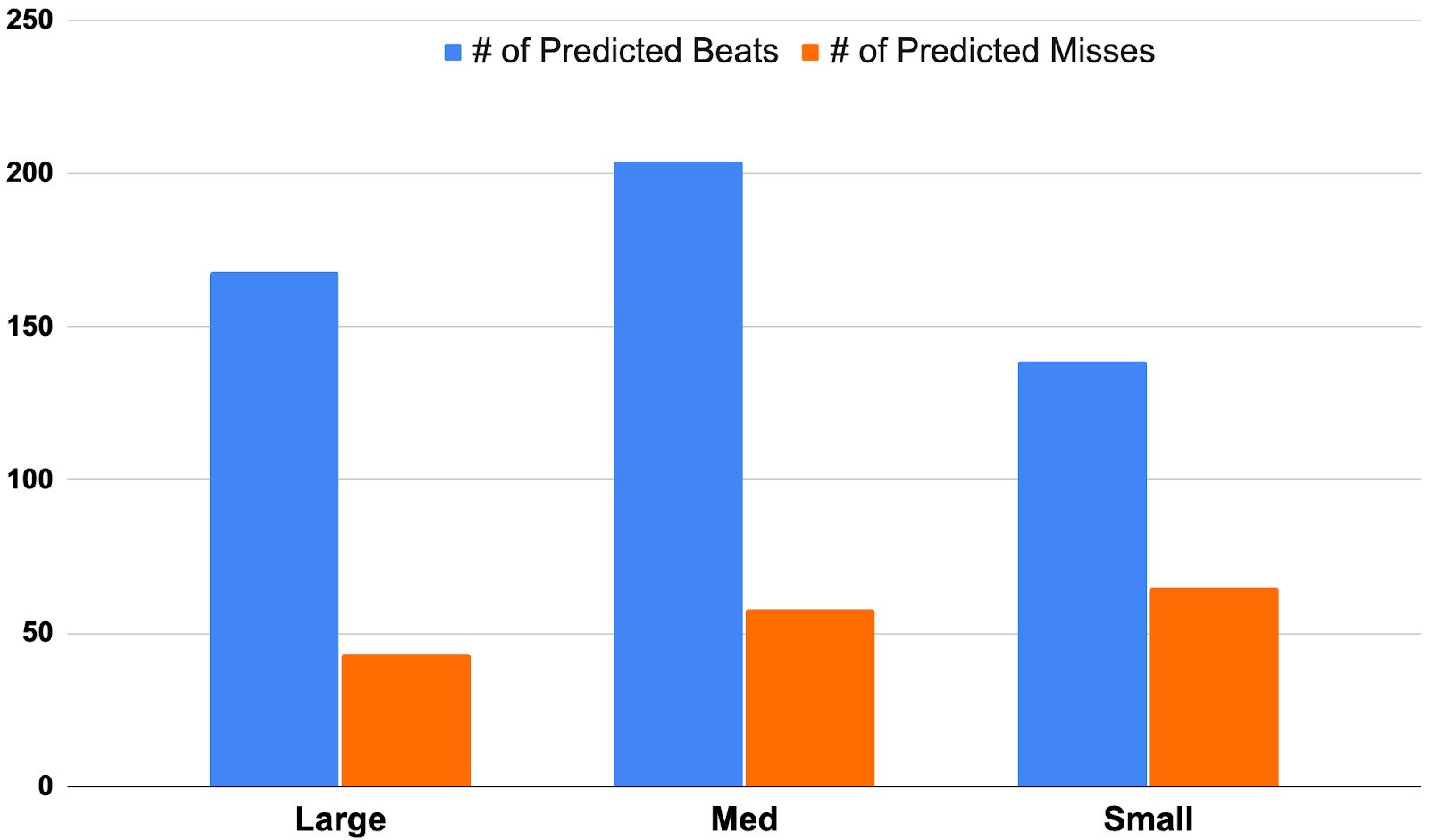

Market Cap Breakdown

Our model sees:

Large Caps: Heavily skewed toward likely beats, including household names like AAPL, AMZN, and XOM.

Mid Caps: Largest volume of earnings this week, with a mix of strong and marginal signals.

Small Caps: More evenly split, with considerable dispersion in prediction strength—an alpha-rich cohort for active managers.

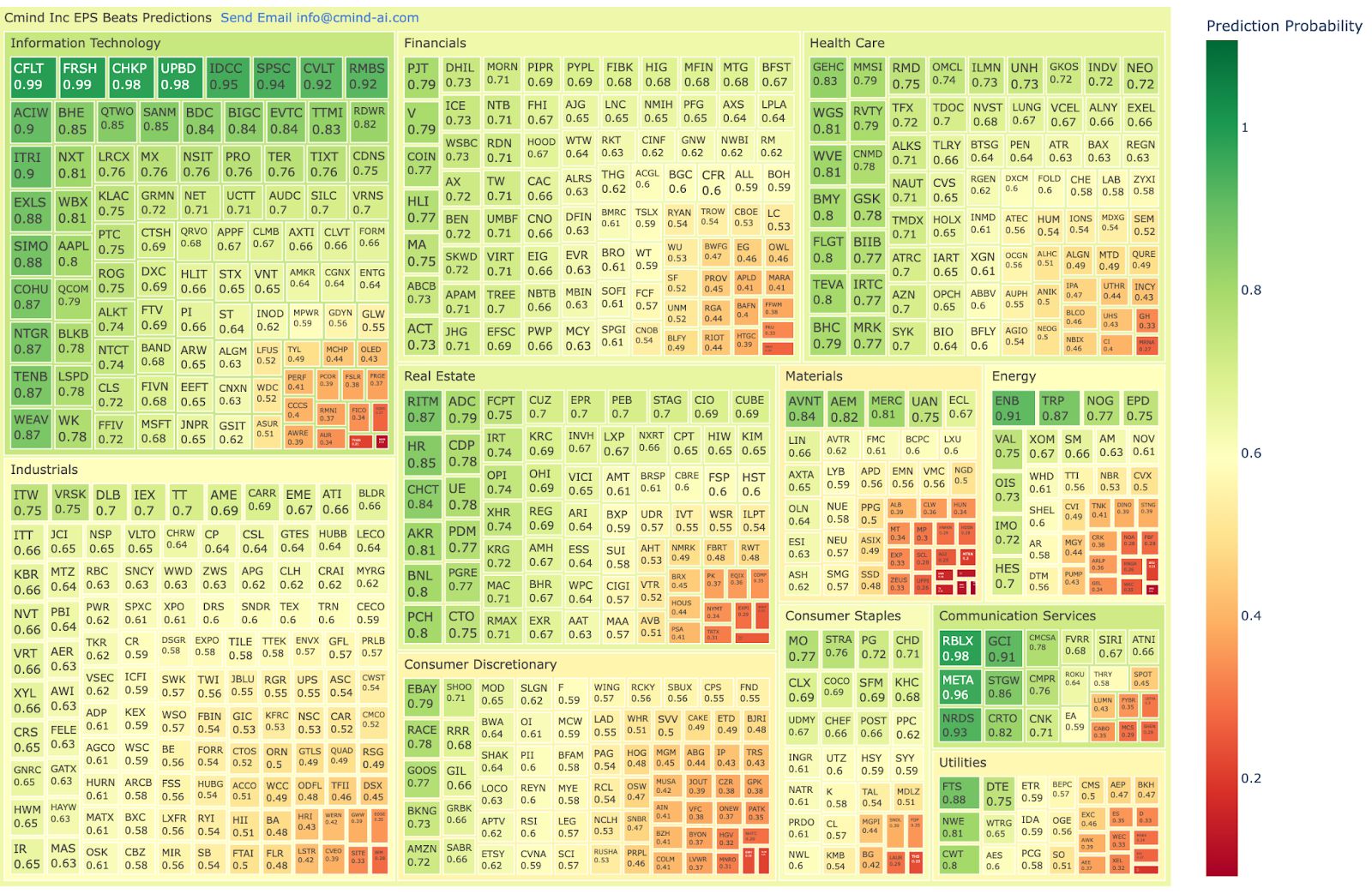

🔝Top 5 Predicted Beats This Week

CFLT – 99% – Information Technology

FRSH – 99% – Information Technology

UPBD – 98% – Information Technology

RBLX – 98% – Communication Services

META – 96% – Communication Services

🔻Top 5 Predicted Misses This Week

SPOT – 49% – Information Technology

ASIX – 43% – Materials

AGIO – 40% – Health Care

PRGO – 38% – Health Care

BRC – 37% – Industrials

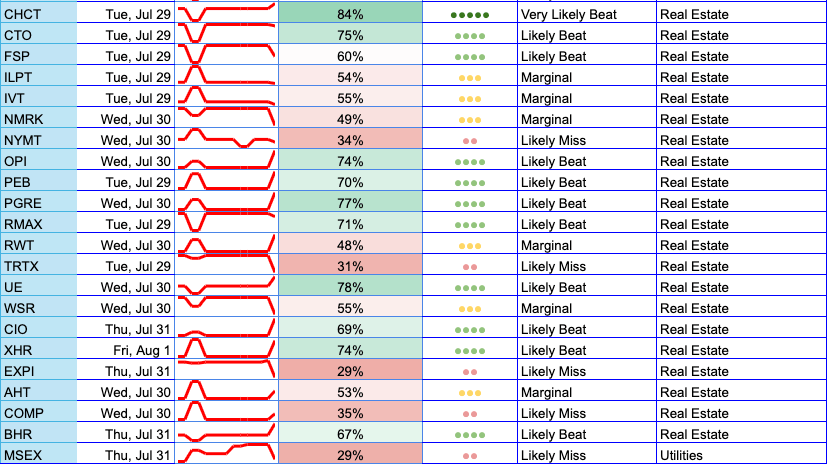

Weekly Heatmap

📌 See the full interactive prediction heatmap here

(Preview shown in the email or attached above)

Individual Stock Predictions

Large Caps

AAPL and AMZN headline this week's tech releases, both with strong model confidence in earnings outperformance. XOM joins from the Energy side, where our signals point to disciplined capital allocation overcoming commodity headwinds. UNH leads Health Care with a robust margin signal despite macro pressures.

Mid Caps

HOOD and SPGI show high potential for beats, driven by strong fundamentals and peer signals. On the flip side, names like BRC and ASIX raise red flags, with declining quality metrics and deteriorating sentiment.

Small Caps

As usual, small caps remain volatile. A few pockets of strength are visible in niche tech and biotech names, but several sub-50% probabilities indicate riskier terrain for earnings watchers this week.

ℹ️About the Model

Cmind AI’s EPS predictions are powered by a machine learning model built for accuracy, objectivity, and transparency. We ingest over 150 variables across six data modalities—including real-time 10-Q filings, earnings transcripts, governance metrics, and peer signals—to provide early, company-specific EPS forecasts.

Updated daily, our model covers 4,400+ public companies, with proven backtests demonstrating Sharpe and Sortino ratio improvements across portfolios.

📩 To learn more, contact us at [email protected]